A closely watched analyst says billions of dollars of capital are returning to the crypto markets after last week’s correction.

Earlier this month, digital assets witnessed a profound corrective move as the total market capitalization of crypto fell from $1.70 trillion to $1.50 trillion in a single day.

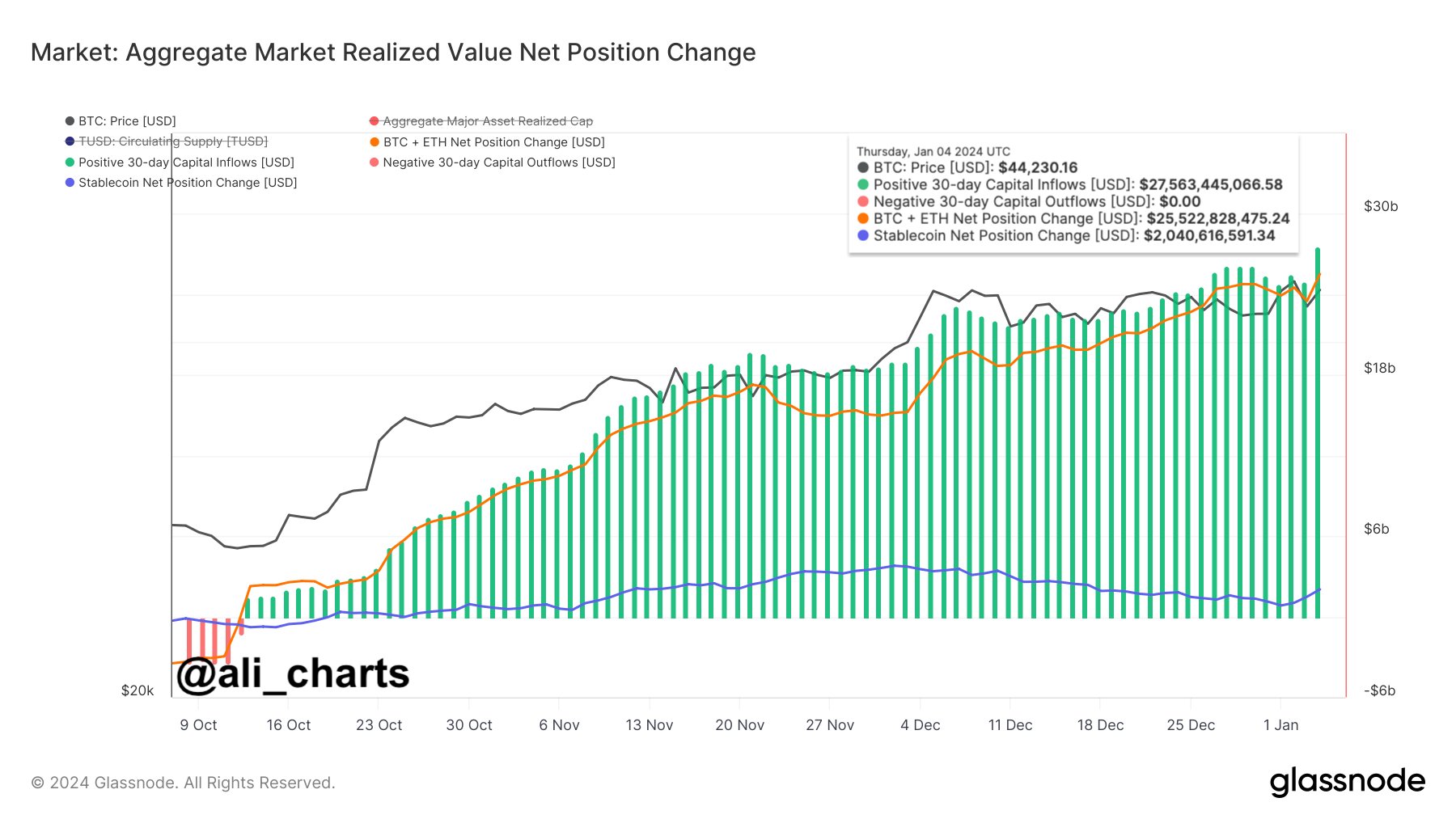

Analyst Ali Martinez tells his 39,700 followers on social media platform

“After the recent shakeout, there has been a remarkable recovery, with more than $2.5 billion returning to the economy. cryptocurrency market. This influx could mean renewed investor confidence and a market revival!”

At the time of writing, the total crypto market capitalization hovers at $1.60 trillion.

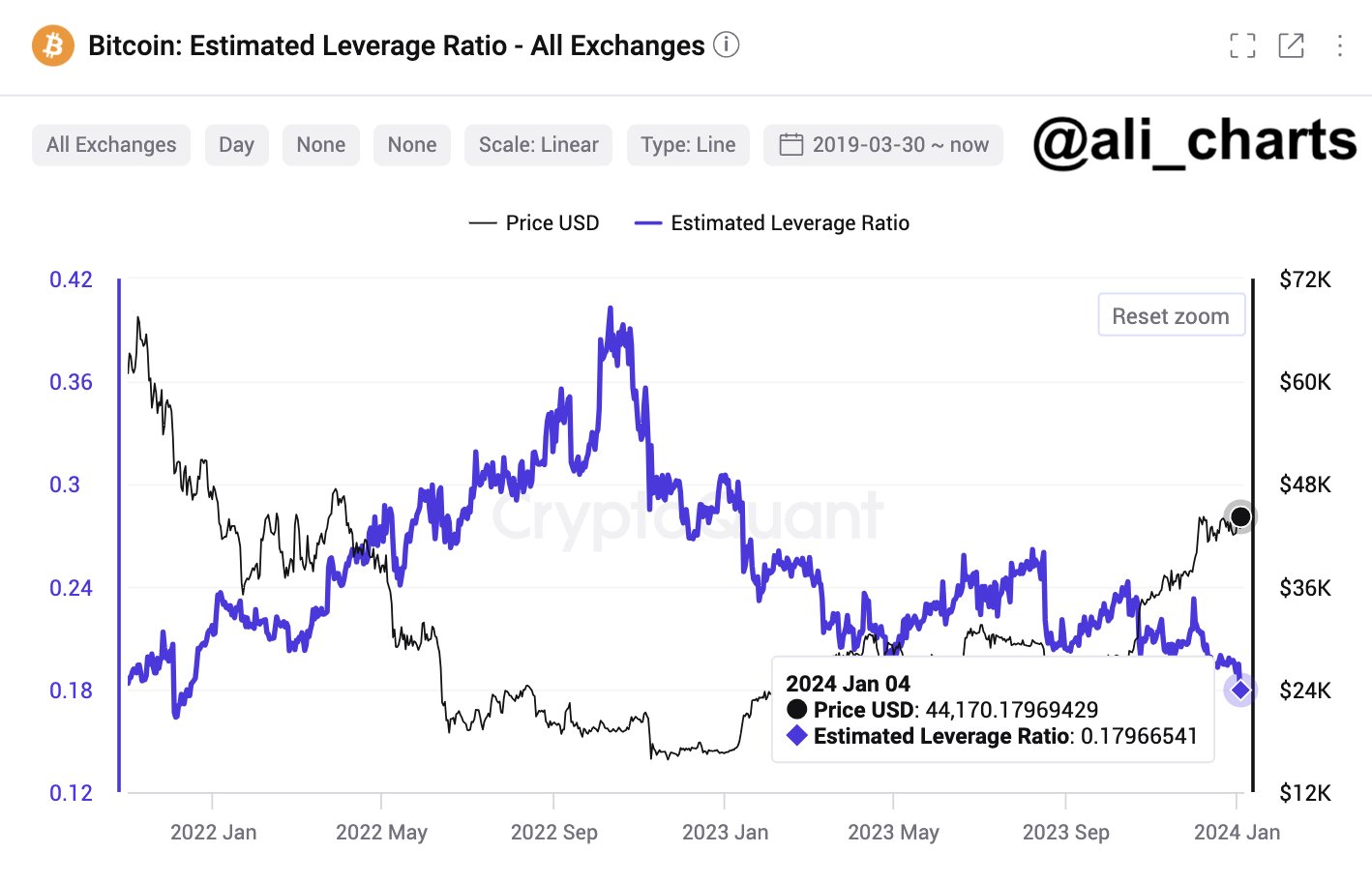

Taking a closer look at Bitcoin, Martinez says the potential adoption of spot-based BTC exchange-traded funds (ETF) is likely not yet fully priced in. According to the analyst, the crypto markets are far from overheated, meaning traders are not going all-in ahead of the highly anticipated event.

“The estimated leverage ratio on all exchanges has fallen to the lowest level in two years. This indicates BTC traders are taking a more cautious approach and reducing the use of borrowed funds pending regulatory clarity.”

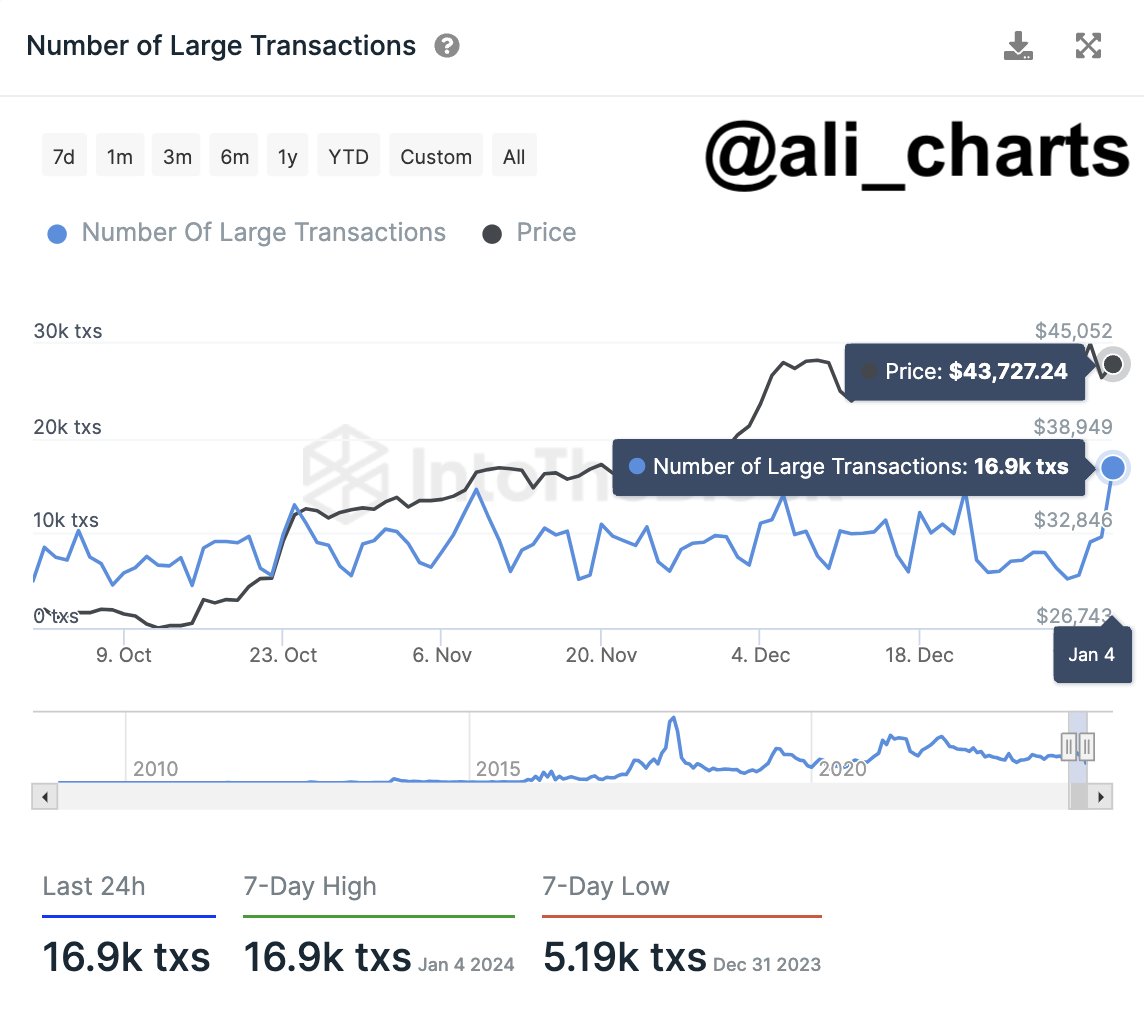

As traders shy away from using excessive leverage, Martinez says crypto whales are in the midst of rapidly accumulating BTC ahead of the US Securities and Exchange Commission (SEC) possibly approving a slew of Bitcoin ETF filings this week .

“In the past 24 hours, Bitcoin has experienced the largest spike in transactions above $100,000 in almost two years. The 16,900 major transactions serve as a proxy for BTC whaling activity, which provides insight into how these major players might be positioned in the world cryptocurrency market.”

At the time of writing, Bitcoin is worth $44,091.

Don’t miss a beat – Subscribe to receive email alerts straight to your inbox

Check price action

follow us on Tweet, Facebook And Telegram

Surf to the Daily Hodl mix

Generated image: Midjourney