This past week was largely defined by the Bitcoin price rising above $45,800 for the first time in more than 20 months, marking a great start to the year. However, the leading cryptocurrency soon experienced a sharp price drop due to negative news about the BTC spot (ETF).

Interestingly, the latest on-chain data has shown that investors do not appear to have completely lost confidence in Bitcoin, as measured by market capitalization, the largest cryptocurrency.

$2.5 billion flows into the crypto market after the Bitcoin crash

In a post on the X platform, crypto analyst Ali Martinez provided on-chain insight into the aftermath of the crash that hit Bitcoin and the entire crypto market. The expert noted in his post that a day after the market decline, a significant amount of money flowed back into the sector.

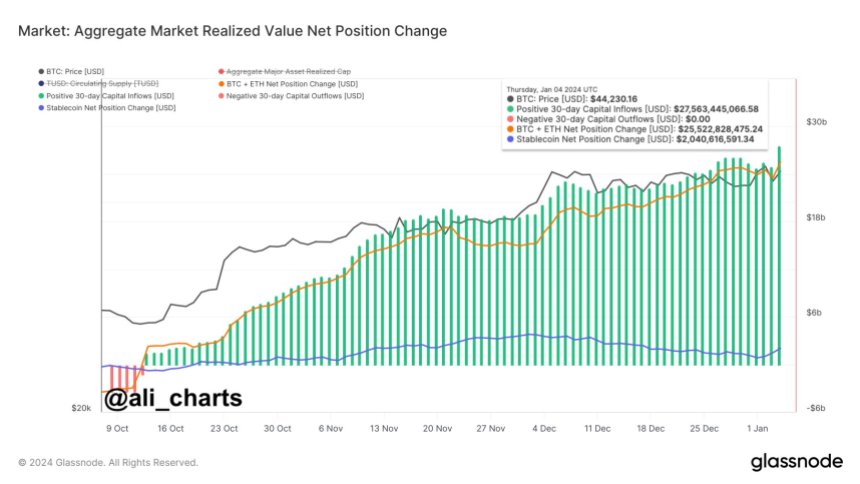

This revelation was based on on-chain data from the blockchain analytics platform Glassnode. The relevant indicator here is the ’30-day positive capital inflow’, which tracks the net inflow of capital into the crypto market over a 30-day period.

Chart showing aggregate market realized value net position change | Source: Ali_charts/X

The chart above shows that a significant amount of money has entered the cryptocurrency market in recent months. According to Glassnode data, more than $2.5 billion flowed back into the cryptocurrency market on Thursday, January 4, bringing positive 30-day capital inflows to approximately $27.5 billion.

This latest influx of capital into the market provides insight into the positive shift in sentiment and market conditions. It essentially signals renewed investor confidence in crypto assets after a brief period of uncertainty and price correction.

At the time of writing, the Bitcoin price stands at $43,661, reflecting a decline of 0.2% in the past 24 hours. However, the market leader seems to be recovering well, with $44,000 not far out of reach.

How BTC Holders Reacted to the Market Drop

a recent analysis shows how different classes of Bitcoin investors reacted to the negative ETF news and subsequent decline. This evaluation was based on the Spent Output Age Bands USD (SOAB) indicator on the CryptoQuant analysis platform.

The investors were divided into five classes based on the age of their holdings. According to the analysis, short-term investors who fell within the 1 week to 1 month and 1 month to 3 month ranges exited the market at breakeven and profit, respectively.

Meanwhile, long-term holders who bought Bitcoin in the first half of 2023, falling between the six- and 12-month range, have dumped about $7.6 billion worth of BTC. In contrast, the one- to five-year holding class made little movement after the market decline.

Bitcoin price at $43,690 on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image from iStock, chart from TradingView

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.