Bitcoin price has risen over 5% and cleared the USD 45,000 resistance. BTC is showing positive signs following rumors of EOD approval of spot ETFs.

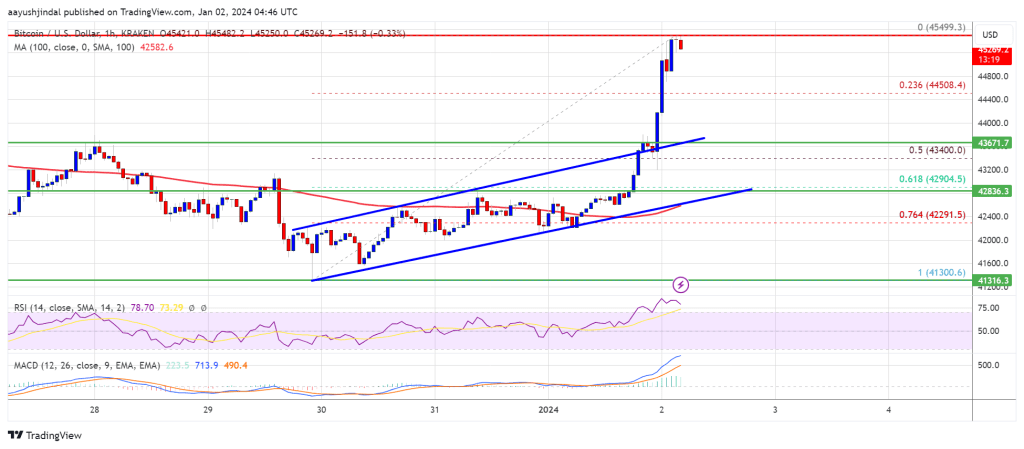

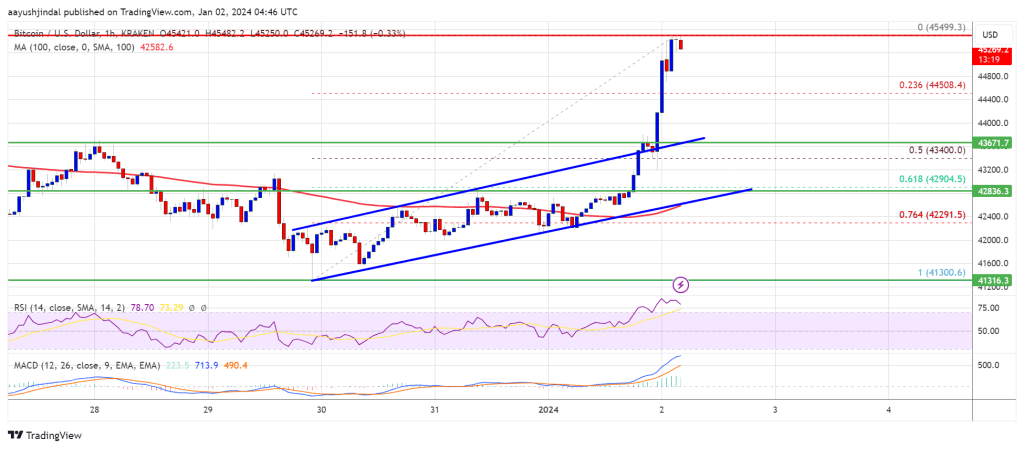

- Bitcoin is gaining pace above the USD 44,000 and USD 44,400 resistance levels.

- The price is trading above $45,000 and the 100 hourly Simple Moving Average.

- There was a break above a key ascending channel with resistance near $43,500 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair is up over 5% after several rumors about EOD’s approval of BTC spot ETF.

Bitcoin price rises above $45K

Bitcoin price formed a base above the $41,200 level and started a new increase. BTC has overcome some major barriers near $43,200 to enter a bullish zone.

There are several rumors circulating that approval for a spot ETF could be possible by the end of today. The price is gaining speed on this rumor and broke the $44,000 level. There was also a break above a key ascending channel with resistance near $43,500 on the hourly chart of the BTC/USD pair.

Bitcoin even managed to overcome the resistance at $45,000. A new multi-week high is formed near $45,499 and the price is now consolidating gains. It is trading well above the 23.6% Fib retracement level of the upward move from the $41,300 swing low to the $45,499 high.

Bitcoin is also trading above $45,000 and the 100 hourly Simple Moving Average. On the upside, immediate resistance is around the $45,500 level.

Source: BTCUSD on TradingView.com

The first major resistance is $46,000. A close above the USD 46,000 level could send the price rising further. The next big hurdle is at $46,800. Any gains above the $46,800 level could open the doors for a move towards the $48,000 level.

Are dips attracted in BTC?

If Bitcoin fails to rise above the USD 45,500 resistance zone, a downward correction could occur. The immediate downside support is near the $45,000 level.

The next major support is near $44,500. If there is a move below $44,500, there is a risk of more losses. In the mentioned case, the price could fall towards the support at $43,500 in the short term.

Technical indicators:

Hourly MACD – The MACD is now gaining speed in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major support levels – USD 45,500, followed by USD 46,800.

Major resistance levels – $45,000, $44,500 and $43,500.

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.