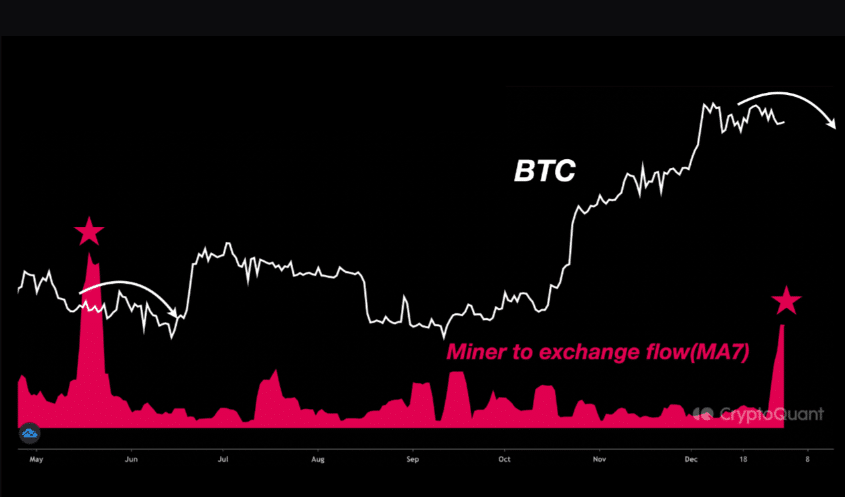

- The price of BTC may fall like in May 2023.

- Miners sold their property instead of selling it.

According to SignalQaunt, an author profile on CryptoQuant, Bitcoin [BTC] miners have started sending large amounts of coins to exchanges. Sending a large amount of BTC to exchanges hardly has a good impact on the price.

For example, in May 2023 there was a similar situation. During that time, the Bitcoin price fell from $29,000 to $26,000.

Source: CryptoQuant

As the scenario replayed, the SignalQaunt handle noticed the following:

“We need to monitor whether this increase in miners’ deposits is temporary or sustainable so we can invest wisely.”

BTC miners are shedding their assets

Bitcoin’s price has moved sideways in recent days. But if a potential plunge is on the horizon, the currency could lose a significant portion of its value.

This potential contrasted with expectations of a price increase in the first half of January 2024.

AMBCrypto then considered the miner’s net position change. This metric considers the 30 day supply change that miners hold.

At the time of writing, the Miner Net Position Change was in the negative territory. Specifically, the number had dropped to -7174.44.

This drop was confirmation that Bitcoin miners were selling their holdings instead of accumulating as they did for most of October.

Source: Glassnode

Should the Miner Net Position Change remain in the red, market players should expect the same for BTC. However, participants also need to know the outcome of the ETF registrations, which are due soon and could impact BTC.

For some, an approval could send the Bitcoin price higher.

Either way, an opportunity presents itself

However, there are others who believe the outcome would be a ‘sell the news’ event. A review of the technical outlook showed the Money Flow Index (MFI) at 35.60.

In the early hours of December 30, the MFI was 6:50 p.m. This reading suggests that Bitcoin was oversold.

Therefore, the higher trend the indicator showed at the time of writing was evidence that sellers were exhausted. At the same time, the signal could also serve as a confirmation that the BTC price could jump back to $43,000.

But rising above the price can be a challenge.

This was because the 12 and 26 EMAs had fallen into the negative region. If the EMA fails to follow the MACD’s rise to green, BTC’s momentum could move downward.

Source: TradingView

Furthermore, AMBCrypto looked at the Bitcoin Hash Ribbon. The Hash Ribbon is a market indicator that shows when Bitcoin has become too expensive to mine relative to the cost of mining.

How much are 1,10,100 BTCs worth today?

When the hash ribbon changes from a bright area to red, it indicates a danger zone. In this region, Bitcoin has the potential to capitulate. However, the metric was in the white area at the time of writing.

Although BTC tends to correct based on press-time value, long-term holders may find it profitable to buy Bitcoin before the market overheats.

Source: Glassnode