For years, Ethereum developers have been working hard to address one of the network’s biggest security risks: Thousands of validators operate the second most valuable blockchain, but only a few of them hold nearly all the power.

A new transaction block is added to Ethereum every 12 seconds. These blocks are added by validators, which can be companies, individuals or collectives that lock up or ‘stake’ at least 32 ETH (currently worth about $70,000) in exchange for stable returns.

Lido, the collective that is the largest validator on Ethereum, controls 32% of all staked ETH. If this share grows by just a few percentage points – beyond the 33% threshold needed to block a vast majority of 67% of validators – network outages or deliberate crimes at Lido could have huge consequences for Ethereum as a whole.

This vulnerability stems from the ‘centralized’ nature of most validators; virtually all validators are just individual computers (or servers) loaded with one of the few popular node software. If there are bugs in the software – or if a computer goes offline – or if the person operating a large validator decides to act dishonestly – the entire network can suffer.

Distributed validator technology, or DVT, aims to eliminate these risks. Projects using this technology, such as Obol, SSV and Diva, are helping validators spread their activities across different parties, ostensibly as a way to make validators more resilient and less subject to single points of failure.

DVT solutions have been It’s been talked about for a while, but even as some highly anticipated DVT platforms finally go live, their overall adoption remains low. By Obol’s estimate, less than one percentage point of staked ETH is controlled by DVT-based validators.

In 2024, that could all change. Leaders in the DVT space are finally putting the finishing touches on their platforms, and Lido could soon transfer some of its business into the hands of distributed infrastructure.

This article appears in the latest issue of The protocolour weekly newsletter where we explore the technology behind crypto, block by block. Register here to receive it in your inbox every Wednesday. Also check out our weekly The protocol podcast.

Lido at critical threshold

The big selling point of blockchain networks is that they are “decentralized.” Ethereum’s validator system – which divides power between parties based on the amount of ETH they stake – is the main way it stays resilient to disruptions and remains ‘credibly neutral’, meaning it theoretically immune to the whims of companies or governments.

But only a few validators, including those from Lido, have gradually amassed a lion’s share of power over the network.

Lido’s presence in the market gives it a tremendous amount of influence over how transactions are added to the chain, as validators ultimately choose which transactions are written to Ethereum and in what order.

Even more troubling is that if Lido or another validator ever amassed 33% of all staked ETH, it would have the ability to interfere with how the chain reaches consensus. If Lido goes offline or decides to attack the network as soon as it passes it critical threshold, it could theoretically slow down all network activity.

What is distributed validator technology (DVT)?

The prospect of network attacks and unfair power distribution have always loomed large over Ethereum. The ecosystem has traditionally prided itself on operating with a relatively high degree of decentralization, and has transitioned from a Bitcoin-like mining system to the current staking regime in part to further democratize control of the network.

But as certain strikers – and Lido in particular – have amassed increasing control over the Etheruem network, DVT has been seen as a possible saving grace.

“It all goes back to the ethos of Ethereum,” says Alon Adir, head of global PR at DVT company SSV, which offers a network that validator operators can use to distribute control over their infrastructure. “People don’t want to be dependent on a single entity. I think that ethos is very strong.”

While no two DVT solutions are exactly the same, they generally work in the same way, by distributing the “keys” to a given validator across different nodes. There must be a consensus among keyholders who approve decisions about the operation of DVT validators, and if one keyholder goes offline, others can step in to keep things running.

An advantage of this arrangement is the extra resilience.

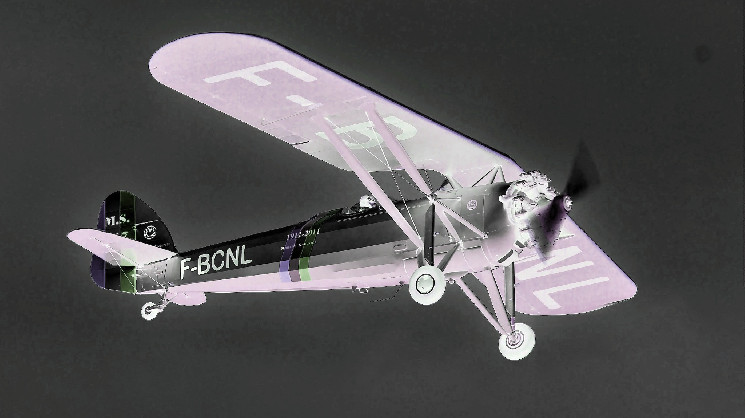

“Today, validators are single-engine planes. If a validator goes down, it’s offline,” said Brett Li, head of growth at Obol Labs, which is also building a network to distribute validators. With DVT, “It’s redundancy. You can have two engines, and if one of the engines fails, you can still get where you need to go safely.”

The big year of DVT

With product launches and testnets this year from Obol, Diva, SSV and others, the long-dormant hope for a more decentralized Ethereum validator network is finally nearing production.

In November Lido took one first step toward transitioning to DVT with the introduction of the “Simple DVT Module.” Lido takes deposits from users and distributes them to third-party validator operators. The new DVT module, which is being tested in collaboration with Obol and SSV, will allow Lido’s third-party validators to be decentralized, diluting the ability of Lido, which today controls the validators, to put unnecessary pressure on them.

The ambitions for DVT operators do not end at Lido.

“If the milestone with Lido is successful, it will become the standard for everyone, because Lido is the largest,” Adir said. “If Lido takes the step, others will take the step.”

It may take some time for Lido to transition its validators to DVT, or for broader infrastructure managers to feel comfortable adopting the technology. Validators managed by large institutions can continue to use their validators entirely internally; they are familiar with the software and maintenance required to keep a validator node running, and are reluctant to adopt new technology that could compromise their flexibility.

But hobbyist “solo strikers” and community-run collectives like Lido, which still control a large portion of all ETH, could soon embrace DVT for its easy setup and ideological underpinnings.

“In two or three years, you will hopefully see a third to a half of validators running on DVT,” Adir estimates. Obol’s Li made a similar short-term prediction, saying that in the long term he expects “80%” of validators to run on DVT-based infrastructure.