Over the past week, inscriptions on a number of blockchains have attracted the attention of crypto traders and developers alike due to the large transaction volumes that generated unusual amounts of gas fees. On Layer 2 (L2) chains like Arbitrum and Layer 1 chains like Avalanche and Solana, there has been a proliferation of inscriptions: on-chain chunks of data stored in transaction call data.

On the Solana network, transactions reached a cumulative value of more than $1 million since November 13, 2023; Solana activity also peaked on December 16, with 287,000 new inscriptions in one day. These inscription-based NFTs and tokens follow a similar structure to Bitcoin’s BRC-20 standard, based on Bitcoin Ordinals, with Solana adopting the SPL-20 token format.

On Avalanche, inscription-related transactions were recorded to have reached over $5.6 million in gas fees in a single day, as recorded on December 16, 2023. This record is followed by Arbitrum One of $2.1 million in gas fees spent on inscriptions.

On December 15, Arbitrum experienced a two-hour outage. Arbitrum is still investigating the exact cause, but initial analysis showed that an increase in network traffic brought the sequencer to a halt, causing batch transactions to be rolled back and depleting the sequencer’s Ether reserves. Although compromised during the outage, Arbitrum’s core functionality was restored shortly afterwards.

A recent analysis by the pseudonymous Twitter account Cygaar, a core contributor at Ethereum L2 network Frame, sheds light on the inner workings of inscriptions and how they ended up in L2 networks and L1 chains in recent weeks.

People can spam these txns because they are extremely cheap compared to smart contract txns.

This has led to the removal of Arbitrum and reduced experience at other chains such as zkSync and Avalanche.

It remains to be seen when this craze will end.

— cygaar (@0xCygaar) December 18, 2023

What are inscriptions?

Inscriptions are pieces of data recorded or ‘written’ on a blockchain. This data can include transaction details, smart contract codes, metadata and more. The addition of inscriptions to a blockchain not only adds complexity and richness to the technology, but also expands its capabilities for securing and managing all types of data.

According to Cygaar, inscriptions store token or NFT metadata in on-chain transaction call data. This enables cheap transactions for ‘xRC-20’ tokens – where ‘x’ represents standards such as BRC-20, ZRC-20, etc. – as most of the logic and enforcement happens off-chain. Smart contacts, on the other hand, store significant data on-chain and require more computing resources and therefore higher costs. Other inscription token standards include PRC-20, BSC-20, VIMS-20 and OPRC-20.

“Smart contracts must execute logic and store data in the chain. For registrations, only call data is sent on-chain, which is much cheaper,” Cygaar explains.

Entries are being spammed on networks like Avalanche, Arbitrum and Solana that are likely to secure an early position for trading speculative opportunities with low market capitalization. However, these repetitive automated mints and transfers provide little utility and have caused congestion and disruptions. If these subscription transactions continue to dominate activity, changes to these protocols may be necessary to limit their disruption.

Chain Analytics: Top Networks That Create Inscriptions

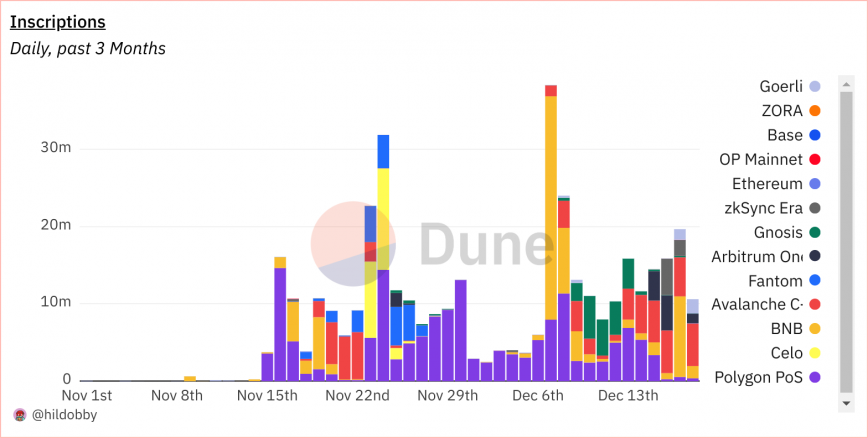

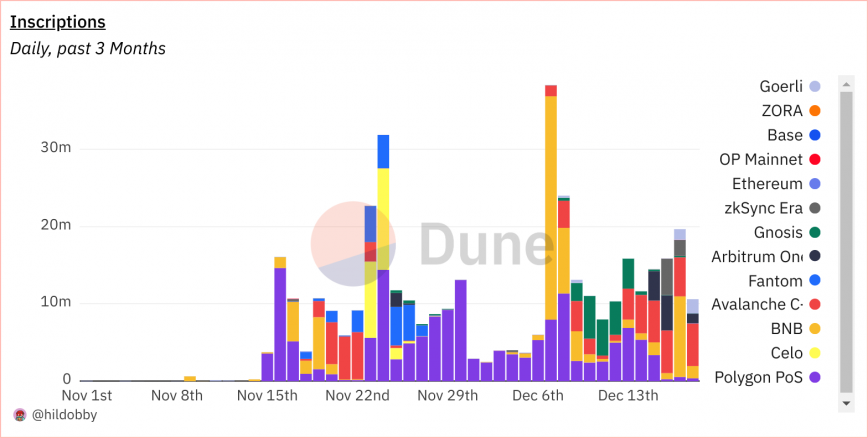

A dashboard on Dune Analytics published by Hildobby, an on-chain analyst at crypto venture capital firm Dragonfly, provides some insights into the impact of inscriptions on EVM chains.

According to the dashboard, inscriptions have exploded on all major EVM-compatible blockchains over the past week.

Between November 15 and December 18, chains such as Polygon, Celo, BNB Chain, Arbitrum and Avalanche will see daily sign-up transaction volumes in the millions, with the six largest chains representing more than half of all 13 listed chains.

Polygon PoS has the most number of inscriptions (161 million), while BNB Chain has the most number of inscriptors (217k). Ethereum has the largest number of inscription collections, despite only 2 million inscriptions minted by 84,000 inscriptions.

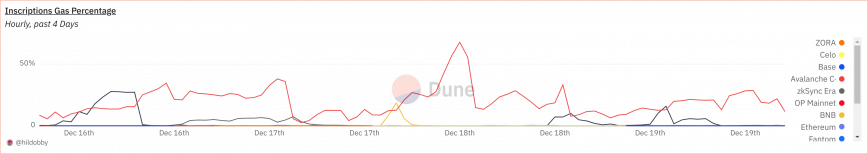

The largest share of gas costs is claimed by Avalanche C Chain, which surpassed all other chains and claimed 68% of all transactions as of December 18.

Prospects for inscriptions

While some protocols are benefiting from the activity spikes due to gas fee revenue, analysts argue that systemic changes such as tweaking gas pricing algorithms, limiting which transactions are eligible for refunds or completely blocking known spam accounts will be essential to ensure that they do not affect network functionality. .

On the other hand, the increase in inscription-related activities also encourages miners. Miners benefit from increased volume and cumulative fees, despite minimal transaction fees. Notably on Avalanche, transaction fees are paid in AVAX, and the transaction fee is automatically deducted from one of the addresses controlled by the user. The fee is burned (destroyed forever) and not given to validators.

The recent spike in low-cost subscription transactions on EVM-compatible blockchains appears to be driven more by short-term profits than real utility. It is likely that policy changes on transaction fees or restrictions may be necessary to avoid creating network-disruptive transaction volumes due to pointless activity. For inscriptions to mature as a scalability solution rather than just a fad, they need to enable valuable applications rather than repetitive token mining.