Bitcoin’s price starts the new week in the red after a surge in Ordinals coins this weekend resulted in a clogged blockchain network.

Dates of CryptoSlate shows that the price of BTC fell about 2% to $41,189 during trading hours in Asia, reminiscent of how the flagship digital asset started the week before.

Similarly, other large-cap alternative cryptocurrencies such as Ethereum, Solana, Cardano and Avalanche posted significant losses between 2% and 5% during trading hours.

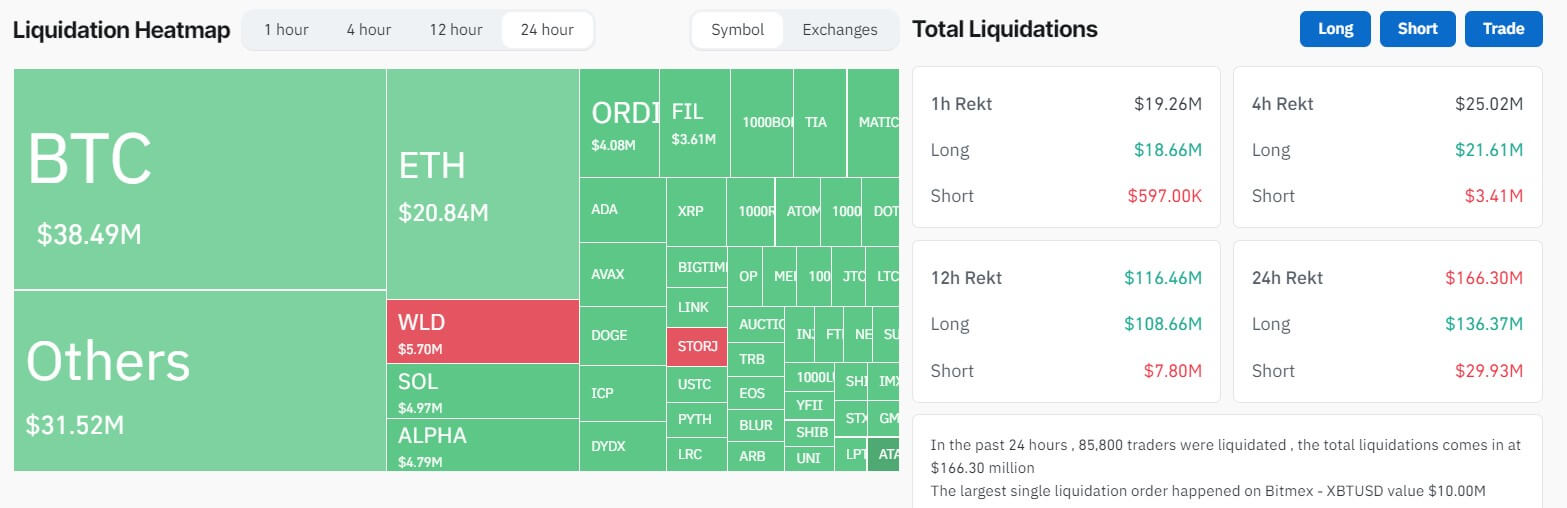

$166 million liquidated

Mint glass facts shows that the recent price drop caused approximately $166 million in losses for approximately 85,000 crypto traders with active market positions.

The breakdown of these liquidations shows that long traders suffered the largest losses, totaling $136 million, while short traders lost $30 million.

Traders with positions on BTC saw losses totaling more than $40 million across positions. Long positions, or positions that speculate on higher BTC prices, contributed $38 million to this amount, while short position holders, or traders betting on lower prices, accounted for $7 million.

Ethereum investors also suffered notable losses, with approximately $20 million liquidated from long positions and $2.66 million from short positions.

Across all exchanges, Binance and OKX posted the most substantial losses, with liquidations of more than $74 million and $42 million, respectively. Notably, the most significant individual loss was a long $10 million bet on the price of Bitcoin via BitMEX.

Notably, Bitcoin maintains a low Liquidation Sensitivity Index (LSI) score of just $15.5 million USD/%, highlighting the reduction in leverage compared to the 2021 bull run that saw an average of $74 million liquidated per 1% change in the price of Bitcoin.

Clogged network

According to BitInfoCharts, a surge in Ordinals Inscriptions last weekend resulted in a clogged blockchain network, pushing average Bitcoin transaction fees above $37. facts.

Facts from Mempool further shows that these transactions resulted in more than 288,000 unconfirmed transactions at the time of writing.

Earlier this month, Ordinals sparked heated debate among the BTC community, with purists claiming that these assets exploited a vulnerability in the Bitcoin Core to spam the blockchain.

However, many in the community oppose this view, arguing that inscriptions will never stop and are an evolution of the blockchain network.

Interestingly, a similar trend was observed in Ethereum virtual machine (EVM)-compatible chains such as Avalanche, Polygon and Arbitrum, with users spending more than $10 million in transaction fees on these assets over the weekend, according to Dune analytics. dashboard from Hildobby.