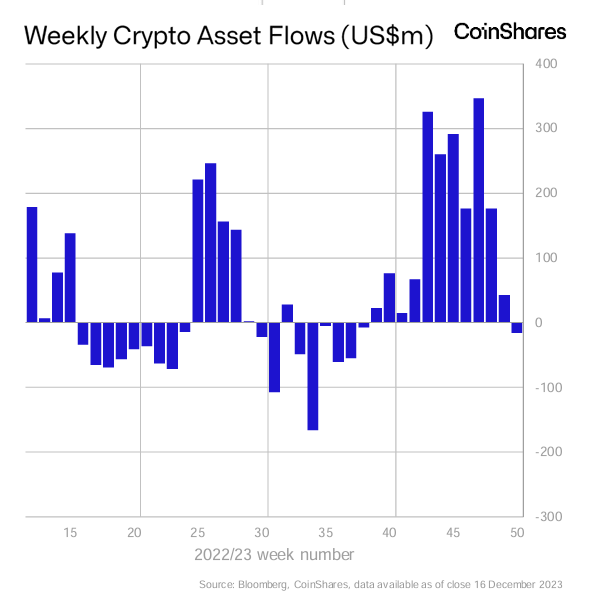

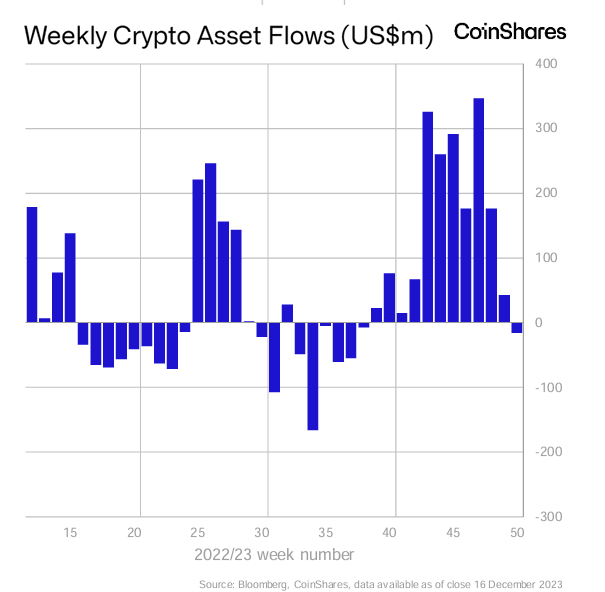

After eleven weeks of consistent inflows into digital asset investment products, outflows totaling $16 million showed a slight reversal in the market.

The latest CoinShares report highlights this subtle shift in the digital asset investment landscape. Total trading activity for the week was $3.6 billion, significantly higher than this year’s average of $1.6 billion. Despite the recent outflows, this robust trading volume indicates continued interest in the market.

Even despite a seemingly impending Bitcoin ETF approval, proxy Bitcoin investments in the form of blockchain stocks continued to generate positive investor sentiment. These stocks saw substantial inflows totaling $122 million last week. CoinShares reports that these inflows bring the total for the past nine weeks to $294 million, which is the most significant run ever. This robust interest in blockchain stocks highlights the growing recognition of the long-term potential of blockchain technology beyond the immediate swings in the crypto market.

Bitcoin was the most affected, with an outflow of $33 million. Even short Bitcoin positions, typically a hedge against the value of Bitcoin, saw small outflows totaling $0.3 million.

In contrast to the general outflow trend, altcoins emerged as a bright spot, with inflows of $21 million. Solana stood out with an inflow of $10.6 million, far better than any other project. Cardano, XRP and Chainlink followed this positive move, collectively attracting inflows of $3 million, $2.7 million and $2 million respectively.

A closer look at the geographic distribution of these flows reveals a more complex picture. In the United States, the outflow was most pronounced and amounted to $18 million. Sweden and Germany also experienced outflows, albeit on a smaller scale, totaling $4 million and $10 million respectively.

However, this trend was not universal across all regions. Canada ($6.9 million) and Switzerland ($9.1 million) saw continued inflows, while Brazil totaled $3.5 million. CoinShares attributes this mixed pattern across regions to profit-taking activity and not a fundamental shift in investor sentiment toward digital assets.

Overall, recent movements in digital asset investments reflect a diverse and dynamic market. While there are signs of cautious profit-taking, continued high trading volumes and selective inflows into certain assets and regions indicate underlying confidence in the long-term prospects of the digital asset sector.

The full report of CoinShares is available on its website, which is published weekly on Mondays.