Recent reports have shown that Bitcoin (BTC) experiences a significant increase in whale activity, which has since caused a stir throughout the crypto community.

Bitcoin Experiences Rise in Whale Transactions

According to Whale Alert, Bitcoin has seen an increase in whale transactions over the past 24 hours. The crypto tracker recently revealed several whale transfers from unknown wallets to crypto exchanges such as Binance And Coin base.

The report shows that Binance has amassed a whale inflow of more than $67 million through the transfers. Meanwhile, Coinbase amassed an influx of whales worth more than $310 million through the transfers.

A recent one transaction of 781 BTC was reported by Whale Alert, coming from four different cryptocurrency wallets. However, approximately 658 BTC were transferred directly to Binance.

Additionally, early Wednesday morning, another unknown wallet sent 499 BTC to Binance. This move is worth almost $20.6 million at the time of the transaction.

Most recent The whale activity reported by the crypto tracker shows that approximately 500 BTCs have been transferred to Binance. At the time of the report, the transaction was valued at $20.5 million.

For Coinbase, the tracker revealed a whopping 7,515 Bitcoin transferred to the crypto exchange from unknown wallets. The first transaction saw approximately 2,510 BTC, worth $104.2 million, sent from an unknown wallet 1xkfCoJyCZ…Ur7bZJWuXJ to Coinbase. The second In a whale transaction, 2,494 BTC was transferred to the crypto platform from another wallet.

Meanwhile, the last whale transaction from the anonymous wallet is 15LhEQYPdK…88T9kLM55m transferred 2,511 BTC to Coinbase. Nevertheless, the crypto tracker has reported that these BTCs have been moved from the exchange to various wallets.

So far there is no hard evidence that this whale transactions have had some effect on the price of Bitcoin.

Support levels to look out for, says analyst

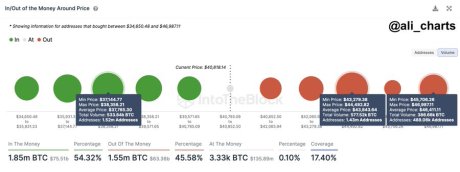

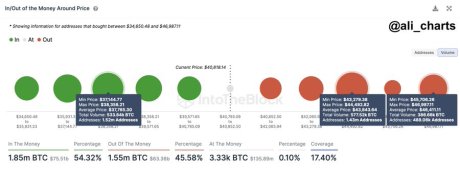

Cryptocurrency analyst Ali Martinez recently did just that shared key levels to be aware of regarding the crypto asset. The analyst took to X (formerly Twitter) to share these crucial levels of support for the crypto community and investors.

Ali claimed that BTC will find solid support between $37,150 and $38,360 should a deep correction occur. He further added that the zone is supported by 1.52 million addresses holding approximately 534,000 BTC.

Moreover, he highlighted two walls of resistance that could hold back the crypto assets’ upward rally. The first resistance wall costs $43,850, while the second wall costs $46,400.

Currently, BTC is at $41,380, which at the time of writing indicates a decline of 1% in the past 24 hours. The market cap is currently estimated at around $809 billion, which indicates a similar percentage decline, according to CoinMarketCap.

Featured image by iStock, chart by Tradingview.com

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.