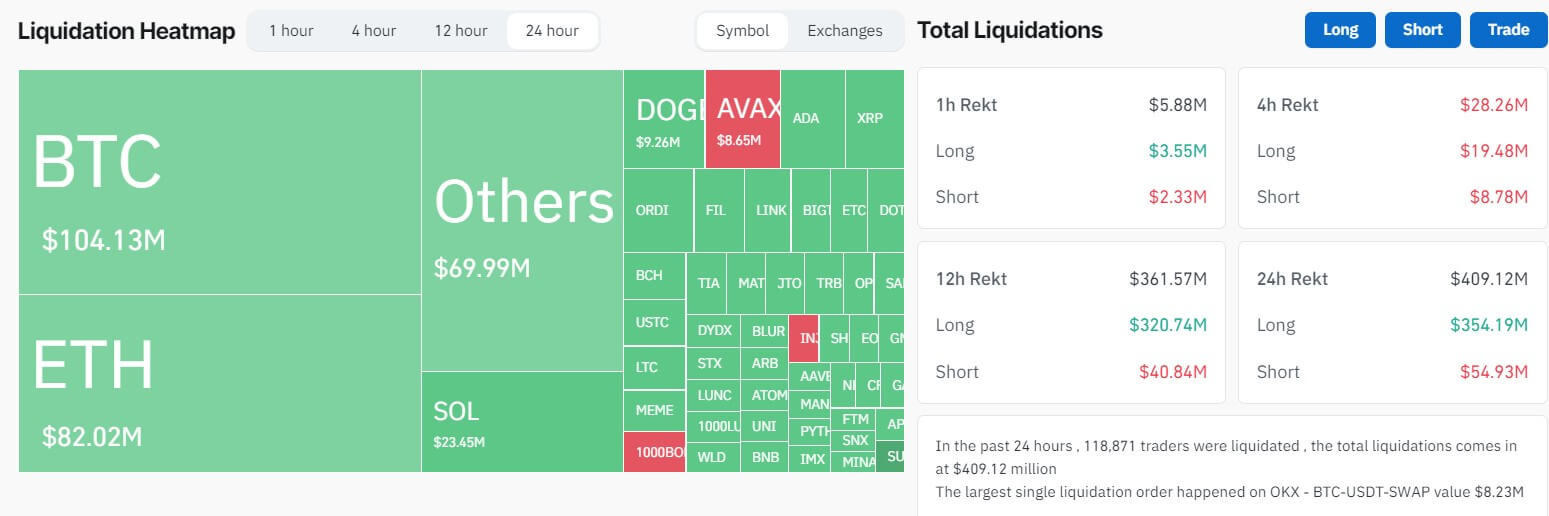

Nearly 120,000 crypto traders lost more than $400 million in the past 24 hours as digital asset prices plummeted during the opening of Asian trading hours on December 11.

Mint glass facts indicates that approximately $356 million of these liquidations were attributed to long positions, representing the largest single-day loss due to long-term speculation in the past four months. Additionally, short traders faced losses totaling $54.79 million.

Bitcoin traders bore the brunt of these losses, accounting for approximately $104 million in total liquidations. Long positions in BTC contributed $90.9 million to this figure, while shorts accounted for $12.12 million.

Ethereum investors also faced significant losses, with approximately $74.62 million liquidated from long positions, in addition to $6.52 million from short positions.

Other cryptocurrencies such as Solana, XRP, Dogecoin, Avalanche, Cardano and Litecoin saw notable losses during this period for traders who held long positions.

Among exchanges, OKX and Binance witnessed the biggest losses, with liquidations of over $171 million and $128 million respectively. The most substantial individual loss recorded was a long $8.2 million bet on the price of Bitcoin on the OKX exchange.

The crypto market is taking a breather.

Bitcoin, the largest cryptocurrency by market cap, fell about 5% to a low of $41,649 before recovering to its current value of $42,155 at the time of writing, according to Crypto Slates facts.

The fall of BTC caused the price declines of other major cryptocurrencies such as Ethereum, which fell by almost 5%, followed by other large-cap cryptocurrencies such as Solana, XRP, Binance-backed BNB and Cardano, which saw some of their most significant losses in recent time members. to soften.

The global crypto market capitalization fell by about 4% to $1.57 trillion.

The recent decline comes after a three-month surge fueled by optimism over the possible approval of a Bitcoin Exchange-Traded Fund (ETF) in the United States.

Although approval has not yet taken place, experts point to the ongoing communication between the US Securities and Exchange Commission (SEC) and the applicants as a positive sign, indicating that the regulator may finally give the green light to these investment products.