Ethereum’s market performance has been steadily rising since October, marking a positive and long-term trend. The increased buying activity has been the main driver of this positive momentum that has persisted over time, pushing the cryptocurrency past the vaunted $2,000 resistance mark and sparking a sustained rally.

The value of Ethereum has grown strongly as a direct result of this increased demand and market optimism, with its sights set on breaking the crucial resistance area at $2,300. This uptrend serves as further evidence of rising investor confidence and general bullishness surrounding Ethereum, solidifying its place in the evolving cryptocurrency market.

Ethereum hits 18-month high and targets $3,000

Ethereum, the world’s second largest cryptocurrency, is rising rapidly and has reached levels not seen in the past 18 months. With a market valuation of $285 billion, ETH is now trading 5.7% higher at $2,375 at the time of publication. Some speculators even shared price predictions of $3,000 for ETH during the last market breakout.

Ethereum’s impending resistance level poses a huge challenge for buyers of the altcoin, including the $2.5K fixed limit, which often proves to be a major roadblock. But if the market can recapture this critical area, Ethereum could reach $2.5K – or even $3,000 – in the future.

Ethereum currently trading at $2,358 territory on the daily chart: TradingView.com

As Ethereum clears further hurdles, investors and market watchers are keeping a close eye on the situation. A notable indication of the increased interest from institutional investors is the eagerness with which major players such as VanEck, BlackRock and Grayscale await approval for Spot Ethereum ETFs.

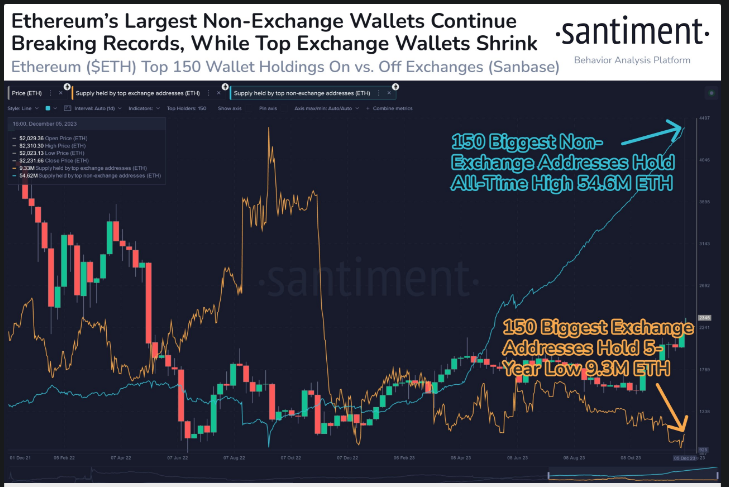

According to Santiment, an on-chain data service, Ethereum has reached $2,349, the highest price since June 2022. The convergence of the positive long-term trend pointing to an increase in the wealth of the leading whale portfolios that cannot be traded on the exchange, and a decrease in the selling power of the leading whale portfolios on the exchange, offers a favorable situation for a stable economy. rising.

Ethereum’s off-exchange holdings rise to 55 million ETH

A recent tweet from Santinment highlights some intriguing variations in Ethereum’s wallet mechanisms. Exchange portfolios hit a five-year low of 9.3 million ETH, while the main non-exchange portfolios are building to a record 54.6 million ETH. This movement points to upward trends, with wealth being built through non-barter transactions and reduced selling pressure.

Over the course of two months, the bearish difference between the price and the RSI indicator grew, indicating a possible overvaluation of Ethereum at this point. Given the current market characteristics, even if buyers appear to be in charge and overall sentiment is bullish, there is a significant chance of a short correction phase that will bring consolidation and higher volatility in the near future.

Meanwhile, a recent ACDE meeting provided information about Ethereum’s upcoming Dencun fork, which is expected to take place in January 2024. The Goerli Network Testnet fork was well prepared by development teams and opened the door for a larger Goerli Shadow Network fork in 2024. in the coming weeks.

ACDE#176 took place earlier today: we discussed Dencun State, testnet timelines, and how to plan for the next network upgrade ⛓️

Agenda: https://t.co/ATVLQ7f9Xp

Current: https://t.co/tDM0tDKxC5Summary below 👇 https://t.co/PhGBkYxhYN

— timbeiko.eth ☀️ (@TimBeiko) December 7, 2023

By using proto-dankhardening, Dencun is expected to significantly increase data availability for layer 2 rollups. This improvement should result in lower overall transaction costs, which will ultimately benefit end customers.

Dencun’s overall effects include rollups that increase Ethereum scalability, gas rate optimization, improved network security, and the implementation of various housekeeping upgrades.

As Ethereum’s price rises to cross the $2,300 milestone, speculation is mounting about the cryptocurrency’s potential to reach the next major threshold of $3,000. The recent upward trajectory reflects the market’s confidence in Ethereum’s underlying technology and its role in the evolving digital landscape.

(The content of this site should not be construed as investment advice. Investing involves risks. When you invest, your capital is subject to risk).

Featured image from Shutterstock