Positive sentiment for Bitcoin has risen quite rapidly in recent months as the market has made an incredible recovery. This caused the Bitcoin Fear & Greed Index to go from deep fear to deep greed, and that greed just kept growing. Now sentiment is on the verge of extreme greed, which may be good in the short term but could become inherently bearish because of the price.

How the fear and greed index works

The Bitcoin Fear and Greed Index uses a number scale from 1-100 to identify how investors feel towards the crypto market at any given time. This index uses a number of different indicators to arrive at a number that ranges from social media posts to market volatility and momentum, among others.

The scale is then divided into five different categories depending on how investors feel and the number the index is on. 1-25 is considered extreme fear and is a time when crypto investors tend to stay away from the market due to price drops. However, this has often proven to be the best time to buy cryptocurrencies.

Next is the range of 26-46 known as the fear zone. It’s a step ahead of the extreme fear, but it’s also a time when investors aren’t as wary despite the rampant fear. It is also a good time to buy and precede the next phase, which is neutral.

Neutral is the range between 47-52 and indicates a time when investors are uncertain about this market. Investors mainly refrain from making any moves during this period, waiting for the market to rise or fall before deciding their next move.

One step above that is the greed level which starts at 53 and ends at 75. At this point, investors return to the market and prices recover quickly. This often results in extreme greed between the ages of 76 and 100, with important decisions being made.

BTC price reclaims $44,000 | Source: BTCUSD on Tradingview.com

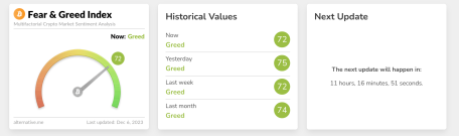

Bitcoin sentiment rests at 72

The Fear & Greed Index currently stands at 72, treacherously close to entering extreme greed territory, which could have huge implications for the price. Now, looking back at times when the index’s score has risen so high, it paints a picture of bullishness, followed by bearishness.

An example of this is in December 2020, when the index rose into extreme greed territory. It would continue to rise as investors flooded the market, eventually reaching 91. What followed was a crash that sent investors into a spiral. The same thing happened between October and November 2021, where the score reached extreme greed before crashing.

Source: alternative.me

Considering how the Bitcoin price has performed when the score has been this high, it stands to reason that extreme greed can often act as a top signal. So the index entering the 76-100 region can often mean it’s time to exit the market.

If this trend repeats, Bitcoin price could rise further and stage more recovery. However, it is heading towards a market crash that could trap bulls who have not timed their exit correctly.

Featured image of Trade Santa, chart from Tradingview.com