Bitcoin has really warmed up in recent weeks, pushing the price above successive price resistances to make new yearly highs. Bitcoin recently pushed past $44,000recording profits from 15% in a period of 7 days.

Although the price gain can be partially attributed to the hype surrounding the spot Bitcoin ETFsData about the chain shows that there is increased activity at many large companies. According to on-chain analytics platform Santiment, the recent rise in the price of BTC has been associated with an increase in the number of wallets holding more than 100 BTC.

Large Bitcoin wallets increase purchases

An X-post from Santiment has shown that the number of wallets holding 100 BTC or more has been increasing for four weeks. Bitcoin posted unprecedented gains in October, with whales and large holders holding between 100 and 1,000 BTC increased by 16 purses. As a result, BTC continued its price rise and rose $30,000, the first of many to come in the following weeks.

However, data from Santiment shows that the number of major wallets saw a large decline on November 9, which correlated with a brief period of profit-taking in which Bitcoin fell from $37,000 to $35,500 on November 15.

By mid-November, things started to change, indicating that the bull rally was not slowing down. The number of whale addresses holding 100 BTC or more started to rise around this time, and 48 of these whale wallets have returned in the past four weeks, indicating that these major players have been busy stocking up on BTC during the rally. According to data from Santiment, there are now about 16,000 of these wallets.

#BitcoinThe rise has continued, reaching $44K just 2 hours ago. The number of existing 100+ $BTC portfolios are closely correlated with this price increase. Since a major pullback on November 9, 48 of these whale portfolios have returned in the past four weeks. https://t.co/4lNBvn1HB3 pic.twitter.com/jJYVsPSbfk

— Santiment (@santimentfeed) December 5, 2023

More BTC Gains in December?

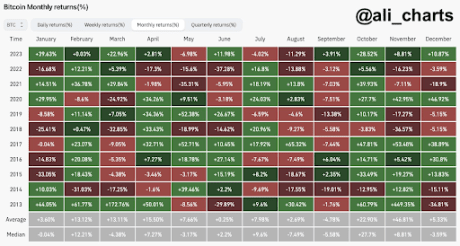

December has historically been a mixed month of performance for Bitcoin. However, the last time the crypto recorded a price increase in October and November, it would rise another 46.92% in December. If there is a repeat, Bitcoin could rise above $55,000 before the end of the year.

Source: X

The recent Bitcoin price rally is somehow different from previous rallies potential catalysts for a price increase if the next halving and the launch of spot Bitcoin ETFs has yet to happen in the US. Santiment’s on-chain metric regarding whale wallets reiterates this position of many crypto analysts predict that the recent price increase is just the beginning of a long bull run that will continue until 2024.

Bitcoin is currently trading at $43,767, after briefly trading above $44,000 for a few hours. According to crypto analyst Ali Martinez, the TD Sequential indicator signals a possible price drop for BTC towards the $37,000 support zone.

a #Bitcoin price correction is coming… The question is when?

Well, the TD Sequential indicator suggests there is a potential $BTC The price decline could start within the next 7 to 48 hours, based on the daily and three-day charts.

pic.twitter.com/UwI1IMq4jo

— Ali (@ali_charts) December 5, 2023

BTC price reclaims $44,000 | BTCUSD on Tradingview.com

Featured image from InfoMoney, chart from Tradingview.com