A widely followed crypto analyst says Bitcoin’s (BTC) pullback ahead of the halving could actually be a good thing.

Pseudonymous crypto trader Rekt Capital takes a deep dive into pre-halving BTC activity for his 372,100 followers on social media platform X.

The Bitcoin halving takes place approximately every four years. The pre-programmed event reduces the reward for Bitcoin miners by half, ultimately limiting the total supply of Bitcoin to 21 million coins.

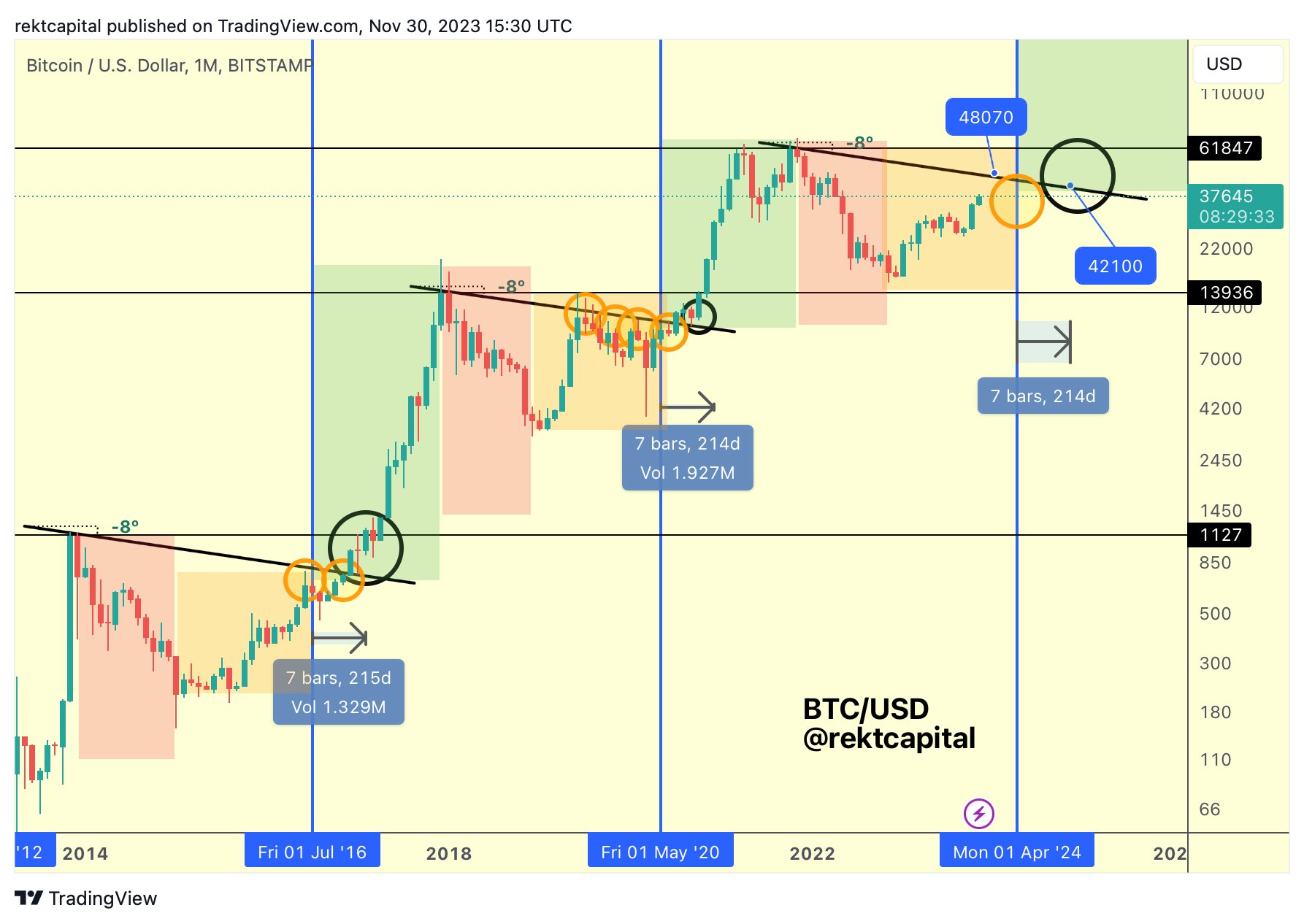

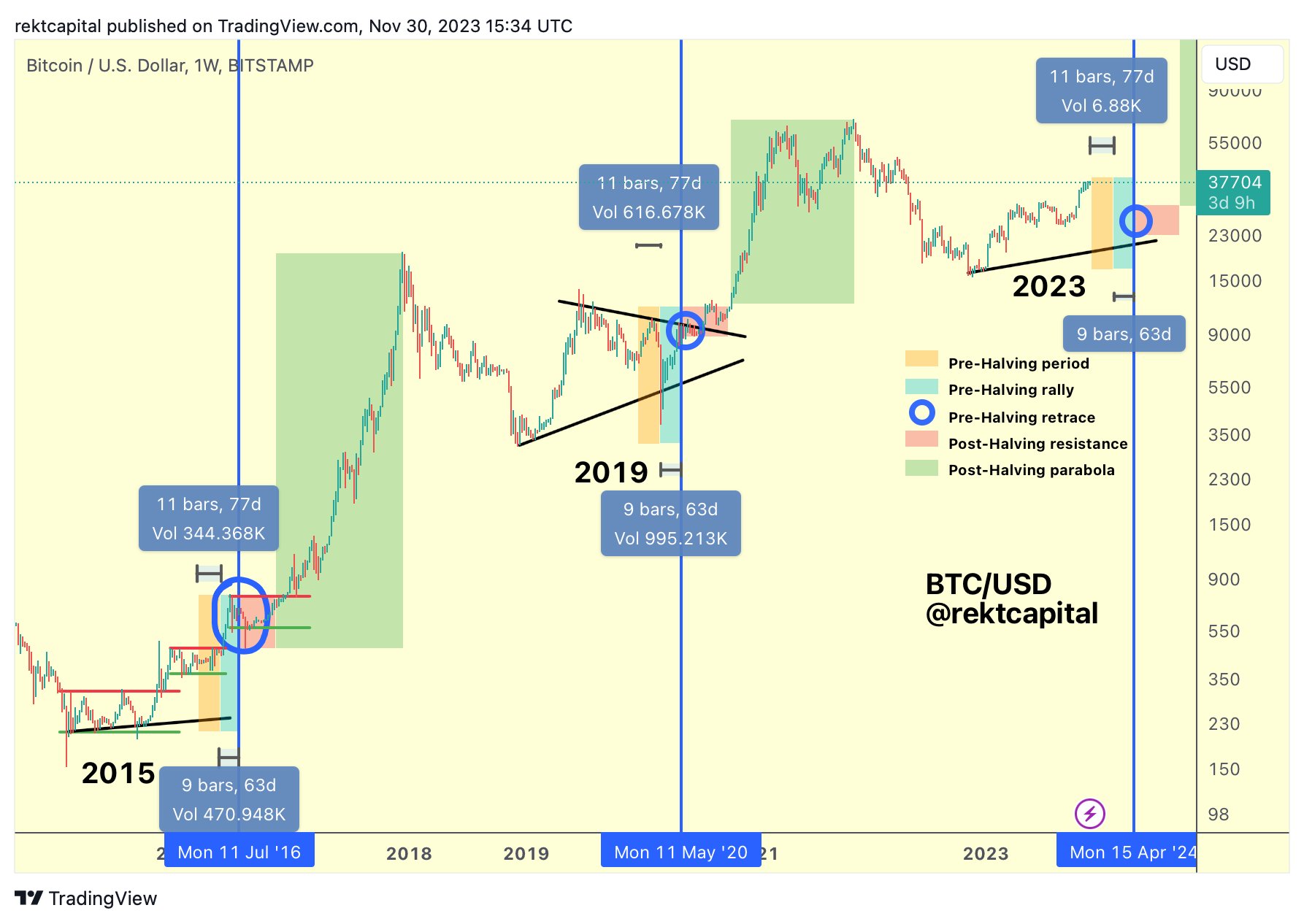

According to Rekt Capital, BTC has historically used halving to jump to new all-time highs.

“The black trendline tends to act as resistance in the period before the halving (orange circles)

But after the halving it is broken and reclaimed as new support (black circle)

After a successful retest, BTC later jumps to new All Time Highs.”

According to the trader, this will happen if the price of BTC drops before the halving any result in an even more explosive period after the event, currently expected in April 2024.

“Any deeper retracement during the pre-halving period will enable the future parabolic uptrend in the post-halving period.”

According to the analyst, BTC is still drenched in the pre-halving phase.

“Bitcoin is still in the pre-halving phase

But after the halving, Bitcoin will spend a few weeks in reaccumulation (red) before entering a parabolic uptrend (green).”

BTC is worth $37,594 at the time of writing.

Don’t miss a beat – Subscribe to receive email alerts straight to your inbox

Check price action

follow us on Tweet, Facebook And Telegram

Surf to the Daily Hodl mix

Featured image: Shutterstock/Macrovector