Bitcoin price rose to $38,475 yesterday, marking a marginally higher high for the year. Nevertheless, the price failed to close the day above the important $38,000 mark. Shortly before the end of the day, the bears managed to push the price down again.

As crypto analyst Daan Crypto Trades noticed“The market is doing its best to shake off anyone trying to prepare for a possible Bitcoin ETF approval. It’s just free liquidity for the middle market/whales. Sweep highs, trap longs, squeeze out longs, bait shorts, front run lows and repeat the whole process.

BlackRock Argues With SEC Over Details Of Spot Bitcoin ETF

In a notable development, BlackRock, the world’s largest asset manager, was again actively involved yesterday in discussions with the US Securities and Exchange Commission (SEC) about the structure of its spot ETF.

Eric Balchunas, senior ETF analyst at Bloomberg, revealed, “BlackRock met again yesterday with the SEC’s Trading & Markets Division and presented them with a ‘revised’ in-kind model draft based on Staff’s comments at their November 20 meeting.” This revised model includes a notable change in the process, specifically at “Step 4,” where the offshore entity market maker acquires Bitcoin from Coinbase and then pays cash up front to the US registered broker-dealer who is not allowed to touch BTC.

James Seyffart, another Bloomberg analyst, highlighted the ongoing negotiations: add, “More confirmation that issuers are still in discussions with the SEC. BlackRock/Nasdaq still insist on in-kind creation and redemption. It appears that the SEC did not give in to the demand for cash when this was the primary focus of the meeting. At least not before yesterday, interesting days ahead!”

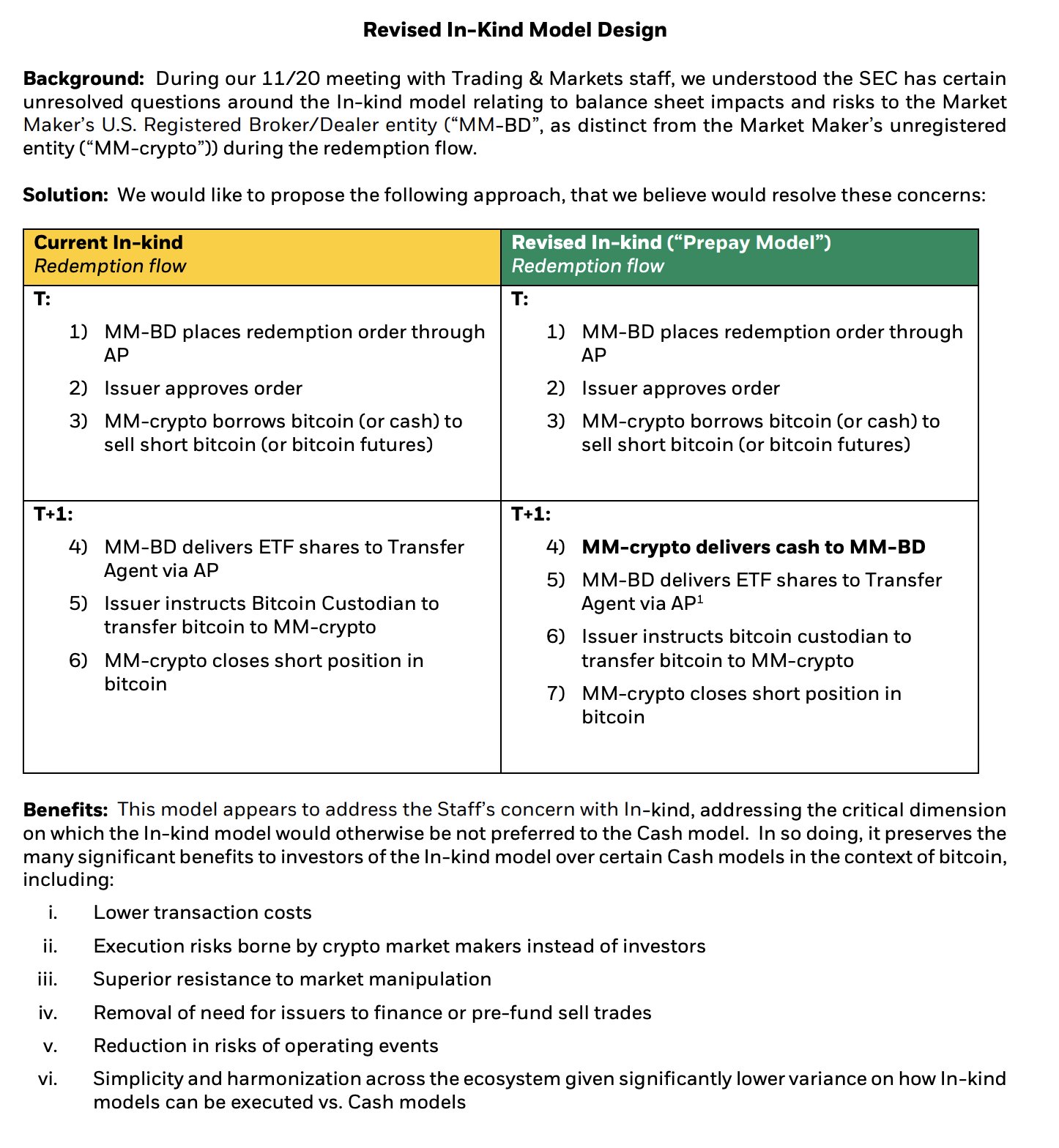

In the original “In-Kind Redemption” flow, Market Maker’s (MM-BD) Broker/Dealer entity placed a redemption order through the Authorized Participant (AP), who approved the order, allowing MM-crypto Bitcoin (or could borrow cash). sell short. This redemption flow had potential balance sheet implications and risks that concerned the SEC.

BlackRock has now proposed a “Revised In-Kind (‘Prepay Model’)” redemption flow. This new model involves MM-crypto delivering cash to MM-BD instead of Bitcoin, and MM-BD then delivering ETF shares to the Transfer Agent via API. The Bitcoin custodian is instructed by the issuer to transfer Bitcoin to MM crypto, which then closes the short position in BTC.

The benefits of this revised model are numerous. It aims to reduce transaction costs and shift execution risks from investors to crypto market makers. It also claims to provide superior resistance to market manipulation and eliminate the need for issuers to finance or pre-fund sales transactions. The reduction in risk from operational events and simplification across the ecosystem could mean less variation in how in-kind models can be run versus cash models.

There remains a 90% chance of approval

Should the SEC approve this revised model, it could herald the introduction of the first US-based spot Bitcoin ETF, a major milestone that would allow investors to gain direct exposure to Bitcoin rather than through derivatives such as futures. Despite these developments, a degree of uncertainty remains regarding the SEC’s position on this matter, particularly regarding the implications of spot BTC exposure for retail investors through an ETF.

Recent leaks suggested that the SEC could favor cash generation processes over Bitcoin in-kind transfers, a move that could significantly change the landscape for ETF issuers and broker-dealers dealing with Bitcoin. Nevertheless, Bloomberg ETF analysts yesterday reiterated their 90% odds for approval of a spot ETF by January 10.

At the time of writing, BTC was trading at $37,728.

Featured image from Shutterstock, chart from TradingView.com