Data shows that altcoins have lost correlation with Bitcoin lately, and among them, XRP and BNB have seen a particularly pronounced decoupling.

XRP and BNB have seen the biggest declines in the 60-day correlation with Bitcoin

As noted by an analyst in a after on X, BTC has recently seen a drop in correlation with the altcoins. The “correlation” here refers to an indicator that tracks how similar the prices of two assets are at the moment.

When the value of this measure is positive, it means that the given assets respond to movements in each other’s price by moving in the same direction. The closer the value of the indicator is to 100%, the stronger this correlation is.

On the other hand, negative values imply that there is a negative correlation between the assets because their prices move opposite to each other. In this case the extreme is -100%, so the more negative the value, the closer the relationship.

The 0% mark represents the point at which there is no correlation between the prices, implying that movements in one price have no impact on how the other might perform.

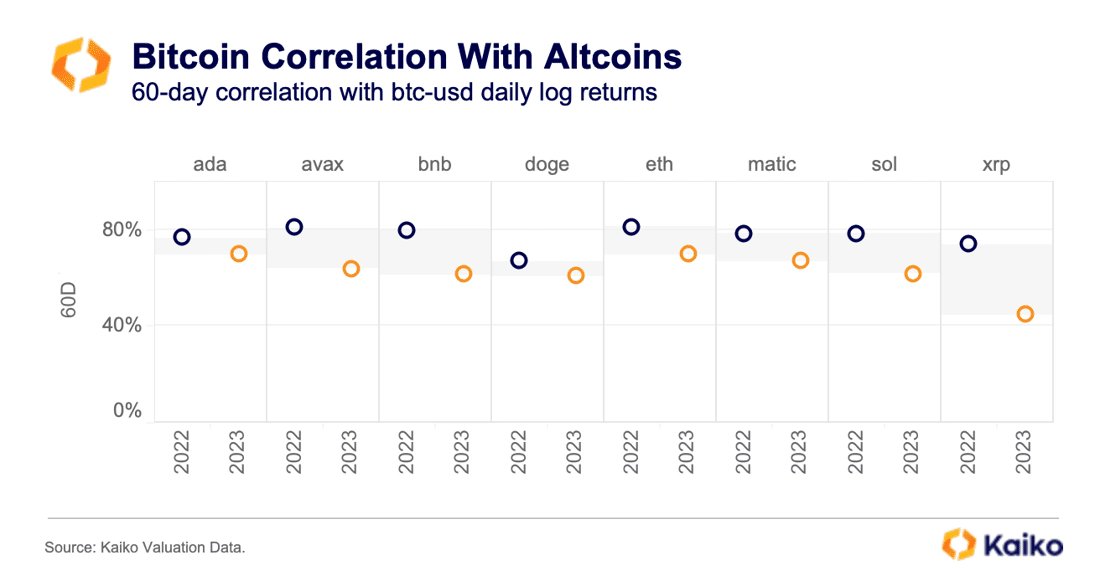

Here’s a chart showing what the 60-day correlation between the daily log results of Bitcoin and various altcoins looks like now, and how it compared a year ago:

Looks like XRP has seen the strongest decoupling out of these coins | Source: @CryptoBusy on X

As shown in the chart above, the 60-day correlation between Bitcoin and This means that the price of XRP has moved much more independently of BTC over the past 60 days.

BNB (BNB), Avalanche (AVAX), and Solana (SOL) have also seen some decoupling from the original cryptocurrency. Still, these alts have seen the indicator drop much less than XRP has seen.

Cardano (ADA) and Dogecoin (DOGE) are the altcoins that have seen the least change. However, in the case of the memecoin, the correlation was initially smaller than that of the other assets, so even with the small decoupling, the correlation level still matches that of BNB.

In general, correlation is something to be aware of when an investor is trying to diversify their portfolio, as two assets with significant correlation do not provide much safety.

Since XRP is currently the cryptocurrency least correlated to Bitcoin on this list, it could thus be a better diversification option than coins like Ethereum (ETH) or Polygon (MATIC), which have the indicator’s 60-day value at relatively high levels to have. still.

XRP price

Just a few days ago, XRP had revisited the area above $0.63, but it didn’t take long for it to fall back below $0.60. However, since this low, the cryptocurrency has seen some recovery as it is now approaching $0.61 again.

XRP seems to have gone through a tumble recently | Source: XRPUSD on TradingView

Featured image of Kanchanara on Unsplash.com, charts from TradingView.com, Kaiko.com