A recent analysis by crypto expert CryptoCon, focusing on the Ichimoku Cloud indicator, suggests a bullish outlook for Bitcoin, with a potential rally to $48,000 in early January.

CryptoCon, in its latest analysishighlighted the reliability of the Weekly Ichimoku Cloud, stating: “The Weekly Ichimoku Cloud called our latest Bitcoin surge to $38,000 two months in advance, projecting the cross into the future.”

The analysts’ confidence comes from the indicator’s historical performance, which is said to have identified previous price movements with considerable accuracy: 11 weeks, 7 weeks and 13 weeks in advance.

Bitcoin Rally to $48,000 Ahead?

The chart accompanying CryptoCon’s statement outlines four different cycles, each marked by major price events and the Ichimoku Cloud’s predictive crosses. The current cycle, also called Cycle 4 and running from 2023 to 2026, shows a Leading Span Cross – a crucial signal within the Ichimoku Cloud methodology – pointing towards an upward trajectory.

CryptoCon explains: “Now we wait for it to fulfill its next calls, the completion of our increase and the first target of 43k.” This expectation is based on the observed duration of the Leading Span Cross to the respective local summits, ranging from 7 to 11 weeks, with an average of 10 weeks. If the pattern holds, the proposed timeline places the completion of this increase in early January.

The analysis further highlights the potential for Bitcoin to reach the upper limits of the red portion of the Ichimoku Cloud, also known as the ‘Leading Span B’. According to CryptoCon, “the most conservative level here is 43.2k, but the real top of the red cloud could be as high as 48k.”

It is worth noting that the Ichimoku Cloud is a comprehensive indicator that provides insight into market momentum, trend direction, and support and resistance levels. The tool is highly regarded for its forward-looking capabilities, especially the ‘clouds’, which are projected 26 periods ahead of the current price to suggest future potential support or resistance zones.

BTC price floor could reach $41,200 after halving

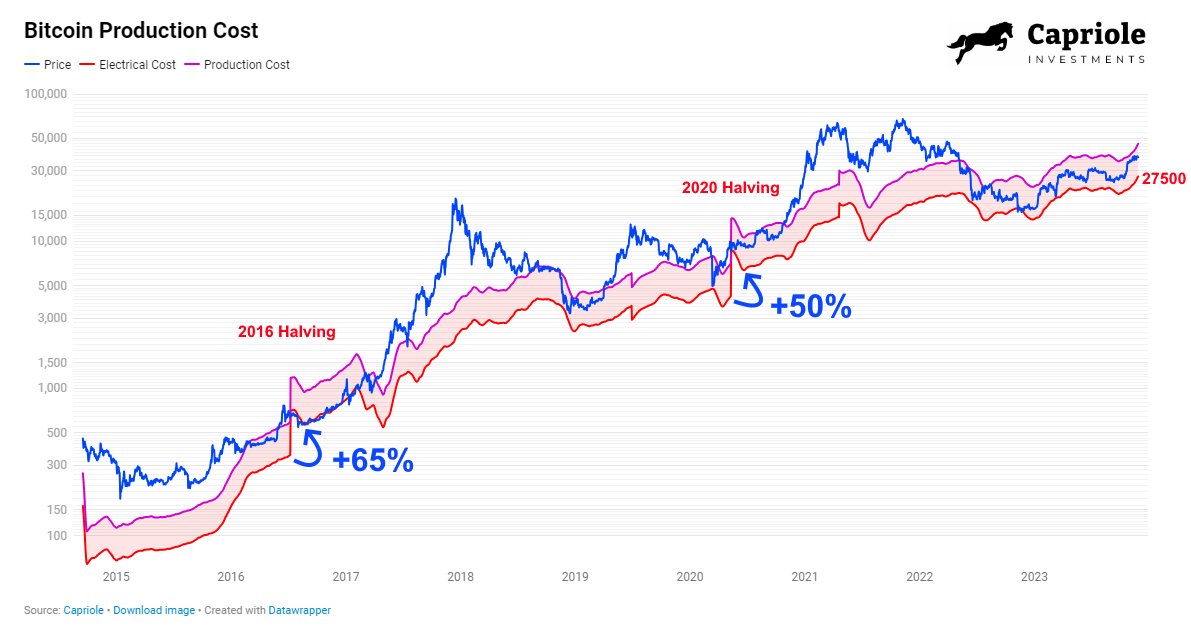

On a related note remarkCharles Edwards, the founder of Capriole Investments, provided a data-driven perspective on the future of Bitcoin’s price floor. With the next Bitcoin Halving event scheduled for April 2024, Edwards projects significant changes to the leading cryptocurrency’s mining economics.

“In April 2024, Bitcoin’s electricity cost, the raw energy cost of mining Bitcoin, will double overnight. This is a certainty,” Edwards stated, drawing attention to the predictable nature of the Halving event, which halves the reward for mining Bitcoin transactions. This systemic shift is likely to push inefficient mining operations out of the market as they struggle with suddenly halved revenues against a backdrop of static costs.

Edwards’ analysis of previous halving events reveals a trend where the cost of electricity – essentially the floor for Bitcoin’s price – settles to a significantly higher level after the halving.

“During the last two halvings, electricity costs bottomed out at +65% and +50% of pre-halving values,” he notes. If this pattern holds true, and electricity costs reach +50% this time, it is estimated that “Bitcoin’s historical price bottom will reach $41.2K in just 5 months.”

At the time of writing, BTC was trading in the mid-range at $37,146. Although BTC has left the trend channel down, the price is making even higher lows.

Featured image from Shutterstock, chart from TradingView.com