Ethereum prices are firm at spot rates and still trading above the $2,000 level, and several other factors point to a possible continuation of the trend.

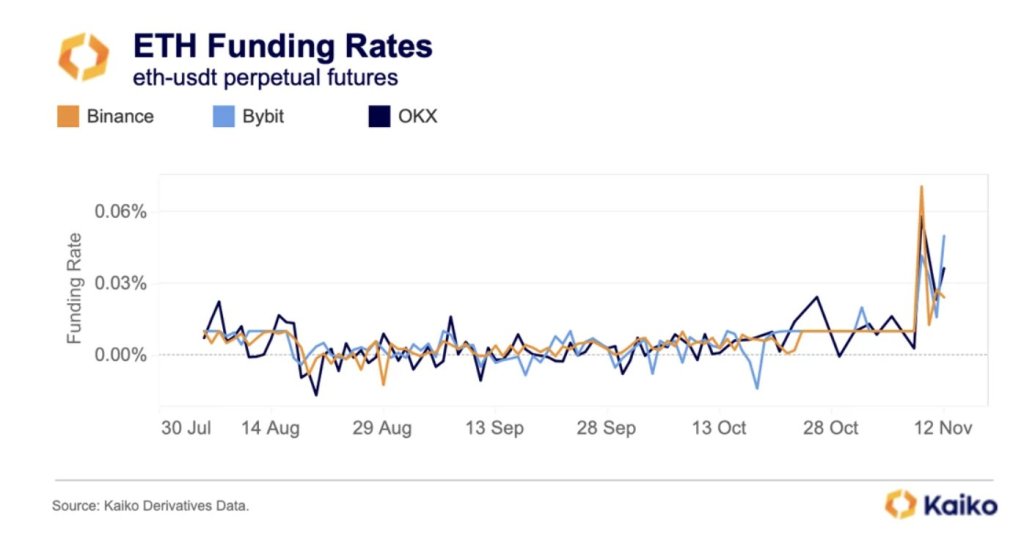

According to Kaiko facts on November 12, not only does the ETH-BTC ratio shift and reverse after extended periods of lower lows, but there is also a notable increase in trading volume with funding rates on crypto derivatives platforms shifting from negative to positive, indicating increasing demand .

Ethereum breakout above $2,000

At the time of writing on November 13, Ethereum is relatively firm and is changing hands around the $2,090 level. Despite the expected contraction in trading volume in recent days following the November 9 rally, the uptrend remains.

So far, technical analysts are looking at the immediate support level at $2,000, which marks the July 2023 high. Conversely, the $2,100 zone, which marks the April high, is a crucial liquidation level that bullish bulls must break through to establish a pattern of buying trend continuation.

As it is, traders are optimistic. However, whether the uptrend will continue largely depends on trader sentiment and whether existing fundamentals could lead to more demand, which could push ETH to new highs in 2023. While the overall ETH support base remains bullish, unlike Bitcoin (BTC), the coin has so far struggled to break the key resistance levels from the first half of 2023, which is concerning.

ETHBTC turns bullish as funding rates turn positive

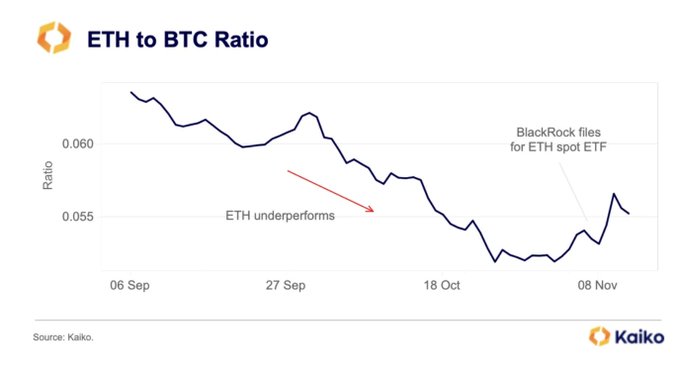

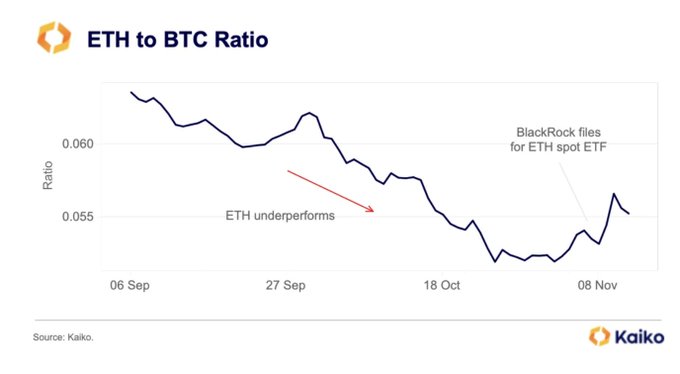

On the upside, looking at the ETHBTC candlestick arrangement in the daily chart, the sharp reversal in ETH fortunes on November 9 could anchor the next surge, signaling another shift in a trend that favors Ethereum buyers. Looking at the ETHBTC formation, Bitcoin bulls have had the upper hand in 2023.

Related Reading: XRP Price Path to $1: Exploring Two Potential Outcomes from the $0.66 Resistance Level

To quantify it, BTC is up 33% against ETH, with the climax of the October 23 sell-off pushing BTC to all-time highs against the second most valuable coin in 2023. The sharp recovery on November 9 and the subsequent failure of the BTC bulls to reverse losses suggests that ETH has the upper hand.

So far, ETHBTC prices are within the bullish sweeping bar of November 9, against the backdrop of light trading volumes, a net positive for bullish ETH holders.

After this wave, Kaiko notes that the funding rate of the ETHUSDT pair is positive, indicating increasing demand in the crypto derivatives world. When the funding rate changes positive from negative, it means that ‘long’ traders are paying ‘short’ traders to keep their positions open. This development indicates that more traders are going long ETH, expecting prices to rise in the coming sessions.

Feature image from Canva, chart from TradingView