Posted:

| Last updated: November 6, 2023

- Market players are overlooking BTC and ETH, taking riskier bets and focusing on lower-capitalization assets.

- Bitcoin Open Interest fell while spot volume rose.

The attention has been that for the past seven days Bitcoin [BTC] And Ethereum [ETH] had enjoyed in previous weeks. This inference came as Bitcoin traded sideways within the period, gaining 1.98%. ETH’s performance was also only slightly better. Its value rose 2.58% and traded at $1,834.

Realistic or not, here it is The market cap of ETH in BTC terms

However, the price action of both assets is not the only determining factor in the decline of their dominance. IntoTheBlock, in its November 3 Medium post, elaborated on the statistics that point to a rotation in the market.

The eyes are focused on the new shining stars

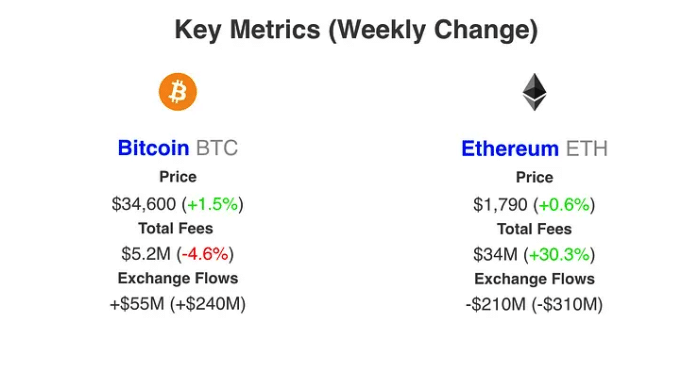

According to the report analyzed by AMBCrypto, transaction fees on the Bitcoin network fell by 4.6%.

An increase in these fees suggests that there is high demand for BTC. On the other hand, a decrease in it means something different. So if the total cost of Bitcoin drops to 5.2 million, it means that the number of transactions has decreased and volatility has also decreased.

In the case of Ethereum, the total costs have increased. But that wasn’t because there was a lot of demand for ETH.

Instead, the crypto trading signal platform explained that the 30% jump could be related to the surge in on-chain trading. This on-chain trading was that of tokens operating on the Ethereum network.

For those who don’t know, the Ethereum network is very different from Bitcoin.

On the Bitcoin network, tokens cannot be traded via a Decentralized Exchange (DEX). But Ethereum allows users to trade other ERC-20 tokens on DEXs Uniswap [UNI]. ERC-20 is also the standard for creating smart contract tokens using Ethereum.

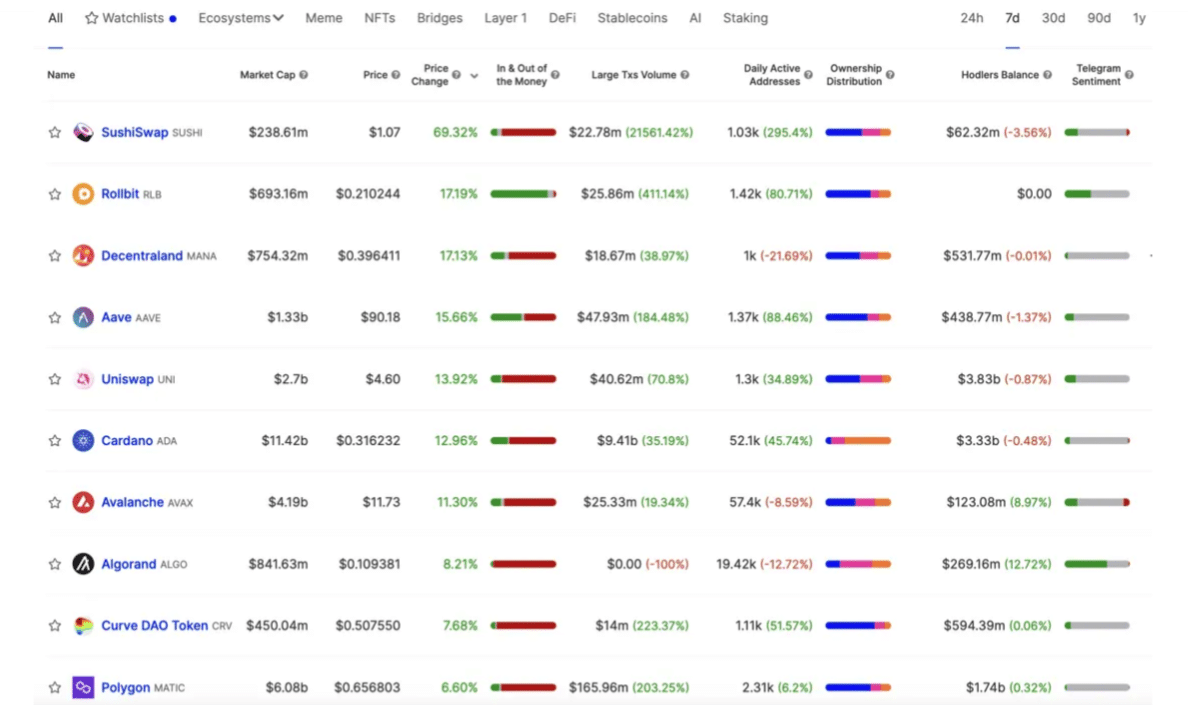

Furthermore, IntoTheBlock mentioned that L1 altcoins and DeFi tokens are now the stars of the market. Cryptocurrencies such as Cardano [ADA] up 12% over the past seven days.

SushiSwap [SUSHI] increased by no less than 69%. There were also others with double-digit increases.

This rotation is also a sign that altcoin season is just around the corner. The report interpreted the data to mean that market players now have a greater appetite for risk. Regarding this, IntoTheBlock noted:

“Historically, crypto cycles have followed the trend of Bitcoin leading the initial surge, followed by Ethereum, gradually allocating capital to lower and riskier bets.”

Bitcoin OI is falling, but a rally may be on the way

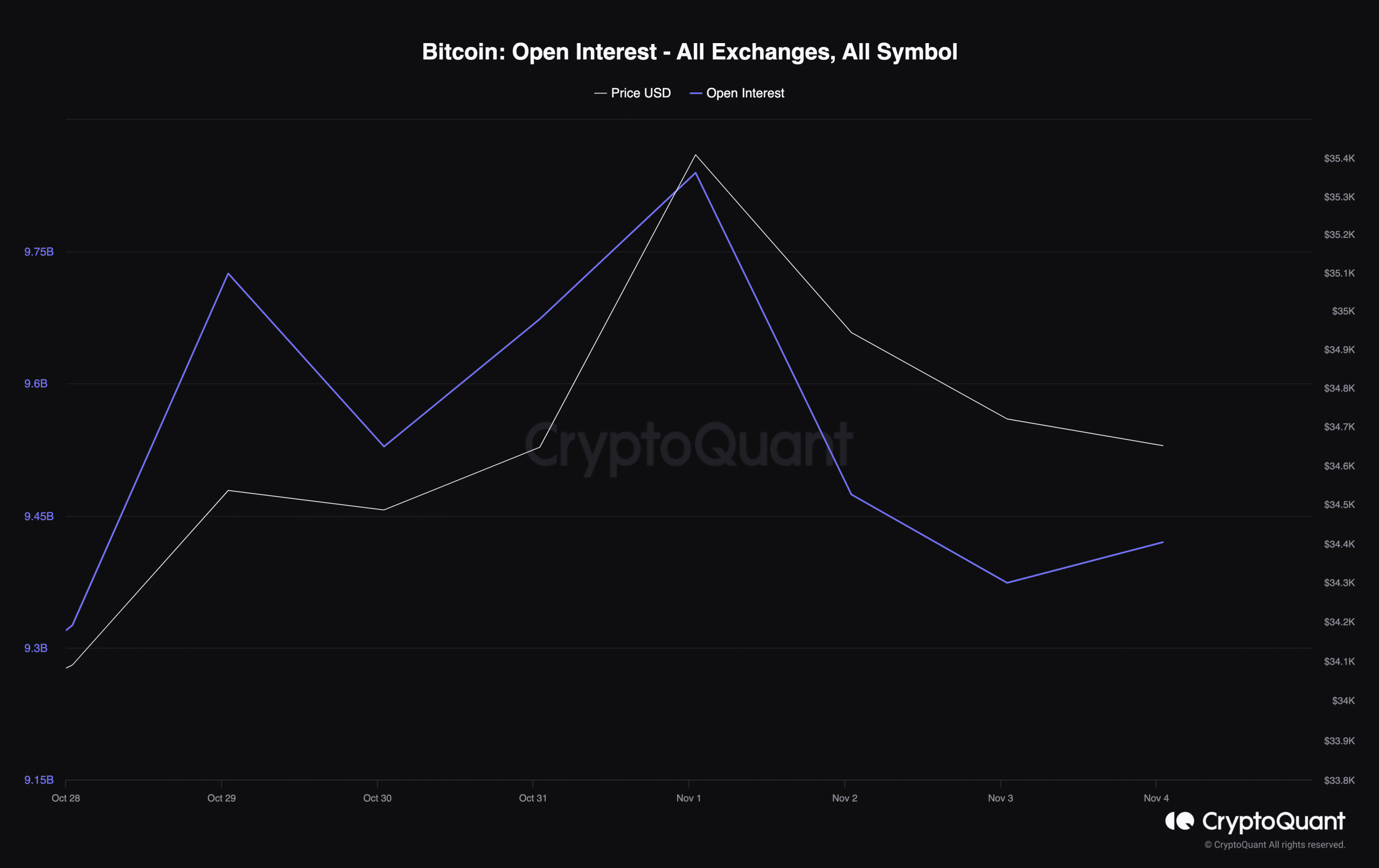

Another argument supporting an altcoin season is the decline in Bitcoin Open Interest. Open Interest is a measure of market activity. A high open interest means that there are many market participants looking at the market.

On the other hand, a decreasing Open Interest means an increase in closed positions. According to CryptoQuant data evaluated by AMBCrypto, Bitcoin’s Open interest had decreased significantly over the past seven days.

This drop was evidence of the shift in Bitcoin’s attention.

This decline in Open Interest also means that demand is largely led by spot market volume. Unlike the futures market, the spot market allows users to buy and sell at current market prices (CMPs).

How many Worth 1,10,100 ETHs today?

This was also confirmation that the demand for these DeFi and L1 tokens was organic. So there was no market manipulation.

In conclusion, the report noted that prices may be below par correction soon. However, it is also important to note that the rotation is an early sign of a bull market. IntoTheBlock explained:

“The increasing amount of volume handled through the chain is in line with this trend, demonstrating that fundamentals are improving. While market prices may correct due to the recent rapid rise in smaller cap assets, improving on-chain activity and growing spot-driven inflows indicate that strong demand is fueling crypto’s rally.”