In the ever-changing terrain of the financial sector, a nuanced battle is unfolding as traditional banks and blockchain technology companies battle for supremacy in acquiring deposits.

Established financial institutions, industry stalwarts, find themselves at a crossroads as they grapple with changing customer preferences and the disruptive power of evolving technologies. The battle to capture deposits, a linchpin for these institutions, has become increasingly intense in light of the disruptive innovations emerging from the blockchain technology sector.

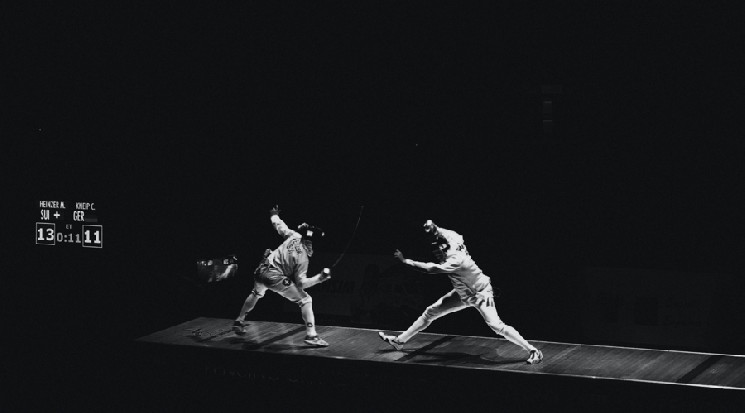

A clash of ideologies

On the one hand, traditional banks, leveraging their time-honored reputation, regulatory compliance and extensive customer base, are steadfastly asserting their relevance in this digital age. At the same time, the rise of blockchain technology introduces a new player into this financial arena – one characterized by agility, decentralization and a resolute commitment to reshaping the landscape of financial transactions.

Recent strategic initiatives, exemplified by Polygon Labs’ substantial $85 million grant program, underscore blockchain technology companies’ assertive moves to attract builders to their fast-growing ecosystems. Polygon Labs’ commitment signals a commitment to fostering innovation within its network, encouraging developers and content creators to contribute to the growth of the blockchain ecosystem.

The divide is becoming clear as blockchain technology companies seek not only to compete for deposits, but also to fundamentally redefine the traditional banking model.

Their focus is on providing decentralized financial solutions, decentralized applications (DApps) and a more inclusive and efficient financial infrastructure, challenging the essence of conventional banking practices.

Content and applications play a crucial role in this evolving story. Blockchain technology companies are working vigorously to attract developers and builders who can create compelling content and applications within their ecosystems.

This competitive landscape goes beyond mere financial transactions; it’s about delivering a comprehensive and user-friendly experience that surpasses what traditional banks offer.

Polygon Labs’ grant program acts as a microcosm of this broader trend, with blockchain technology companies actively investing in and encouraging the creation of innovative content and applications. This approach represents a marked departure from the conventional banking model, where innovation often faces barriers due to regulatory constraints and entrenched legacy systems.

Blockchain projects such as MATIC or Loopring (LRC) involve not only attracting developers, but also creating ecosystems conducive to collaboration and creativity. The goal goes beyond diverting deposits away from traditional banks; it’s about offering a dynamic and responsive financial ecosystem that meets the changing needs of users.

In response, traditional banks are waking up to the need to adapt.

Some have begun explorations into blockchain technology, aiming to integrate its benefits while leveraging their established strengths. Nevertheless, the challenge remains significant as these financial institutions struggle with legacy systems, regulatory complexity and entrenched practices that can hinder the rapid adoption of decentralized technologies.

The competition for deposits therefore transcends direct competition for funds. It embodies a clash of ideologies and approaches to finance. Traditional banks, strengthened by their historical status and the trust they have built, are defending their territory. Conversely, blockchain technology companies are challenging established norms and advocating for a decentralized and community-driven financial future.

Conclusion

The dichotomy between banks and blockchain technology companies in the battle for deposits sheds light on the seismic shifts underway in the financial sector. Initiatives like Polygon Labs indicate that the competition is not just about raising funds, but also about the content and applications that define the user experience. The financial landscape is undergoing a profound evolution, and the winners in this battle will be those adept at navigating the complex interplay of technology, innovation and user-centric solutions.