- The user cohort’s behavior reflected bullish momentum for ADA.

- OI in ADA futures rose to the highest level in almost five months.

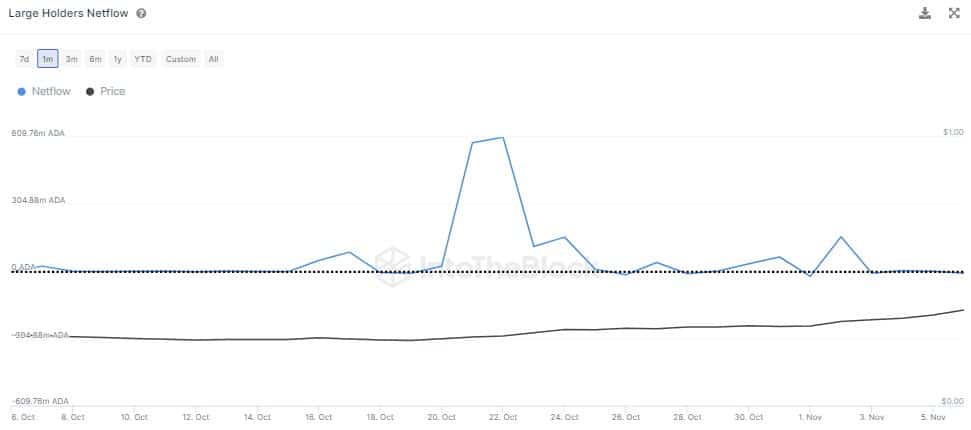

Recently Cardano [ADA] came back onto the radar of investors who controlled a substantial portion of the coin’s circulating supply.

Large holders are in the process of accumulation

According to a recent X-post from an on-chain research firm InTheBlokIn the month of October, major holders seized nearly 1.89 billion ADA coins. In terms of market price at the time of writing, the purchased supply was approx $670 million.

Source: IntoTheBlock

According to IntoTheBlock, large holders are addresses that hold more than 0.1% of a crypto’s circulating supply. Large Holders Netflow measures the number of inflows minus the outflows related to these addresses.

Peaks in this indicator are interpreted by major players as aggressive accumulation. When this cohort shows a strong preference for a currency, it usually reflects bullish momentum.

IntoTheBlock mentioned that the majority of buying occurred between $0.249 and $0.271. Interestingly, although the ADA has since risen by almost 29% to reach a price of $0.35 at the time of writing, no comparable enthusiasm was seen in the purchase.

Big whales go into overdrive

AMBCrypto dug deeper and came up with new findings after analyzing Santiment’s whale transaction data.

While transactions worth more than $100,000 in ADA indeed plateaued after a peak, large whale transfers worth more than $1 million increased in the period between November 1 and November 3.

This was when ADA closed the gap between $0.28 and $0.32.

Source: Santiment

The dramatic spikes in accumulation by different user cohorts at different times began to reflect on their total holdings. The number of addresses with at least 100 ADA coins has steadily increased since the end of October.

Source: Santiment

A look at ADA’s derivatives market

The price of ADA has risen almost 24% in the past week. Such sharp drops in value generally increase speculative interest in a crypto asset.

Open Interest (OI) in ADA futures contracts rose to $164.88 million at the time of writing, a gain of 30% in the past week, and the highest in almost five months.

An increase in OI due to the price increase implied that new positions were opened for ADA.

Source: Coinglass

How much are 1,10,100 ADAs worth today?

Since late October, the Longs/Shorts ratio has largely exceeded 1, indicating the dominance of traders looking for price increases.

As more traders looked to take advantage of an ADA rally, there were reasons to believe that demand for the crypto would increase in the near term.

Source: Coinglass