Bitcoin (BTC) enthusiasts are keeping a close eye on the latest market trends, and recent insights from Glassnode co-founders Jan Happel and Yann Allemann have created a new wave of excitement.

The duo, known by their Negentropic handle on social media platform X, has shared some compelling perspectives that shed light on the current dynamics of the BTC market.

Bitcoin market demand is exceeding supply, a clear sign of robust positive momentum.

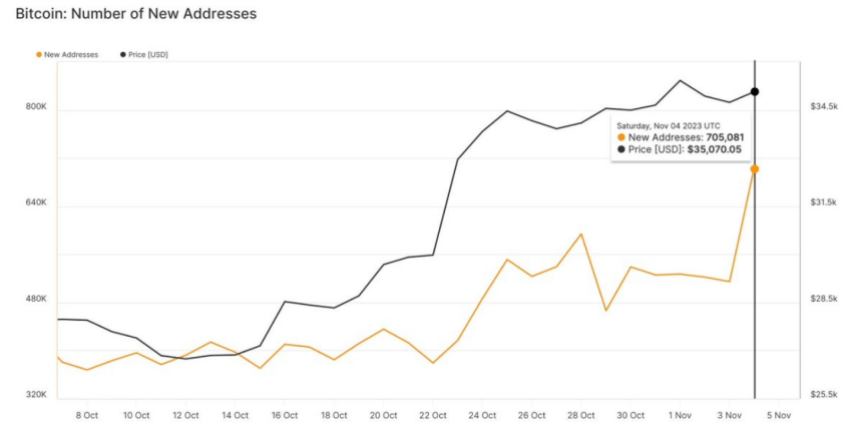

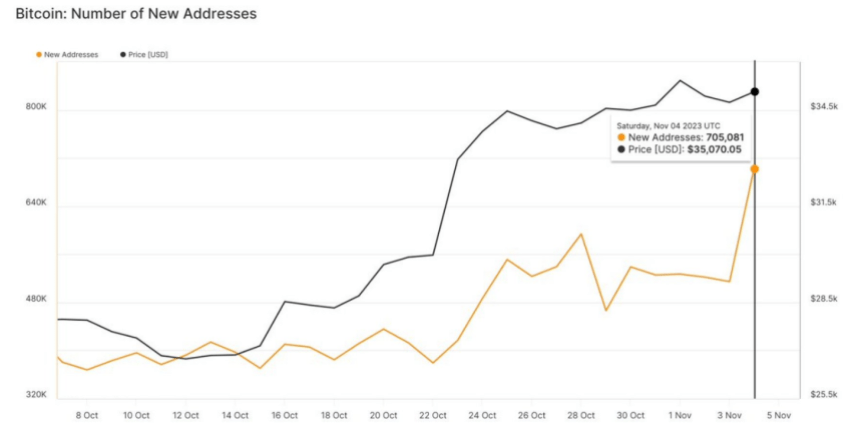

In just one day, as many as 700,000 new BTC addresses joined the network. This expansion is considered one of the most reliable indicators for price predictions.

With fewer BTC coins… pic.twitter.com/zAcgFc9LkS

— 𝗡𝗲𝗴𝗲𝗻𝘁𝗿𝗼𝗽𝗶𝗰 (@Negentropic_) November 6, 2023

Rising market demand and supply imbalance

Happel and Allemann’s recent observation that rising market demand is outpacing BTC supply has created a wave of optimism among investors. They highlighted the remarkable influx of as many as 700,000 new BTC addresses in one day, highlighting this expansion as one of the most promising indicators for BTC price predictions.

As the number of BTC coins in circulation decreases, the co-founders expect to see upward pressure on purchase bids, potentially driving the BTC price even higher.

As of now, the current price of BTC is according to Coin geckois at $35,255, with a gain of 2.0% in the past 24 hours and an increase of 2.7% in the past week.

Source: Glassnode

Unpredictable shifts in market dynamics

A closer look at the current state of the BTC market reveals a dynamic landscape where buyers are expected to embrace a proactive approach and potentially enter the market without waiting for significant dips.

The co-founders’ analysis suggests that the rapid pace at which BTC is evolving has created an environment where investors are forced to make timely decisions, leading to an intensified buying spree and the resulting upward pressure on the cryptocurrency’s valuation.

The recent rise in the use of Bitcoin futures and options has captured the attention of both the media and seasoned investors. Glassnode’s Happel and Allemann speculate that this increasing demand for leverage is mainly fueled by investor expectations of two very bullish catalysts scheduled for 2024.

Bitcoin currently trading at $35K level today. Chart: TradingView.com

The first catalyst revolves around the long-awaited potential for a spot BTC Exchange Traded Fund (ETF), a development that could significantly boost institutional adoption and boost demand for BTC.

Second, the prospect of Bitcoin’s halving has emerged as another powerful stimulus, capturing the attention of investors anticipating a subsequent scarcity-induced price surge.

As the BTC market continues to evolve and capture the attention of seasoned investors and newcomers alike, the observations and insights shared by Glassnode’s co-founders serve as valuable guideposts, guiding market participants through the complicated maze of cryptocurrency investments and market dynamics.

The latest developments in the world of Bitcoin point to a market where demand is exceeding supply, potentially paving the way for a bullish run.

(The content of this site should not be construed as investment advice. Investing involves risks. When you invest, your capital is subject to risk).

Featured image from Shutterstock