- While ARB’s price rose, trading volume fell over the past 24 hours.

- Investor confidence in ARB was high, but indicators appeared bearish.

Arbitration [ARB] has managed to surpass an important resistance level in the recent past. This episode suggested that the token’s price could rise further.

Read Arbitrums [ARB] Price prediction 2023-24

So let’s take a closer look at ARB’s on-chain metrics and market indicators to find out whether investors should expect ARB to reach the $2 mark soon.

Arbitrum’s price action looks ambitious

Crypto Tony, a popular crypto influencer, recently posted a tweet on X (formerly Twitter) highlighting how ARB breached a key resistance level. According to the tweet, ARB managed to break above the $1.07 mark.

The token was able to do this for the first time after mid-August 2023, giving hope for a further increase in price in the coming days.

The only resistance zone we need $ARB / #Arbitrum to close to confirm ARB SEASON pic.twitter.com/r3gW2Izhh4

— Crypto Tony (@CryptoTony__) November 4, 2023

CoinMarketCaps facts it turned out that the price of ARB actually rose further. The value of the token has increased by more than 2% in the last 24 hours.

At the time of writing, ARB was trading at $1.10 with a market cap of over $1.39 billion. This made it even more likely ARB $2 could touch. However, closer inspection revealed a different picture.

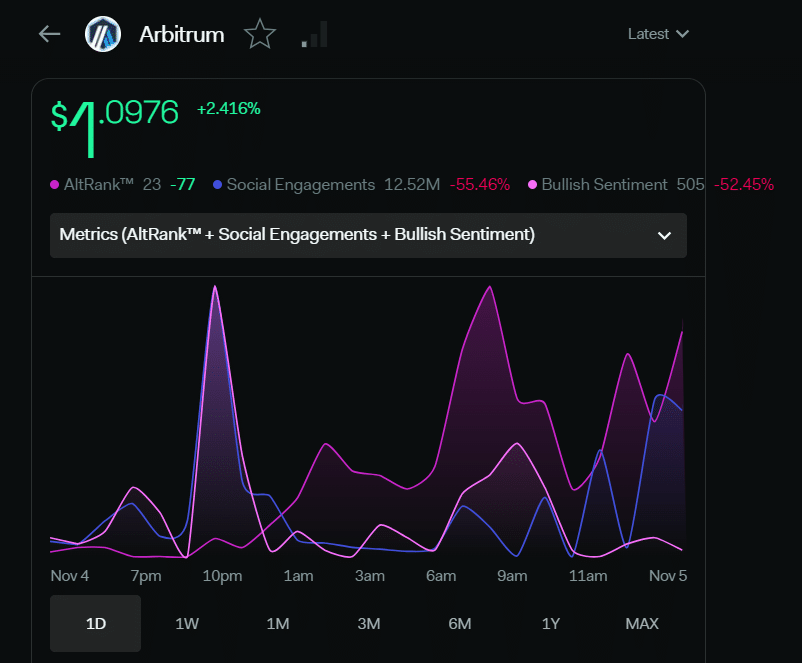

As the price of the token rose, trading volume fell, meaning investors were unwilling to trade the token. Market sentiment around Arbitrum also turned bearish, as bullish sentiment fell by over 52% in the past 24 hours, as did social engagement.

Nevertheless, some of the token’s metrics remained bullish.

Source: LunarCrush

For example, Arbitrum’s AltRank improved, increasing the likelihood of a sustained price increase. Not only that, but the token’s MVRV ratio has increased significantly. Network growth remained high, meaning more new addresses were created to trade the token.

The confidence of whales and investors in ARB also remained high. This was evident as the number of whale transactions and the total number of ARB holders increased over the past week.

Source: Santiment

Realistic or not, here it is ARB market cap on BTC futures

Look forward to something

Arbitrum’s Relative Strength Index (RSI) had moved into overbought territory, which could put selling pressure on ARB and in turn drive the price down. Another bearish indicator was ARB‘s Bollinger Bands.

The indicator showed that ARB’s price had reached its upper limit, increasing the likelihood of a trend reversal. Nevertheless, the MACD showed a clear bullish advantage in the market. The Chaikin Money Flow (CMF) was also updated, indicating continued price appreciation.

Source: TradingView