In their newest market updateQCP Capital, a crypto asset trading firm headquartered in Singapore, has dissected Bitcoin’s recent price movements, attributing the rally to macroeconomic factors rather than the long-awaited adoption of a spot ETF. As a reminder, Bitcoin rose from $34,500 to almost $36,000 on Wednesday.

The main reason for the Bitcoin price rally

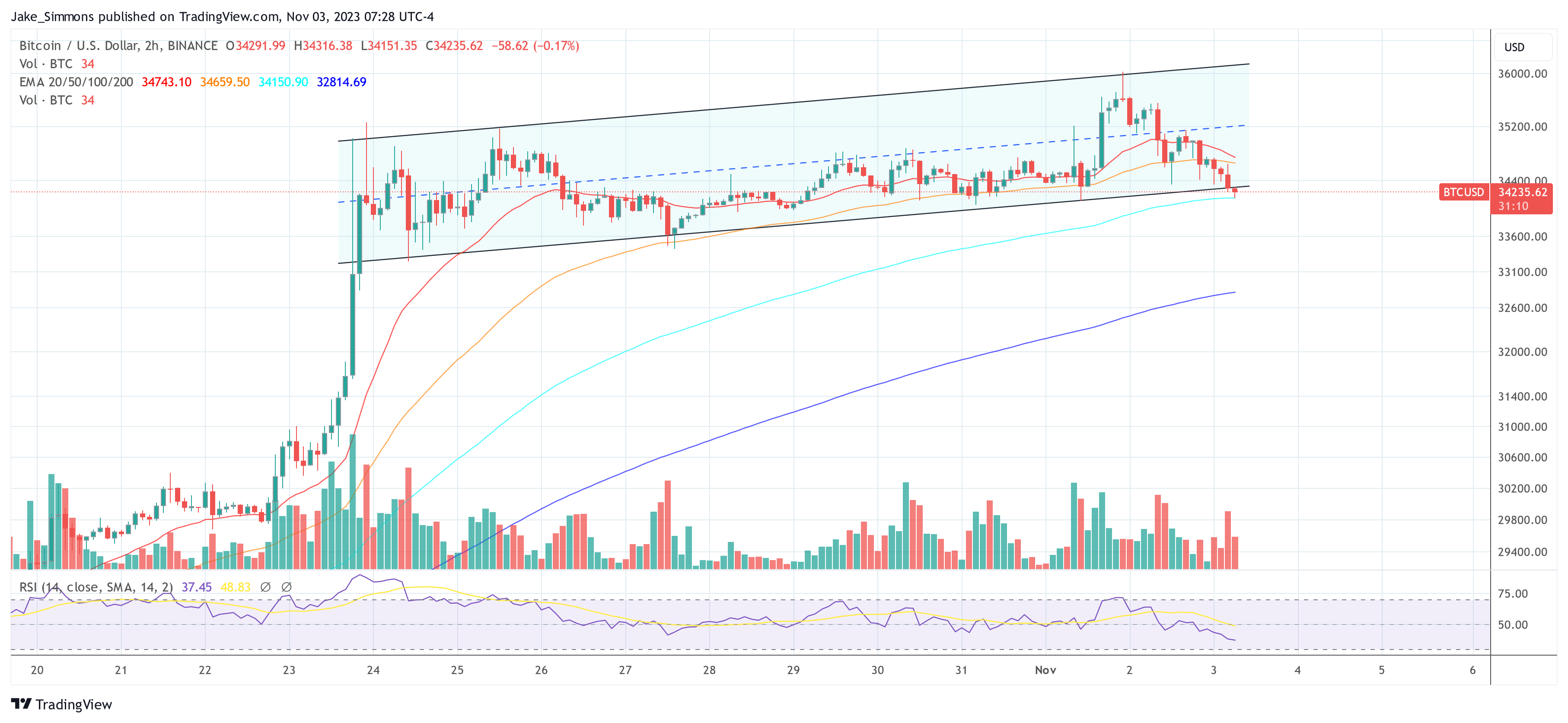

The firm’s technical analysis showed Bitcoin reaching the 38.2% Fibonacci retracement level at $35,912 and reaching the upper channel trendline before retreating, a move that was keenly observed by market participants.

QCP Capital’s report states: “However, this latest rally was less about spot ETF developments and more about macro forces.” These macro forces were identified following a dovish stance from the Federal Open Market Committee (FOMC) and a smaller-than-expected first quarter Treasury supply estimate, which led to a significant decline in bond yields. This in turn has had a bullish effect on risky assets, including Bitcoin and the broader crypto market.

However, the company also had a word of caution: “Whether this marks the start of a new global uptrend in stocks and bonds remains to be seen, as the macro picture remains essentially unchanged, barring a correction to the overly bearish sentiment on bonds .”

The company also noted the Bitcoin derivatives market, where “perp financing and forward terms, implied volatility, and risk reversals across the curve persist or expand at extremely high levels.” This signals that the market is bracing for a major move, with derivatives traders positioned for a potential upside breakout that hinges on the approval of a spot ETF.

Looking at the broader financial landscape, the bond market has seen notable swings. Recently, 30-year Treasury yields hit another 16-year high, rising above 5%. This level of return has not been seen since 2007 and represents an increase of more than 4 percentage points in just three years. Such movements in the bond market are crucial for the Bitcoin and crypto market as they influence risk sentiment among investors.

However, Bitcoin is currently following the example of gold as a safe haven. “The market is starting to price in the Fed’s over-tightening and weakening of the economy. Combined with geopolitical tensions and war, the need for QE is increasing rapidly in the future. This makes insurance assets (gold, Bitcoin) absolutely rip in unison,” says Charles Edwards of Carpriole Investment noticed recently.

In summary, QCP Capital’s insights into Bitcoin market dynamics versus current bond market trends suggest that while the Bitcoin market is influenced by a variety of factors, including speculation about the adoption of exchange-traded funds, macroeconomic indicators such as bond yields play a larger role in determining the value of the Bitcoin market. market sentiment and price action than other experts believe.

At the time of writing, Bitcoin was trading at $34,235 and was at risk of breaking the established uptrend channel to the downside. If that happens, low price levels may follow.

Featured image from iStock, chart from TradingView.com