- Bearish sentiment around BTC is on the rise.

- Bitcoin’s growth rate has slowed over the past 24 hours.

As the crypto market started its bull rally, investors’ expectations, especially with Bitcoin [BTC], shot up. Their hopes were rewarded in time, as the value of the king’s coin rose above the $35,000 mark for a time.

Read Bitcoins [BTC] Price prediction 2023-24

However, high confidence should often be considered a bearish indicator as it increases the likelihood of a price correction.

Bearish sentiment around Bitcoin is growing

According to CoinMarketCapBitcoin’s value has increased by more than 12% in the past seven days. At the time of writing, it was trading at $34,323.71 with a market cap of over $670 billion.

Not only did the coin’s price rise, but its 24-hour trading volume also increased, which is widely considered a bullish sign. However, BTC‘The growth momentum came to a halt as the price moved only marginally over the past 24 hours up to the time of writing.

This happened at a time when Bitcoin’s fear and greed index reached a value of 72, representing increased greed in the market.

Bitcoin Fear and Greed Index is 72. Greed

Current price: $34,713 pic.twitter.com/iB6JZLk7jg— Bitcoin Fear and Greed Index (@BitcoinFear) October 29, 2023

The Fear and Greed Index is an indicator that analyzes and generates a number between 0 and 100, where 1 is the indication of extreme fear and 100 is the indication of extreme greed.

When the index rises above 50, the chance of a price correction increases significantly. Therefore, given press time, the chances of BTC experiencing a price drop seemed high.

Furthermore, a closer look at the Bitcoin numbers showed that at the time of writing, investors had already started selling their holdings. According to CryptoQuantBTC’s foreign exchange reserve increased, indicating that the currency was under selling pressure.

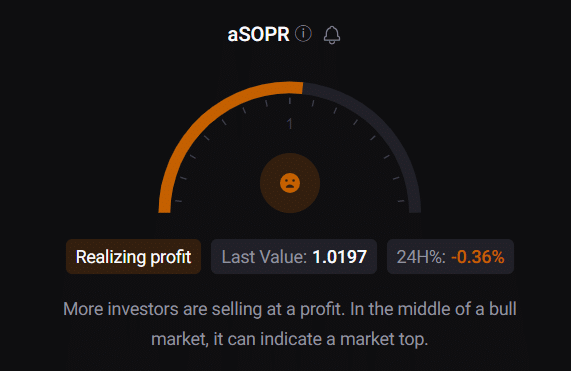

Bitcoin’s aSOPR was in the red, meaning more investors were selling at a profit – signaling a possible market top amid a bull rally.

Source: CryptoQuant

Is your portfolio green? look at the BTC profit calculator

Bitcoin investors should be careful

In addition to the above figures, Bitcoin’s RSI was also in an overbought position at the time of writing. This could further increase selling pressure on the coin and possibly lead to a price drop.

Like the RSI, the Bitcoin Money Flow Index (MFI) also hovered near the overbought zone, increasing the likelihood of a downward price trend. However, BTC‘s Chaikin Money Flow (CMF) looked bullish as the rating was above the neutral line.

Source: TradingView