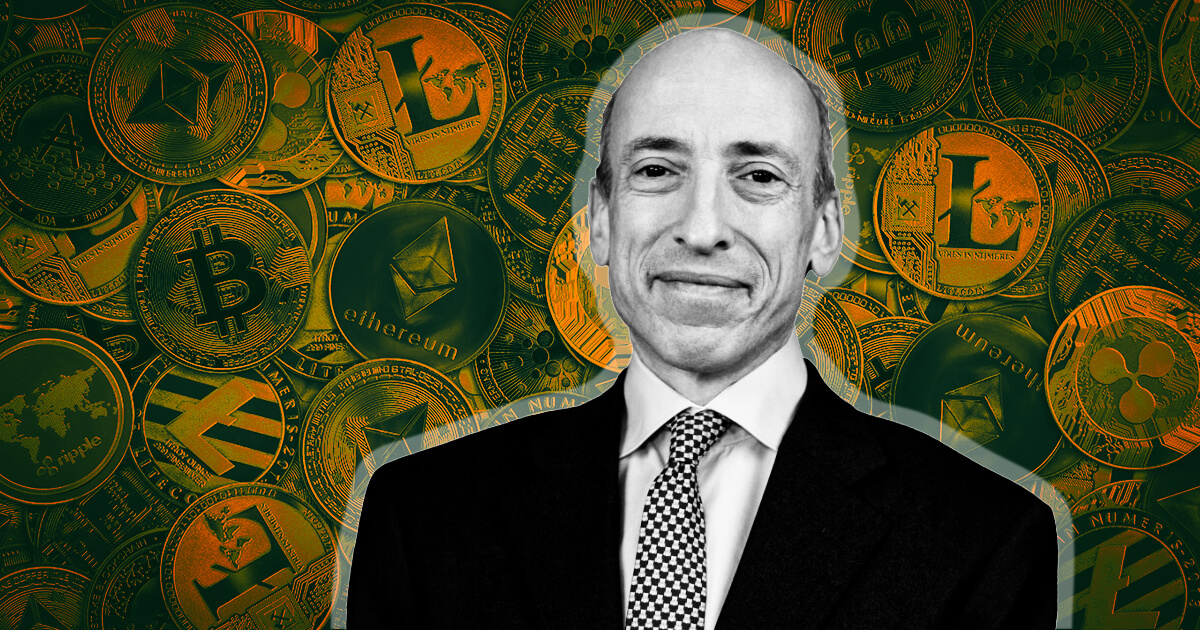

In his recent speech to the 2023 Securities Enforcement Forum, SEC Chairman Gary Gensler issued a stark warning to the burgeoning crypto asset securities markets, captured in his brief comment: “Don’t get me started on crypto.”

This assertive comment underscores the SEC’s ongoing concerns about compliance and liability within the fast-growing crypto industry and signals increased scrutiny.

Gensler’s speech painted a comprehensive picture of the issues impacting crypto. It powerfully reinforced the SEC’s commitment to enforcing the securities laws, clarifying that investors and issuers in crypto asset markets deserve the same protections as those in traditional financial markets.

He explained the broad definition of a security, which also includes the “investment contract,” a concept he said is undeniably evident in the crypto landscape given the economic realities most investors face. Gensler argued that most crypto assets likely meet the investment contract test, making them subject to securities laws.

“Without prejudging any particular asset, the vast majority of crypto assets likely meet the investment contract test, making them subject to the securities laws.”

Drawing comparisons between today’s crypto scenario and the financial landscape of the 1920s, Gensler outlined the challenges of the crypto field – fraud, scams, bankruptcies and money laundering – before federal securities laws were introduced.

He argued that these issues require stricter regulation. However, the crypto community counters that the nature of digital assets differs significantly from those in the past, necessitating unique regulatory approaches.

Gensler noted that while many crypto entities claim immunity from pre-blockchain era regulations, they often seek the protection of these laws when faced with bankruptcy or lawsuits. However, he emphasized the SEC’s active role in addressing these issues, stating, “We have taken numerous enforcement actions against actors in this space – some of which have been settled, and some in litigation.”

Despite a recent setback with the Grayscale lawsuit – leading to hopes for multiple spot Bitcoin ETFs – the SEC is maintaining its steadfast stance on “investor protection.” It is said that the pursuit of lawsuits and enforcement actions is a demonstration of its commitment to its mission of investor protection.

In his comments, Gensler maintained an apparently neutral stance, focusing on his assessment of the regulatory issues within the crypto market. He underlined that robust regulation is crucial to safeguarding investments in the crypto market despite the challenges of this new digital frontier, without suggesting that digital assets would be completely restricted.

However, it is worth noting that SEC Commissioner Hester Peirce recently emphasized the need for regulators to foster an environment conducive to crypto innovation in the US. She emphasizes that regulators should consider what they can do differently to make the US a viable location for crypto companies.

Gensler’s message indicates that the crypto industry cannot expect to remain without stricter regulations for long. The SEC remains committed to enforcing the securities laws on digital assets. Still, it is essential to remember that there is an ongoing dialogue about the nature and scope of these regulations, with differing views within the crypto community and the SEC itself.