The chief investment officer at the largest crypto index fund manager in the US is very optimistic about what an approval of a Bitcoin (BTC) exchange-traded fund (ETF) could do to the price of the king crypto.

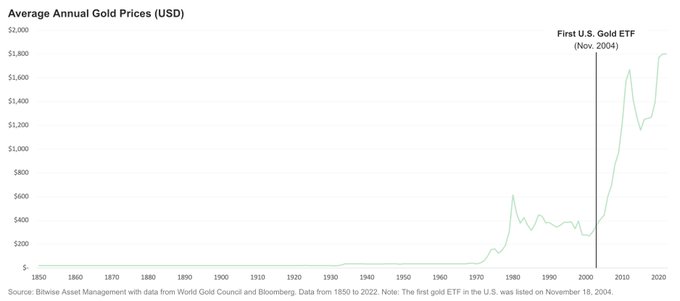

Matt Hougan, CIO of Bitwise, pulls a comparison to what happened to the price of gold after the precious metal secured its first ETF in the US in 2004, suggesting something similar could happen to BTC.

“People ask me, what happened when the first gold ETF launched in the US?”

Bitwise is one of several companies that have filed a spot Bitcoin ETF application with the U.S. Securities and Exchange Commission (SEC).

In a recent interview with Thinking Crypto, Hougan said that Bitwise focuses on educating traditional financial stakeholders about Bitcoin.

“The thing to think about with the Bitcoin ETF – why it matters – is that it unlocks this other segment of the market that essentially has no allocation to crypto, which is the financial advisor marketplace. This is a significant market – it is at least twice, and perhaps four times, the size of self-directed private investors. So the people who own crypto now are mostly self-directed retail investors. The financial advisor marketplace manages between 2x and 4x as many assets.

And so what we do every day, with a sales team of over twenty people, is meet with these advisors, talk to them about what Bitcoin is, talk to them about where it fits into their portfolio, and lay the groundwork for when that ETF is launched so that they can adopt it easily. We’re seeing real traction. There are a lot of advisors who want to allocate in favor of the Bitcoin ETF.”

I

Don’t miss a beat – Subscribe to receive email alerts straight to your inbox

Check price action

follow us on Tweet, Facebook And Telegram

Surf to the Daily Hodl mix

Generated image: Midjourney