Bitcoin has had an eventful week in terms of price action. The world’s largest cryptocurrency saw an 18% increase in the past seven days, the highest percentage increase this year. This unexpected surge caused a wave of liquidations of short positions, and according to Glassnode, futures positions worth 60,000 BTC were closed. Amid all the price increases, data from Glassnode has shown that a large portion of investors are now trading above profits.

Bitcoin surges past $35,000 and turns millions of coins into profit

Bitcoin bulls have managed to push Bitcoin price above $35,100 in the past 24 hours, which is the largest single-day increase this year. The upward move started around the $25,000 level and continued until it reached its new yearly high.

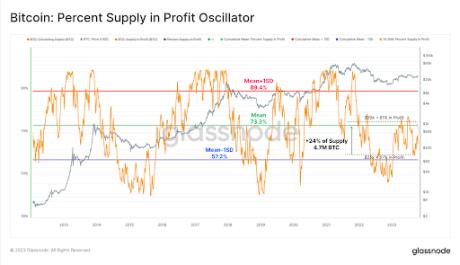

A blockchain analytics platform Glassnode report showed that Bitcoin zooming past $35,000 is a big deal for holders. At this price level, millions of BTC investments were made profitable. During this rally, the percentage of supply that benefited from the price jump from $25,000 to $35,000 increased by a whopping 4.7 million BTC, equivalent to 24% of the total circulating supply.

Long-term investors in particular enjoyed a large profit margin at this price. While approximately 29.6% of long-term holders’ supply is still held at a loss, their total holdings recently broke a new all-time high of 14.899 million BTC.

Source: Glassnode

Short-term bonds were also not left out, as investor confidence based on cost basis models has recovered from bearish to neutral. We are now at a crossroads towards positive bullish sentiment for short-term investors. A look at the average buying price of short-term holders estimates that the majority of entry into the market is $28,000, indicating a profit margin for both short- and long-term traders.

Source: Glassnode

What’s Behind Bitcoin’s Sudden Price Rise?

Bitcoin’s sudden rise can be attributed to the excitement behind the approval from BlackRock’s spot Bitcoin ETFs application. Bitcoin financiers pointed to the listing of BlackRock’s iShares Bitcoin Trust on the Depository Trust and Clearing Corporation’s (DTCC) website, suggesting that BlackRock had begun seeding money for the ETF.

Although Bitcoin has since done so lose part of this price gain and at the time of writing is now trading at $33,860, statistics show that 80% of holders are making money at the current price. Also exchange signals indicate bullish momentumas traders are now exchanging their assets for BTC on crypto exchanges.

The rise in Bitcoin’s value to $35,000 was reflected in the stock prices of crypto-related companies such as Coinbase and MicroStrategy. For that price, MicroStrategy’s Bitcoin holdings would have generated a profit of $857 million for the company.

BTC reclaims $34,000 once more | Source: BTCUSD on Tradingview.com

Featured image from Outlook India chart from Tradingview.com