The digital assets the markets saw an influx of institutional investors for the fourth week in a row. Data from CoinShares shows that some of the observed momentum can be attributed to growing anticipation of the authorization of a spot Bitcoin Exchange-Traded Fund (ETF) in the United States.

The total value of assets under management (AuM) has seen a remarkable increase, reaching $33 billion, representing a growth rate of 15% since the beginning of September. Nevertheless, investors are showing a greater degree of caution compared to their reaction to Blackrock’s announcement in June.

The latest fund inflows, while possibly associated with the future launch of a spot bitcoin ETF in the US, are very modest compared to June’s inflows.

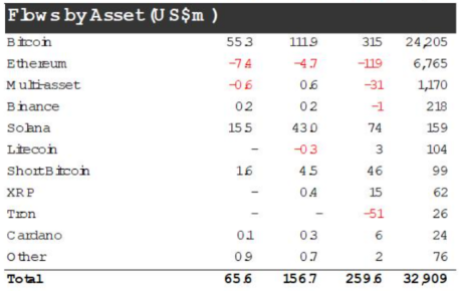

Coinshares: Digital asset investment products saw inflows totaling $66 million for the fourth week in a row. Total assets under management have now risen to $33 billion.

Solana saw another $15.5 million inflow last week, bringing this year’s inflow to $74 million, making it the most popular altcoin this year, so…

— Wu Blockchain (@WuBlockchain) October 23, 2023

Bitcoin leads digital assets: $315 million inflows this year

According to the report, a significant portion of last week’s inflows amounted to $55.3 million, or 84% of the total. This influx was specifically aimed at them investment products related to Bitcoin. As a result, cumulative inflows for Bitcoin products during the current year have reached a total of $315 million.

Solana experienced an additional $15.5 million inflows last week, resulting in a cumulative $74 million inflows for the year. This remarkable achievement positions Solana as the leading alternative cryptocurrency so far in the current year.

Source: Coinshares

On the other hand, and amid ongoing concerns, Ethereum faced a challenging week as it observed significant outflows of $7.4 million. Notably, Ethereum was the only altcoin to experience a decline in its financial performance during this period.

Other altcoins such as Cardano (ADA) and Binance Coin (BNB) saw small inflows of $0.1 million and $0.2 million respectively.

James Butterfill, head of research at CoinShares, pointed out that last week’s inflows have not yet reached the same magnitude as those seen earlier this year, when BlackRock initially filed for a Bitcoin ETF.

Bitcoin slightly below the $34K level today. Chart: TradingView.com

Butterfill said:

“While the latest inflows are likely related to excitement over the launch of a Bitcoin ETF in the US, they are relatively low compared to the initial inflows following BlackRock’s announcement in June.”

Navigating the digital asset landscape: trends and caution

Digital assets are becoming more and more popular and many people are investing in them. However, some investors are cautious about these assets, and we don’t know if they will continue to be cautious. We will have to wait and see if the market will change in the coming weeks and bring new trends or opportunities for investors.

The world of digital assets is growing rapidly, with more and more people putting their money into cryptocurrencies and other digital investments. Despite this, some investors are still cautious and avoid rushing.

We cannot predict whether this cautious approach will continue or whether the market will surprise us with new trends and opportunities in the coming weeks. These are exciting times in the financial world and we will have to keep a close eye on how things develop.

(The content of this site should not be construed as investment advice. Investing involves risks. When you invest, your capital is subject to risk).

Featured image from Ledger Insights