- Bitcoin’s hashrate was 17% in January; it later grew to 27% in October.

- On the other hand, several public Bitcoin miners are aggressively expanding to adapt to the Bitcoin halving happening next year.

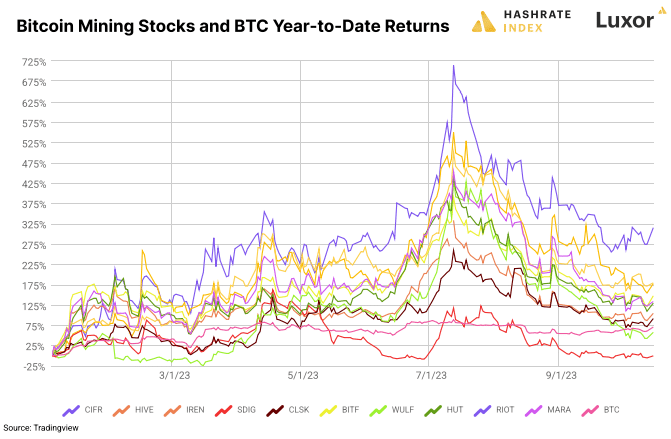

The recent bull run in the market has put Bitcoin back in the spotlight [BTC]. We decided to look at its relationship with the performance of the crypto mining sector.

Hashrate index recently issued its Bitcoin mining report for the third quarter of 2023. The report sheds light on the various aspects of crypto mining in July-September 2023.

Shares of public Bitcoin mining companies started off strong in July, as BTC traded above $30,000 for most days of the month. But the moment the stock dropped to the $25,000-$26,000 price range, the stock’s performance also started to deteriorate.

Source: Hashrate index

As we can see, stock performance is closely related to the price movement of the king coin.

According to the report, Bitcoin’s seven-day average hashrate grew by 56% during the first five months of 2023. It then fell by a modest 1.3% in the months of June, July, and August. In September it suddenly rose 12%. It eventually reached an all-time high (ATH) in mid-October, after growing 6% so far this month.

Source: Hashrate index

The report’s authors write that they are relatively confident that this is a seasonal pattern in summer. US-based miners limit their mining activities during these months. The country is home to approximately 40% of Bitcoin’s global hashrate.

Texas, the mining center of the US, is extremely hot in the summer. Miners operating in the region limited their activities during the season.

What production and hashrate growth tell us

The report also sheds light on the Bitcoin production (units produced) and hashrate (EH/s) of the leading Bitcoin mining companies.

Marathon Digital grew its operational hashrate from 7.3 EH/s to over 19.1 EH/s year-to-date (YTD). It has the largest active hashrate among public Bitcoin miners operating in North America. The report noted that the company could achieve its target of 23 EH/s if it deployed its existing stock of S19 XP rigs to replace their S19j Pros.

Source: Hashrate index

Riot Platforms saw a significant drop in Bitcoin production. The company’s hashrate also did not grow as expected. The main reason for this modest performance was that the facility curtailed its operations during the month.

Source: Hashrate index

Iris Energy has dramatically increased its hashrate from 1.57 EH/s to over 5.55 EH/s this year. The reason behind this growth is that the mining company is purchasing new machines to replace the ASICs. However, Bitcoin production has declined in recent months.

Source: Hashrate index

Core Scientific saw a significant decline in its hashrate capacity as a result of restructuring during the Chapter 11 bankruptcy. During the bankruptcy proceedings, it sold all its BTC to pay creditors and cover operating and bankruptcy costs. However, Bitcoin production wasn’t that disappointing.

Source: Hashrate index

Jaran Mellerud, one of the contributors to the report, drew our attention to the growing share of public Bitcoin miners in Bitcoin’s hashrate for months. In January, public miners contributed 17% of the total hashrate; in October it grew to 27%.

Public miners are responsible for 27% of total mining #Bitcoin‘s hashrate, a huge growth from 17% in January 2022.

Public miners’ share of Bitcoin’s hashrate will continue to grow as well-capitalized public miners buy up the assets of distressed private miners after the halving. pic.twitter.com/GLczGHZTad

— Jaran Mellerud

(@JMellerud) October 21, 2023

One thing to keep in mind is that Bitcoin’s next halving is also approaching, which will take place next year. A number of public Bitcoin mining companies are expanding aggressively to be prepared for the development.

The report concludes that the US still has the most hashrate of any country. North America alone holds roughly 45% of the global hashrate. Europe – especially the Scandinavian region – has also become a popular destination for public Bitcoin miners.

Source: Hashrate index