The Open Metaverse Alliance (OMA3), a consortium of dozens of notable blockchain, NFT and metaverse companies, announced Tuesday that it has created a working group to determine how best to standardize and regulate creator royalties on NFT marketplaces. can survive.

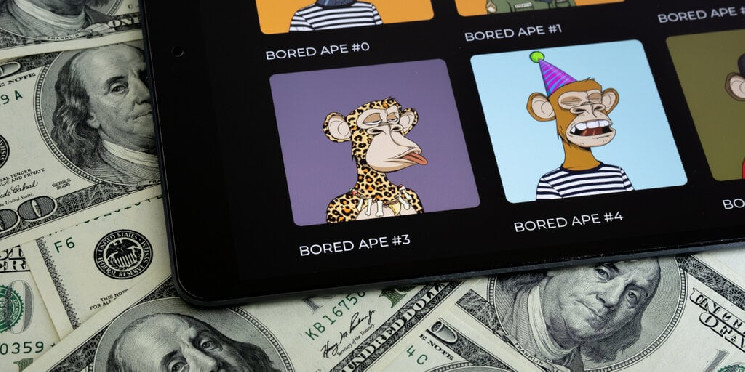

The working group will consist of numerous prominent crypto brands, including Yuga Labs, the company behind the dominant NFT collection Bored Ape Yacht ClubAnd Magical Edenthe multi-chain NFT marketplace that started on Solana.

Creator royalties are fees, typically between 2.5% and 10%, that are added to secondary sales of NFTs and are intended to go directly to the creators’ pockets. Although their adoption was long considered one fundamental doctrine of the crypto ecosystem – an ecosystem that benefits artists and creators more than traditional secondary markets for art and media – its maintenance is increasingly threatened by market forces.

Mark Cuban and Yuga Labs spark backlash over OpenSea’s NFT royalties change

After the start of the current crypto bear market last year, a series of new NFT marketplaces began eliminating creator fees, and some (like Blur) offered gamified, financial incentives to users in an attempt to lure customers from dominant NFT platforms like OpenSea.

Within months, the strategy proved to be astonishingly effective: Blur was launched in February of this year OpenSea dethroned as the largest NFT platform by trading volume. In August, OpenSea – after challenging promising not on– announced that this would also happen stop enforcing creator fees.

As the companies that make up the Open Metaverse Alliance see it, this shift poses an existential threat not only to the NFT ecosystem, but also to the holy grail of metaverse development: a interoperable online ecosystem in which users’ virtual items can be stored travel freely from one platform to another, redefining digital ownership.

“Creator royalties are not only integral to the principle of fairness, or respecting creator authorship,” said Robby Yung, CEO of Animoca Brands. co-founded the Open Metaverse Alliance, narrated Declutter. “They are also critical for interoperability: why would I want to share my content with other people unless I can benefit from royalty payments in the future? Otherwise we just have to go back to Web2, where no one shares anything.”

Bitcoin Metaverse token sourced from Animoca Game Studio

Yung has spent years at Animoca and now through the Open Metaverse Alliance building an online ecosystem that he and his colleagues believe will be more equitable, transparent, and democratic than the current Internet. But he recognizes that right now, many NFT buyers are prioritizing short-term financial interests at the expense of their long-term online well-being.

“Everything always has a price. It may not be obvious in advance,” Yung said. “We’re trying to show people that it’s important to pay creator royalties. [With them]we can create this utopian world.”

The Alliance’s Working Group on Creator Royalties will seek to determine how best to protect creator royalties market-wide, possibly by creating universal standards for NFT marketplaces that member companies will respect. In addition to Animoca, Yuga Labs and Magic Eden, other participants in the group include metaverse gaming platforms Decentraland and The Sandbox, Alien Worlds and Upland.

Chain Letters: MoMA Launches ‘Postcard’ NFT Art Project

“We at Yuga are committed to building a Web3 world that is interoperable and fair for all creators, and we are excited to collaborate on the OMA and the standards that we believe will drive its success,” said Mike Seavers, CTO of Yuga Labs said in a statement. .

In the wake of recent decisions by NFT marketplaces, including OpenSea, to halt enforcement of creator royalties, numerous heavyweight NFT brands have weighed in by threatening to block their compatibility with said platforms.

For example, in August, after OpenSea announced it would no longer enforce creator royalties, Yuga announced that it would in turn negate the compatibility of its NFT marks with the market. Collections created or owned by Yuga have collectively generated more than $9 billion in trading volume on the NFT market.

Edited by Andrew Hayward