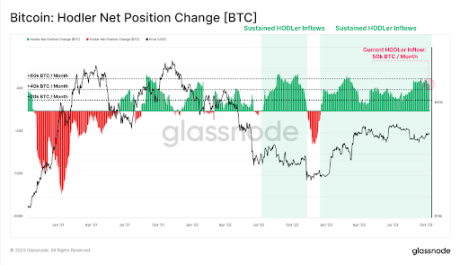

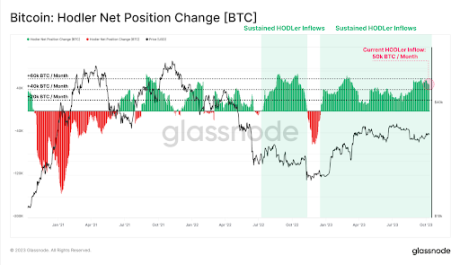

A new report from Glassnodean analysis company on the chain, has provided support recent data points to this Bitcoin holders are expanding their holdings. These long-term Bitcoin investors, also known as “HODLers”, seem unphased by the recent volatility in Bitcoin’s price.

According to on-chain data, long-term holders have rapidly accumulated Bitcoin, adding more than 50,000 BTC to their holdings every month.

Monthly accumulation of BTC worth $1.35 billion

Bitcoin is currently showing signs of slowing down as its price has fallen just below $27,000. It appears that short-term speculators are largely responsible for the continued selling pressure, as data shows that whale investors are seeing this opportunity to buy more BTC at a discount rather than securing profits.

According to Glassnode’s HODLer Net Position Change metric, long-term holders are purchasing an average of 50,000 BTC worth $1.35 billion every month at Bitcoin’s current price.

Another metric, Long-Term Holder Supply, which measures the size of BTC’s market capitalization with holders, also reached an all-time high of 14.859 million BTC. This means that 76.1% of the total circulating supply has not moved in the last five months. Consequently, 94.8% of the total Bitcoin supply has not moved in the past month.

Source: Glassnode

To support this data on increased accumulation, popular crypto analyst Ali Martinez shared chart data from Santiment showing that Bitcoin whales have purchased approximately 20,000 BTC since the beginning of October, worth approximately $550 million.

At this rate, the number of BTC held by holders will exceed 50,000 by October. This increased accumulation suggests that long-term holders remain confident in Bitcoin’s long-term potential and view this price correction as temporary.

#Bitcoin whales bought about 20,000 $BTC as of early October, worth approximately $550 million! pic.twitter.com/47ZePiaIII

— Ali (@ali_charts) October 10, 2023

BTC price falls below $27,000 | Source: BTCUSD on Tradingview.com

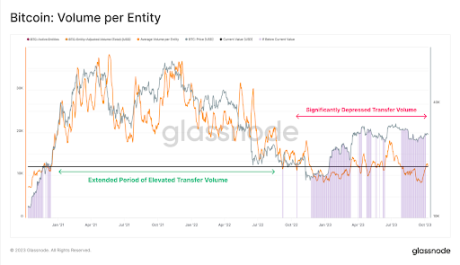

Bitcoin supply is tightening

According to Glassnode, only 11.5% of BTC’s circulating supply has changed hands in the past three months, indicating a long-term inactive period of activity in the chain. Fewer trades indicate that investors are unwilling to sell at current prices while the industry waits approval of spot Bitcoin ETFs.

Source: Glassnode

If this current trend continues, the current downtrend could be short-lived, especially if sentiment among smaller traders also moves toward buying. A predominantly hold mentality would give the assets time to recover and gain significant support that could serve as a springboard for another rally.

Bitcoin is currently trading at $26,766 and is down 1.31% in the span of 24 hours. approaching the next major support near the $26,500 level. If enough big players gather at these lower prices, it could create a price bottom as bulls push the price back up.

As crypto analyst James Straten notes, Bitcoin could rise 50% as part of the correlation between the Grayscale Bitcoin Trust and the price of BTC.

Featured image from Shutterstock, chart from Tradingview.com