In a remarkable turn of events, XRP derivatives trading volume has experienced an astonishing 204% increase in just 24 hours. This increase coincides with Judge Torres’ recent revelation of the denial of the Securities and Exchange Commission’s (SEC) decision. interim appeal against Ripple Labs.

Judge’s ruling against SEC boosts XRP sentiment

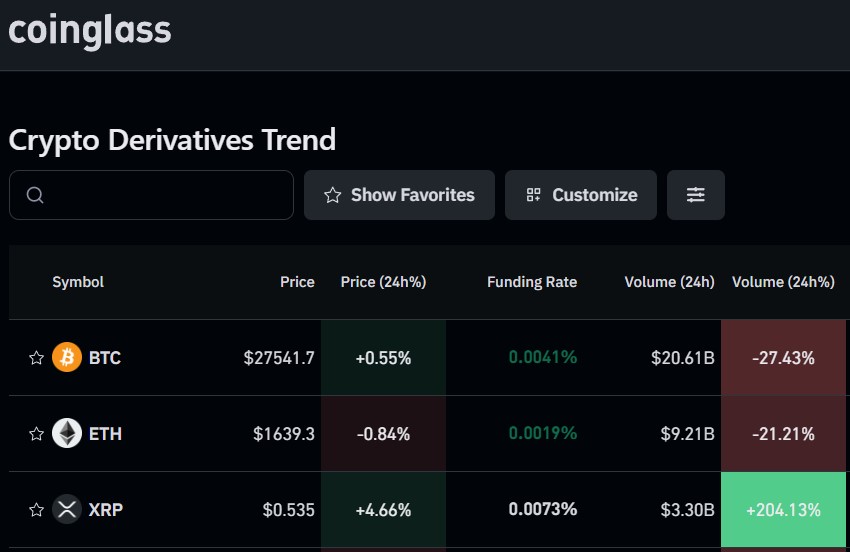

According to facts from Coinglass, a leading cryptocurrency analysis platform, the trading volume of XRP derivatives has witnessed an unprecedented spike, reflecting a significant increase in market activity.

This increase in trading activity signals growing interest in XRP among investors eager to capitalize on the recent legal developments surrounding Ripple Labs.

To provide more context, derivatives trading refers to the buying and selling of financial instruments that derive value from an underlying asset, such as a stock, bond, commodity or cryptocurrency.

These instruments, also called derivatives, include futures contracts, options, swaps and other financial contracts. Derivatives allow investors to speculate on the price movements of the underlying asset without owning it directly.

An increase in derivatives trading volume could have significant implications for XRP. First, it indicates higher market participation and interest in the cryptocurrency.

When more investors and traders actively deal with XRP through derivatives, this can lead to more liquidity and price formation.

Derivatives trading can also contribute to greater price volatility in XRP. As traders speculate on the future price of XRP through derivative contracts, this can amplify price fluctuations.

With higher trading volume, a greater number of participants take positions on the price movement of XRP, which can result in more pronounced price fluctuations.

Furthermore, an increase in derivatives trading volume may reflect growing market sentiment and investor confidence in XRP. When trading activity increases, it indicates a higher level of interest and involvement from market participants.

With XRP currently trading at $0.5347, the cryptocurrency has seen a remarkable 4.3% increase in the past 24 hours.

The rise in derivatives trading volume further adds to growing evidence that the token could be on the cusp of a significant breakout if bullish momentum continues.

Ready for upward movement?

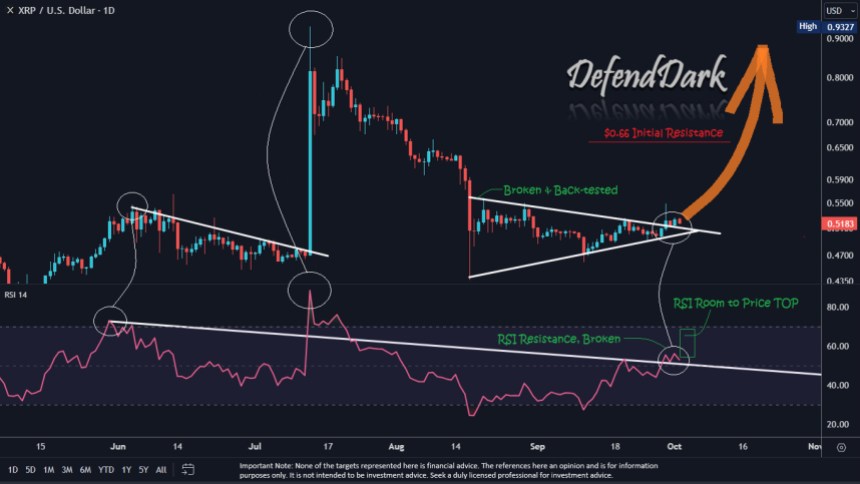

Renowned crypto analyst Dark Defender recently marked that XRP is showing signs of breaking out of its ongoing consolidation phase, given its recent win over the SEC.

This event draws parallels to an earlier ruling on July 13, with Judge Torres’ first ruling, in which the token experienced a remarkable 80% rally, reaching a high of $0.9343.

Based on this historical precedent, it is reasonable to speculate that XRP may be gearing up for another upward move. Dark Defender emphasizes that traders should keep a close eye on the next Fibonacci level, which is $0.66.

However, XRP needs to hold support above $0.50 to reach this level. This support level is of particular importance because XRP remained relatively stable for most of September.

Overall, the recent revelation by Judge Torres dismissing the SEC’s appeal has given a significant boost to Ripple Labs and its supporters.

Furthermore, the news has sparked renewed optimism within the XRP community, leading many investors to believe that a total win for Ripple Labs is now within reach, possibly just months away.

Featured image from Shutterstock, chart from TradingView.com