A crypto analyst believes evidence of a bearish signal is being displayed by an Ethereum (ETH)-based altcoin.

Ali Martinez tells his 30,800 followers on social media platform

Citing data from crypto analytics firm Santiment, Martinez points out that the past two times LINK’s 30-day market value to realized value (MVRV) has exceeded 19%, the asset has undergone steep corrections. LINK’s MVRV recently reached 20%.

MVRV is the ratio of an asset’s current market capitalization divided by its realized capitalization – that is, the value of all measured LINKs at the price at which they were purchased. MVRV 30-Day is a time-bound metric that analyzes only that ratio among tokens that have moved at least once in the last 30 days. Traders use the metric to detect overbought or oversold conditions.

However, Martinez believes that LINK will still reach higher highs after a brief correction. The 19th-ranked crypto asset by market capitalization is trading at $7.40 at the time of writing.

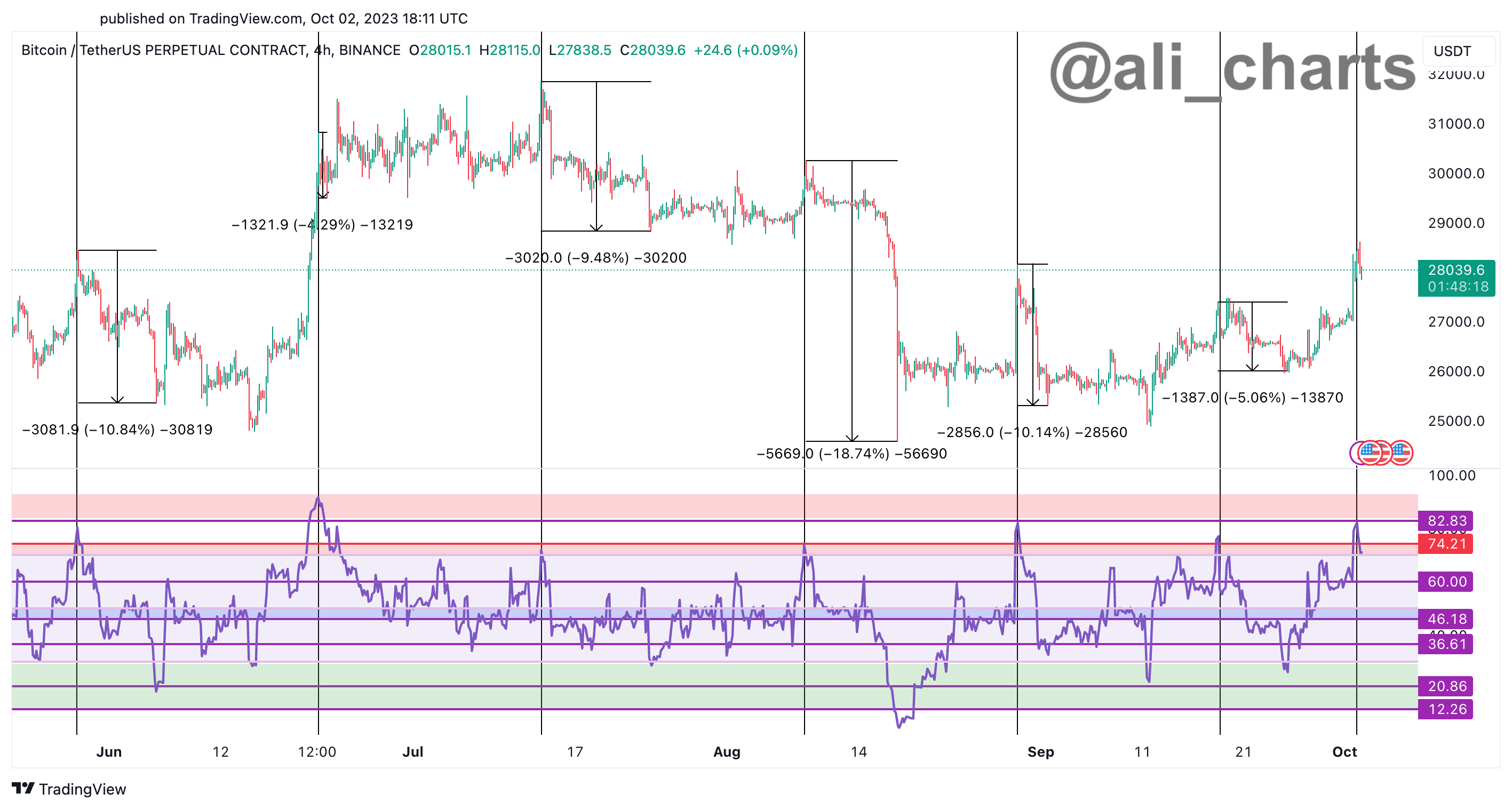

The analyst also looks at Bitcoin (BTC) and examines the Relative Strength Index (RSI) of the major crypto assets, a widely used momentum indicator that aims to determine whether an asset is overbought or oversold.

Say Martinez,

“Note that every time the RSI on BTC’s 4-hour chart reaches or crosses 74.21, BTC tends to reverse. The RSI on the 4-hour chart recently reached 82.83!”

The RSI indicator scales from 0 to 100. A reading below 30 is generally considered bullish, while a reading above 70 is typically considered a bearish sign.

BTC is trading at $27,362 at the time of writing.

Don’t miss a beat – Subscribe to receive email alerts straight to your inbox

Check price action

follow us on Tweet, Facebook And Telegram

Surf to the Daily Hodl mix

Generated image: Midjourney