beginner

Have you ever wondered how cryptocurrencies can be seamlessly transferred between different blockchain networks? The answer lies in the concept of bridges in the crypto world. If you’re new to cryptocurrencies or are simply curious about how they work, this article is here to demystify the concept of bridges and explain how they enable cross-chain transactions.

Greetings, I’m Zifa. With three years of dedicated research and writing in the cryptocurrency domain, I aim to provide insightful and informed perspectives. Let’s discover the complexities of the crypto world together.

Key Takeaways

- Role of Cross-Chain Bridges in the Crypto Ecosystem: Cross-chain bridges, often referred to as crypto bridges, facilitate the seamless transfer of assets and data between diverse blockchain networks, improving interoperability, liquidity, and user experience.

- Benefits of Blockchain Bridges: The blockchain bridge offers diversification, risk management, and the ability to harness the advantages of multiple blockchain networks, such as token swaps, staking, and ecosystem participation.

- Operational Models of Cross-Chain Bridges: Cross-chain bridges typically use the Lock & Mint and Burn & Release models to transfer assets between blockchains.

- Types of Crypto Bridges: There are various forms of cross-chain bridges, including Lock and Mint Bridges, Burn and Mint Bridges, Lock and Unlock Bridges, Programmable Token Bridges, Federated Bridges, and Relay or Notary Bridges.

- Notable Cross-Chain Bridges: Examples include BNB Bridge, Avalanche Bridge, Synapse Bridge, Arbitrum Bridge, Multichain Bridge, Polygon Bridge, Tezos Wrap Protocol, and Portal Token Bridge.

- Security Concerns in Crypto Bridges: Despite their significance, cross-chain bridges have been targets of hacks: notable breaches affected Ronin Bridge, Wormhole, Harmony Bridge, Nomad Bridge, Avalanche Bridge, and Synapse Bridge in 2022.

- Conclusion: While cross-chain bridges offer immense potential for blockchain interoperability, users must prioritize security, stay informed about technical challenges, and choose bridges that align with their risk tolerance.

What Are Cross-Chain Bridges in Crypto?

Cross-chain bridges are pivotal in the blockchain ecosystem, facilitating the seamless transfer of assets and data between diverse blockchain networks. By promoting interoperability and expanding liquidity pools, they enhance the user experience and pave the way for innovative decentralized applications and finance solutions.

Acting as connectors, these bridges allow for the transfer of digital assets, such as ERC-20 tokens and non-fungible tokens (NFTs), across different networks. This capability enables users to harness the advantages of multiple blockchain networks, presenting opportunities for token swaps, staking, and participation in various ecosystems.

Diversification and risk management are among the benefits of adopting cross-chain bridges. Users can diversify their investments by effortlessly moving assets across chains, reducing reliance on any single blockchain. Furthermore, these bridges contribute to risk mitigation by ensuring secure transfers and minimizing trust assumptions.

In essence, cross-chain bridges are integral to the crypto realm, propelling blockchain technology adoption and guaranteeing smooth interoperability. Whether it’s Binance Smart Chain, Avalanche, or Polygon, these bridges ensure the efficient transfer of native assets and foster cross-chain dialogue. With innovations like the Avalanche-Ethereum bridge and the Synapse bridge, the blockchain landscape is continuously evolving, and multichain and cross-chain bridges are leading the charge.

Why Blockchain Bridges Are Necessary in Web3

Cross-chain bridges are indispensable in the Web3 ecosystem. They address the challenge of inter-blockchain communication, ensuring smooth asset transfers between diverse blockchains. In the decentralized Web3 world, where numerous blockchains operate autonomously, a lack of standardized protocol for cross-chain transfers can limit blockchain technology’s potential.

By establishing connections between different blockchains, cross-chain bridges boost interoperability. They allow users to effortlessly move assets, such as ERC-20 tokens and NFTs, between networks. This connectivity broadens opportunities for users, enabling participation in various ecosystems and interaction with decentralized applications across multiple blockchain platforms.

Additionally, these bridges offer diversification and risk management advantages. By diversifying across multiple chains, users can access a broader range of investment options and distribute their risk. This strategy not only optimizes portfolio efficiency but also safeguards against potential risks linked to a single blockchain’s failure.

How Do Cross-Chain Bridges Work?

Crypto bridges allow users to “bridge” two blockchains so that they can use one currency on a blockchain that would normally only accept another currency. For example, let’s say you have Bitcoin but want to use an Ethereum-based project. While you may have plenty of Bitcoin, the Bitcoin and Ethereum blockchains have completely separate rules and protocols. To make up for this disconnect, crypto bridges provide access to an equivalent amount of ETH.

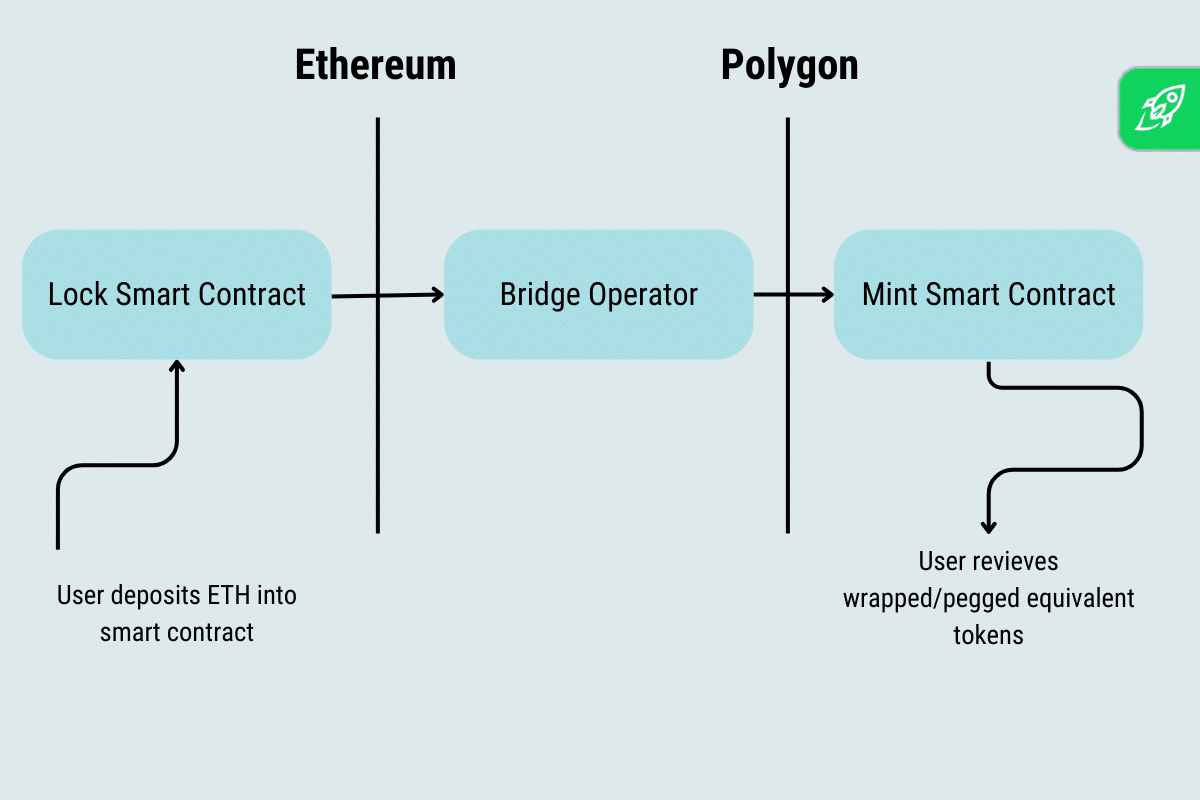

To do all this requires specialized messaging protocols, which allow tokens to be sent from one blockchain to another. This is often achieved via decentralized oracles that can take input from one chain and then direct it towards another, making it possible for assets to move across entire networks as if they were native.

Rather than actually transferring your BTC from the Bitcoin blockchain to the Ethereum blockchain, the bridge creates tokens that represent your BTC and makes them usable on the Ethereum network. The bridge interfaces with both blockchains through smart contracts that keep track of every transaction that takes place — so, no token is ever lost or double-spent. This ensures that both parties are always kept accountable while still allowing access between different blockchains without any manual transfers or shifts.

Cross-chain bridges are usually very specific in terms of purpose, many simply finding their application as application-specific services between two chains. However, they also have more generalized uses, such as enabling cross-chain DEXs, money markets, or wider cross-chain functionality. The versatility of these bridges makes them incredibly useful in digital asset management and will continue to increasingly impact the blockchain industry going forward.

Types of Cross-Chain Crypto Bridges

Cross-chain bridges come in various forms, each designed to address specific challenges and requirements of interoperability.

The Lock and Mint Bridges function by locking tokens from the source blockchain, typically using a smart contract. Once this action is confirmed, an equivalent amount of tokens is minted on the destination blockchain. This method ensures that the total token supply remains constant across both blockchains. Easy to audit and verify, this straightforward approach is commonly used for transferring stablecoins or other assets where maintaining a consistent supply is crucial.

On the other hand, Burn and Mint Bridges operate by burning or destroying tokens on the destination chain, rendering them unusable. Simultaneously, an equivalent number of tokens are minted back on the source chain. This method ensures that tokens are effectively returned to their original state and can be used on the source chain once again. It also maintains the integrity of the token’s total supply, and is useful for temporary transfers where assets are expected to be returned to the original blockchain after a certain period or event.

Lock and Unlock Bridges offer a different approach. Here, tokens are locked on the source chain and then unlocked on the destination chain. The token’s ownership is transferred, but the total supply remains unchanged. This method is efficient as it avoids the complexities of minting and burning processes. It’s also faster since it involves fewer transaction steps, making it ideal for scenarios where assets need to be moved quickly between chains without minting or burning, such as in high-frequency trading.

More versatile are the Programmable Token Bridges. These bridges can handle a variety of assets, including native tokens, decentralized applications (dApps), non-fungible tokens (NFTs), and other programmable tokens. They offer enhanced flexibility and compatibility, allowing for the transfer of complex assets with embedded logic, like dApps or smart contracts. They are particularly useful for platforms that support complex operations, such as gaming platforms where in-game assets (like NFTs) need to be transferred across blockchains or DeFi platforms that require the transfer of tokens with embedded logic.

Federated Bridges rely on a group of validators or nodes that approve the cross-chain transactions. The validators typically hold the private keys to the bridge’s multi-signature wallet. Federated bridges can provide faster transaction times and are often more scalable. However, they tend to be more centralized than other types of bridges and are commonly used in consortium blockchains or in scenarios where all parties in the network are known and trusted.

Lastly, Relay or Notary Bridges use a set of notaries or relayers that witness an event on one chain and then report it to the other chain. They can be more decentralized than federated bridges, depending on the selection process of the notaries, and are useful in public blockchains where trust is distributed, and there’s a need for a more decentralized bridging process.

Each type of cross-chain bridge addresses specific challenges and requirements in the realm of blockchain interoperability. As the crypto ecosystem continues to evolve, the importance and complexity of these bridges are likely to grow, underscoring the need for robust, secure, and efficient bridging solutions.

What Is an Example of a Cross-Chain Bridge

Let’s take a look at the most popular and advanced crypto bridges out there.

BNB Bridge

Binance Bridge stands out as a cross-chain bridge that streamlines the transfer of digital assets between Binance Smart Chain (BSC) and other blockchain networks, including Ethereum. This solution unlocks new possibilities for decentralized applications and finance. Among its many advantages, Binance Bridge boasts rapid processing times for near-instant transactions between chains and offers cost-effective transaction fees. A distinctive feature of Binance Bridge is its capability to redeem wrapped tokens (cryptocurrency tokens that represent a claim on another cryptocurrency at a 1:1 ratio) for their original assets, allowing users to convert wrapped tokens on Binance Smart Chain back to native tokens on Ethereum. This ensures asset liquidity and flexibility. By promoting blockchain interoperability, Binance Bridge reinforces the functionality of various blockchain networks, fostering broader blockchain technology adoption.

Avalanche Bridge

Within the Avalanche ecosystem, the Avalanche Bridge plays a central role by enabling smooth asset transfers between chains, specifically between Avalanche C-Chain, Bitcoin, Ethereum, and other internal chains. Formerly known as the Avalanche-Ethereum Bridge (AEB), the rebranded Avalanche Bridge offers users reduced transfer costs, making cross-chain transactions more affordable. Alongside cost benefits, the bridge prioritizes security, ensuring safe asset transfers. The user experience is also improved, with the bridge providing an intuitive interface for swift and efficient asset transfers.

Synapse Bridge

Synapse Bridge emerges as a state-of-the-art cross-chain bridge, pivotal for cross-chain interoperability within the decentralized finance (DeFi) landscape. Supporting multiple blockchain networks, including Avalanche, Ethereum, Binance Smart Chain, and Polygon, Synapse Bridge ensures users can transfer a diverse range of cryptocurrency tokens across these platforms. The bridge operates by securely locking users’ native assets on the source chain and issuing equivalent tokens on the destination chain, ensuring trustless and secure transfers. With its user-centric design and robust security features, Synapse Bridge revolutionizes the DeFi space, enabling genuine cross-chain interoperability and expanding opportunities in the crypto sector.

Arbitrum Bridge

The Arbitrum Bridge is a specialized cross-chain bridge connecting the Ethereum network to the Arbitrum network. It offers users the advantages of the Arbitrum network, such as enhanced scalability, reduced transaction fees, and faster transaction speeds. Unique to the Arbitrum Bridge is its classification as a trusted bridge, relying on trusted validators or custodians for asset transfers between chains. This approach offers heightened security and reduced risk, making it an optimal choice for users seeking a dependable cross-chain bridge solution. The Arbitrum Bridge is instrumental in exploring the opportunities the Arbitrum network presents, driving the global growth of decentralized finance.

Multichain Bridge

Thanks to the advanced cross-chain bridge protocol Multichain Bridge, users can effortlessly transfer assets across multiple blockchain networks. Supporting a variety of networks, including Bitcoin, Terra, Polygon, Clover, BNB Chain, Avalanche, and Optimism, the bridge ensures users can effectively manage and transfer their diverse portfolios. Notably, the Multichain Bridge processes cross-chain transactions in a mere 10 to 30 minutes and charges a minimal 0.01% transaction fee. With its expansive network compatibility, swift transactions, and affordable fees, the Multichain Bridge stands as a formidable solution for seamless cross-chain asset transfers.

Polygon Bridge

The Polygon Bridge is an innovative cross-chain bridge that facilitates the transfer of NFTs and ERC tokens between the Ethereum network and the Polygon sidechain. It offers two distinct types of bridges: the Plasma Bridge, which uses Plasma technology to enhance Ethereum’s scalability, and the Proof-of-Stake Bridge, which leverages the security of the Polygon sidechain. A significant benefit of the Polygon Bridge is its substantially lower gas fees compared to Ethereum, coupled with faster processing times. By connecting the Ethereum network and the Polygon sidechain, the Polygon Bridge strengthens blockchain interoperability and enables users to capitalize on the benefits of both platforms.

Tezos Wrap Protocol

The Tezos Wrap Protocol is a cross-chain bridge connecting the Ethereum and Tezos blockchain networks. It offers scalability by leveraging the Tezos blockchain’s efficient proof-of-stake consensus mechanism, ensuring faster transaction processing. Additionally, the protocol provides reduced transaction fees, making cross-chain transfers more affordable. The Tezos Wrap Protocol wraps ERC-20 and ERC-721 tokens, converting them into Tezos-native tokens and vice versa, ensuring seamless transfers between Ethereum and Tezos.

Portal Token Bridge (formerly Wormhole)

The Portal Token Bridge, previously known as Wormhole, is a vital tool in the blockchain ecosystem, enabling the seamless transfer of digital assets across various blockchain networks, including Solana, Ethereum, BNB Chain, Polygon, and Avalanche. This bridge allows users to interact with a multitude of decentralized applications (dApps) and unlock new decentralized opportunities. Through the Portal Token Bridge, users can transfer various digital assets, including cryptocurrencies, NFTs, and other tokenized assets, perfecting their experience and broadening their horizons in the crypto world.

What Cryptocurrencies Work with Cross-Chain Bridges?

Cross-chain bridges enable the seamless transfer of assets between different blockchain networks, connecting separate blockchains to facilitate interoperability. These bridges support various cryptocurrencies, including but not limited to Solana, Ethereum, BNB Chain, Polygon, and Avalanche.

The purpose of cross-chain bridges is to overcome the limitations of individual blockchains and enhance the overall user experience. By bridging different blockchain networks, users can transfer their digital assets, such as cryptocurrencies and non-fungible tokens (NFTs), across these networks with ease. This opens up new possibilities in the crypto industry and allows users to leverage the unique features and strengths of different blockchain platforms.

One of the key concepts behind cross-chain bridges is the creation of equivalent tokens on the destination blockchain. When a user transfers an asset from one blockchain to another, an equivalent token representing the original asset is created on the destination blockchain. This ensures the seamless transfer of assets while maintaining their value and properties. These equivalent tokens allow users to interact with the asset on the destination blockchain as if it were native to that network.

Can a Cross-Chain Bridge Work with Multiple Blockchain Networks?

Indeed, a cross-chain bridge can interface with multiple blockchain networks, facilitating the smooth transfer of assets across diverse chains. The weight of such interoperability for the broader acceptance and evolution of blockchain technology should not be underestimated.

Are Cross-Chain Bridges Safe?

Cross-chain bridges are indispensable in the cryptocurrency and blockchain ecosystem because they enable the seamless transfer of assets between different blockchain networks. However, the safety of these bridges is a pressing concern, given the inherent risks associated with transferring digital assets across separate blockchains. Such cross-chain communication can introduce vulnerabilities and potential attack vectors that malicious actors might exploit.

To bolster security and reduce the risk of hacks, cross-chain bridges incorporate various measures. Liquidity pools, for instance, ensure ample reserves of assets on each blockchain to support the transfer process, thereby minimizing the risk of liquidity shortages. Another measure is the minter/burn functionality, which allows for the controlled creation and destruction of assets, facilitating secure transfers between blockchain networks.

However, it’s essential to recognize that risks persist. These include potential flaws in the bridge’s smart contract code, trust assumptions regarding bridge operators, and possible technical mismatches between the source and destination blockchains.

While cross-chain bridges bring about enhanced accessibility and liquidity, users must remain cognizant of the associated risks. By diligently researching, choosing security-centric bridges, and staying updated on potential vulnerabilities, users can make informed decisions and reduce the risks inherent in the crypto sector.

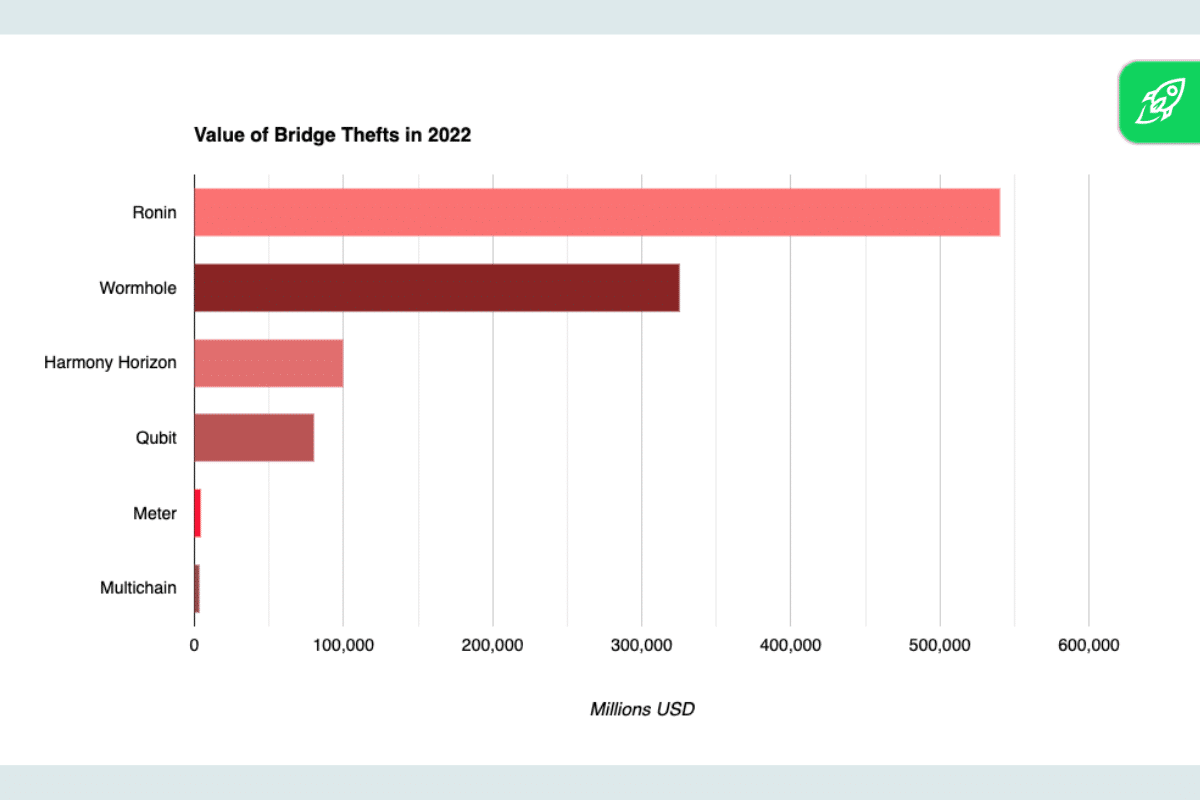

Notable Cross-Chain Bridge Hacks in 2022

Cross-chain bridges, despite their significance in the decentralized finance (DeFi) ecosystem, are not impervious to security threats. Several notable hacks in 2022 underscored the importance of their safety.

Ronin Bridge Hack

The Ronin Bridge, an integral part of the Axie Infinity ecosystem, was targeted in a sophisticated attack. This bridge was responsible for enabling transfers between the Ethereum network and Axie Infinity’s ETH sidechain. During the breach, vast amounts of ETH and USDC were illicitly accessed and transferred. The financial implications were staggering, with both the platform and its users incurring significant losses. What made this hack particularly concerning was the suspected involvement of the North Korean Lazarus Group. This group, notorious for its cyber-espionage activities, has been linked to several high-profile cyberattacks in the crypto space. Their alleged method of attack was gaining access to the private keys of the Ronin Bridge, which gave them the ability to manipulate and illicitly transfer funds. This incident was a stark reminder that even well-established projects with large user bases are vulnerable to sophisticated cyber threats.

Wormhole Hack

The Wormhole Bridge, a prominent bridge connecting the Solana and Ethereum blockchains, faced one of the most significant exploits in its history. The hackers identified and exploited a security loophole, bypassing the bridge’s verification process. This breach resulted in the loss of a staggering 120,000 Wormhole Ethereum (wETH) tokens. The financial implications were severe, shaking trust in the bridge’s security protocols. The nature of the exploit highlighted the importance of having a multi-layered security approach and the need for regular and rigorous audits to identify and rectify potential vulnerabilities.

Harmony Bridge Hack

The Harmony Bridge, which facilitates transfers between the Harmony chain and Ethereum, was compromised in a sophisticated attack. The Lazarus Group, a hacking syndicate notorious for its advanced cyber-espionage techniques, was identified as the primary suspect. Using stolen login credentials, they gained unauthorized access to the bridge’s security system. Once inside, they manipulated the bridge’s verification process, enabling them to illicitly transfer a variety of digital assets, including tokens and non-fungible tokens (NFTs). The exact value of the stolen assets remains undisclosed, but the breach has raised serious concerns about the bridge’s security measures and the broader implications for the crypto industry.

Nomad Bridge Hack

The Nomad Bridge faced a devastating security breach that led to the loss of over $190 million in digital assets. The breach allowed hackers to drain funds from the platform, affecting a variety of digital assets, including tokens and NFTs. While some of the stolen funds were later returned by ethical hackers who identified the vulnerability, a significant portion remains missing. This incident not only emphasized the importance of robust security measures but also highlighted the evolving tactics and sophistication of cybercriminals targeting the crypto space.

What Happened to Binance Bridge?

Binance, one of the world’s leading cryptocurrency exchanges, faced a significant setback when its cross-chain bridge was compromised. The attackers exploited trust assumptions placed on bridge operators, gaining unauthorized access to user funds. The breach had severe implications for the platform’s reputation and user trust. In response to the security concerns and the subsequent fallout, Binance decided to discontinue the Binance Bridge service, directing users to alternative platforms for their cross-chain transfer needs.

Avalanche Bridge Hack

The Avalanche-Ethereum bridge, a key player in the cross-chain transfer space, was targeted in an early 2022 attack. The hackers exploited vulnerabilities in the bridge’s smart contract code, leading to the loss of millions of dollars in native assets. This incident served as a stark reminder of the importance of rigorous code audits, thorough testing, and the implementation of robust security measures to safeguard against such vulnerabilities.

Synapse Bridge Exploit

The Synapse bridge, designed to enable token transfers between different chains within the Synapse network, was compromised due to a technical incompatibility between the source and destination blockchains. This mismatch allowed attackers to manipulate and illicitly transfer tokens, emphasizing the critical importance of thorough testing, compatibility checks, and robust security protocols when establishing cross-chain communication.

Each of these incidents underscores the evolving challenges in ensuring the security of cross-chain bridges. As the crypto industry continues to grow and innovate, so too do the threats it faces. Continuous vigilance, innovation in security protocols, and collaboration within the community are essential to safeguard the future of cross-chain interoperability.

References

- https://chain.link/education-hub/cross-chain-bridge

- https://www.alchemy.com/overviews/cross-chain-bridges

- https://sourceforge.net/software/cross-chain-bridges/

- https://www.chainport.io/knowledge-base/cross-chain-bridges-explained

- https://bitpay.com/blog/crypto-bridging/

- https://hub.elliptic.co/analysis/money-laundering-from-crypto-bridge-hacks-how-your-compliance-team-can-identify-the-risks/

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.