KITE crypto has quietly transitioned from low-volatility consolidation into full-blown on-chain expansion and the data doesn’t look accidental.

After weeks of relatively muted activity through December and early January, the network flipped a switch in late January. Whale transactions surged. Exchange flows accelerated. Volume exploded. And KITE price followed.

This wasn’t retail-led noise. It was coordinated capital movement.

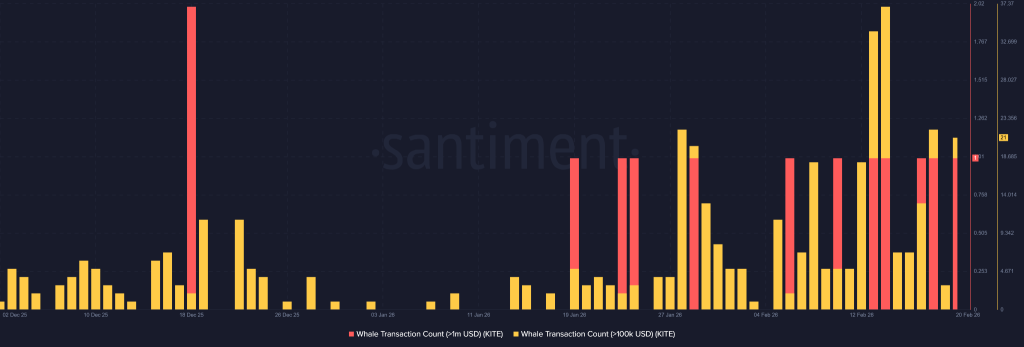

Whale Transactions Spike First Then KITE Price Jumped

On-chain data tracking transactions above $100K and $1M shows a clear shift in behavior. Throughout December, large transfers were sporadic and inconsistent. But as January progressed, high-value transactions began clustering.

By late January and into February, whale activity accelerated sharply.

Notably, the spike in large transactions preceded the most aggressive phase of price expansion. That sequencing matters. It suggests whales positioned early, before volatility and broader participation increased.

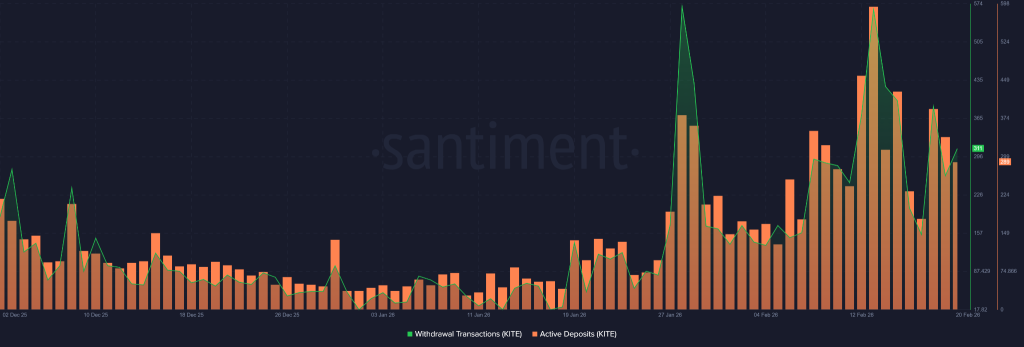

Exchange Flows Turn High Velocity

Similarly, Active deposits and withdrawals rose sharply into February. Instead of one-sided deposit dominance, which would typically signal heavy distribution but the data shows both deposits and withdrawals expanding simultaneously. That suggests high turnover and active trading rather than simple exit flows.

This kind of tug-of-war dynamic is often seen during expansion phases, where capital rotates rapidly between participants. Because this means that Liquidity increased. Volatility increased. Participation increased, too.

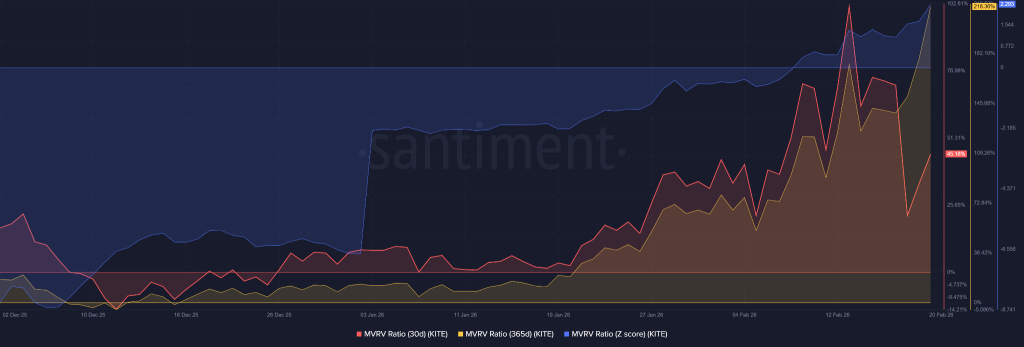

MVRV Indicates Profitability Expansion

Meanwhile, the 30-day MVRV turned sharply positive heading into February, reflecting that short-term holders are now sitting on profits. The 365-day MVRV also climbed steadily, reinforcing the broader shift into profitability territory, too.

Even, the MVRV Z-score moved toward elevated levels, but not historically extreme blow-off territory. That balance is important.

It suggests KITE is in a profitable expansion phase, yet not conclusively overheated. Short-term profit-taking risk exists, but structural exhaustion signals have not yet fully emerged, which is kind of safety signal for longterm investors.

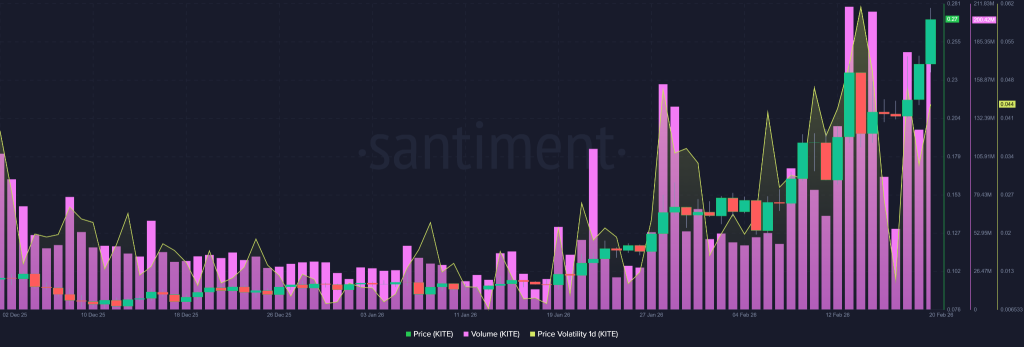

Volume and Volatility Confirm Speculative Phase

Clubbing all data with KITE Price, its momentum feels justified as it accelerated alongside surging volume in late January onwards. Volatility spiked aggressively too which is a hallmark of speculative expansion cycles.

Crucially, after the surge, price consolidated at higher levels instead of collapsing. That pattern supports the idea that demand absorption occurred during high turnover, rather than immediate distribution.

More Expansion Is Possible But With Risk Attached

The on-chain data points toward a growth phase rather than structural breakdown. However, elevated short-term MVRV and concentrated whale clusters mean the next move is critical.

If withdrawals begin consistently outpacing deposits and whale activity sustains, accumulation remains the dominant narrative. If deposits overwhelm and MVRV spikes aggressively, the tone could shift toward distribution.

For now, KITE appears to be operating inside an aggressive expansion cycle which is purely driven by whale positioning, rising volume, and even renewed speculative participation.

The next few weeks will determine whether this momentum builds into continuation or matures into volatility-driven shakeouts.