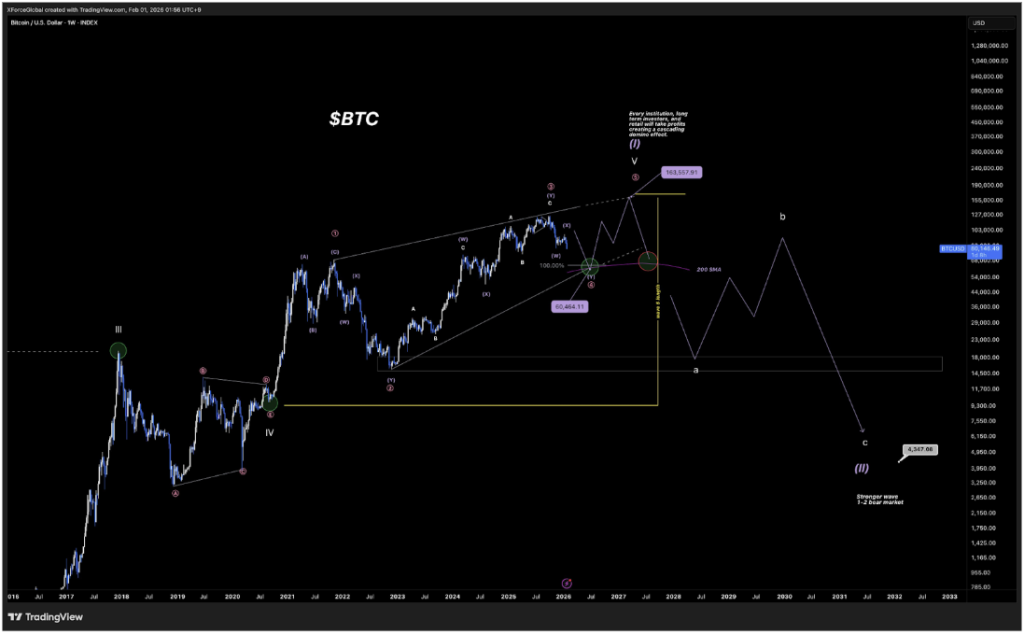

Bitcoin’s price action has fallen into bearish territory after dropping below an important previous low that had supported the rally for months. At the time of writing, Bitcoin is trading at $78,560 after falling to as low as $77,082 in the past 24 hours, a move that crypto analyst XForceGlobal says represents a significant change in the technical structure.

According to his detailed Elliott Wave analysis shared on X, the price action has now invalidated the bullish framework many traders were relying on, and lower levels are becoming more likely in the coming weeks and months.

Related Reading

Breakdown Below Previous Low Changes Primary Wave Count

According to XForceGlobal, Bitcoin had been working through a complex sideways structure, specifically a WXY combination that was expected to resolve through distribution rather than outright breakdown.

Bulls managed to complete three of the five required components of this triangle-like structure, but the failure to defend the prior low was the signal that led to a structural shift. This prior low refers to the $82,000 low in November 2025. Bitcoin bulls failed to defend this low when the price action broke below $80,000 in the most recent 24 hours.

Once that level gave way, the primary wave count could no longer be maintained. In terms of the Elliott Wave count, that lower low means that price action from the all-time high should now be treated as separated and corrective, not part of a healthy continuation. This restructuring gives the current decline more room to develop from a Fibonacci extension perspective and changes how minimum and maximum downside targets should be evaluated.

Bitcoin Price Chart. Source: @XForceGlobal On X

Two Bearish Scenarios Point To The Same Zone

The resulting analysis shows two main scenarios of how Bitcoin’s price action can continue from here, both of which are converging on similar downside levels. The first is a flat correction, where Bitcoin is currently unfolding a C wave. Although XForceGlobal describes this as the least attractive option, it would still imply a full distribution range that invalidates a bullish structure and drags the Bitcoin price to as low as $60,000.

The second scenario is a macro ending diagonal structured as a WXY move to the downside. This scenario uses the October 2025 all-time high above $126,000 as a cut point to improve wave separation of the current price action. Interestingly, the price projection from this scenario also aligns with targets in the same $60,000 area. Despite different technical paths, both interpretations point to comparable downside risk over the medium timeframe.

Related Reading

Now that the larger structure is now compromised, XForceGlobal says it makes sense to adopt a shorter-timeframe bearish bias while reorganizing the next wave count. The outlook is that Bitcoin continues its decline to at least $60,000 before rebounding to stage a return above $100,000.

Featured image from Pixabay, chart from TradingView