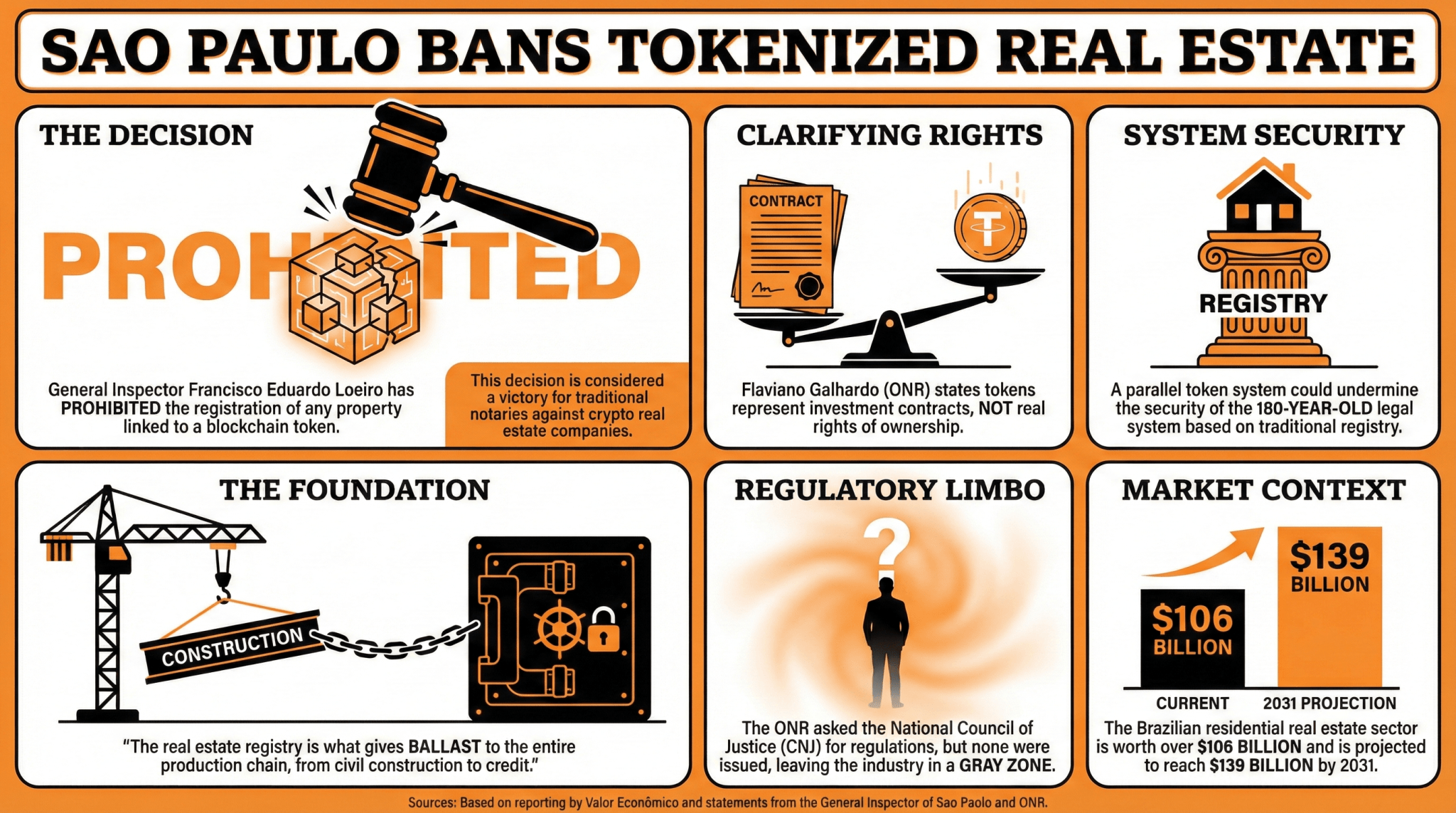

The government of São Paulo, Brazil prohibited the registration of documents linking tokens to real‑estate properties at the request of a group of registrars. The action halts a market operating in a gray zone, which must now wait for proper regulation.

Registration of Real Estate Tokenization Projects Stopped by the São Paolo Government

The city of São Paulo in Brazil will have to stop registering tokenized real estate properties.

According to Valor Econômico, the General Inspector of São Paulo, Francisco Eduardo Loeiro, decided to prohibit the registration of any property linked to a blockchain token, a decision considered a victory for notaries against companies involved in real estate tokenization.

The decision follows an earlier takedown of a resolution issued by the Federal Council of Real Estate Brokers (Cofeci), which sought to regulate the sector.

Flaviano Galhardo, executive director of the National Operator of the Electronic Real Estate Registration System (ONR), agrees with the outcome, stating that it clarifies the economic rights of real estate token holders, separating token ownership from real ownership.

“The token can represent investment contracts or financial instruments, but it cannot induce people to believe that it is a real right of ownership of a property,” he stated.

For Galhardo, the introduction of a parallel token system could undermine the security of the 180-year legal system based on the traditional real estate registry.

He assessed:

“The real estate registry today is what gives ballast to the entire real estate production chain, ranging from civil construction to real estate credit. Everything is built on the security of the property registry.”

The ONR has asked the National Council of Justice (CNJ) to issue a regulation for real estate tokens, but this has not happened. The general inspector’s move is considered a regression by insiders, as it stops an industry already operating in a gray zone without presenting any solution to the issue.

The market capitalization of the residential real estate sector in Brazil reaches over $106 billion, and is projected to grow to nearly $139 billion by 2031, according to Mordor Intelligence.

Read more: Brazil Streamlines Rules for Banking Institutions Entering The Crypto Market

FAQ

-

What recent decision did São Paulo make regarding tokenized real estate?

São Paulo has halted the registration of properties linked to blockchain tokens, marking a setback for real estate tokenization. -

Who decided to prohibit tokenized property registrations?

The decision was made by the General Inspector of São Paulo, Francisco Eduardo Loeiro. -

What concerns did experts raise about real estate tokens?

Experts argue that tokens can’t convey true ownership rights and could undermine Brazil’s traditional property registry system. -

What is the current status of the real estate sector in Brazil?

The residential real estate market in Brazil is valued at over $106 billion, with projections to reach nearly $139 billion by 2031.