- Avalanche explores more growth opportunities in Japan to revive slowing network activity.

- AVAX enters a possible accumulation zone after its recent bearish performance.

As the market extends the period of low volatility, it is important to look into how it has impacted some of the top blockchains. A look at Avalanche and its current performance hammers down this point but the network has been making efforts aimed toward growth.

Read Avalanche’s [AVAX] price prediction 2023-24

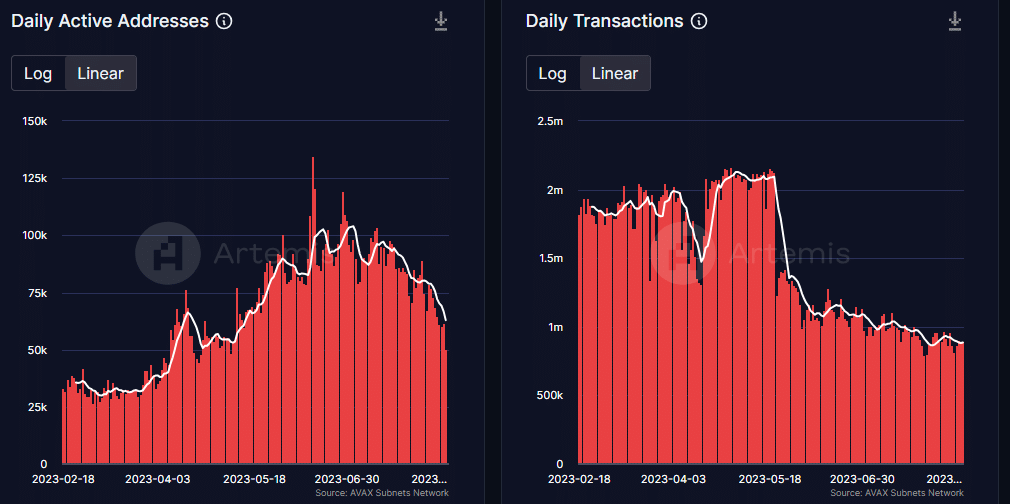

Avalanche’s performance took a hit from sluggish market conditions recently. Its address activity put the impact into perspective. Daily active addresses on Avalanched achieved a six-month peak in mid-June at over 130,000 addresses. It has since cooled down to roughly 50,000 daily active addresses.

Source: Artemis

The number of daily transactions on the Avalanche network unsurprisingly dipped during the same period. However, it is worth noting that daily transactions dipped even before address activity slowed down.

Many networks tend to deploy measures aimed at sustaining growth or activity. Avalanche’s latest efforts revealed that the chain is exploring growth opportunities in the Asian region. Furthermore, it recently revealed that the Japanese firm SBI VC will adopt its AvaCloud WEB3 launchpad to roll out its services.

Japanese financial services company @sbivc_official is using @AvaCloud to launch Web3 business solutions on their crypto exchange!

Users of SBI VCs platform will have access to a number of tools and services, including $AVAX staking and trading through the SBI VC exchange. pic.twitter.com/WePyT0E2Zi

— Avalanche

(@avax) August 16, 2023

The aforementioned development not only underscores Avalanche’s continued growth but also the potential for onboarding more organic utility. AVAX staking will reportedly be among the services offered through AvaCloud. In other words, Avalanche just unlocked a new corridor that will facilitate AVAX demand for staking which may encourage a long-term bias.

Are the tides about to change for AVAX?

AVAX received a 30%+ discount from its highest price point in mid-June. Notably around the same time that daily active addresses started tapering off. It recently bottomed out near the $11 price level and exchanged hands at $11.38 at press time.

Source: TradingView

AVAX’s recent lows could be considered noteworthy for two main reasons. The price retested a previous accumulation range where it bounced off in June. The other observation is that the Relative Strength Index (RSI) recently entered the oversold zone.

These findings underscore a high probability of a pivot in the next few days. However, that will depend on whether AVAX can secure enough bullish demand to yield a sizable rally.

Is your portfolio green? Check out the Avalanche Profit Calculator

AVAX sentiment peaked in favor of the bull in mid-August. However, the price extended the downside, leading to a sentiment dip. Despite this, most of the analysts and investors submitting their expectations are still in favor of a bullish outcome.

Source: LunarCrush

Avalanche’s recent development regarding Japan and the oversold price, may offer substantial reasons for a bullish sentiment.