Closely followed quant analyst PlanB says that Bitcoin (BTC) has crossed a key resistance level that historically kicks off multi-year rallies.

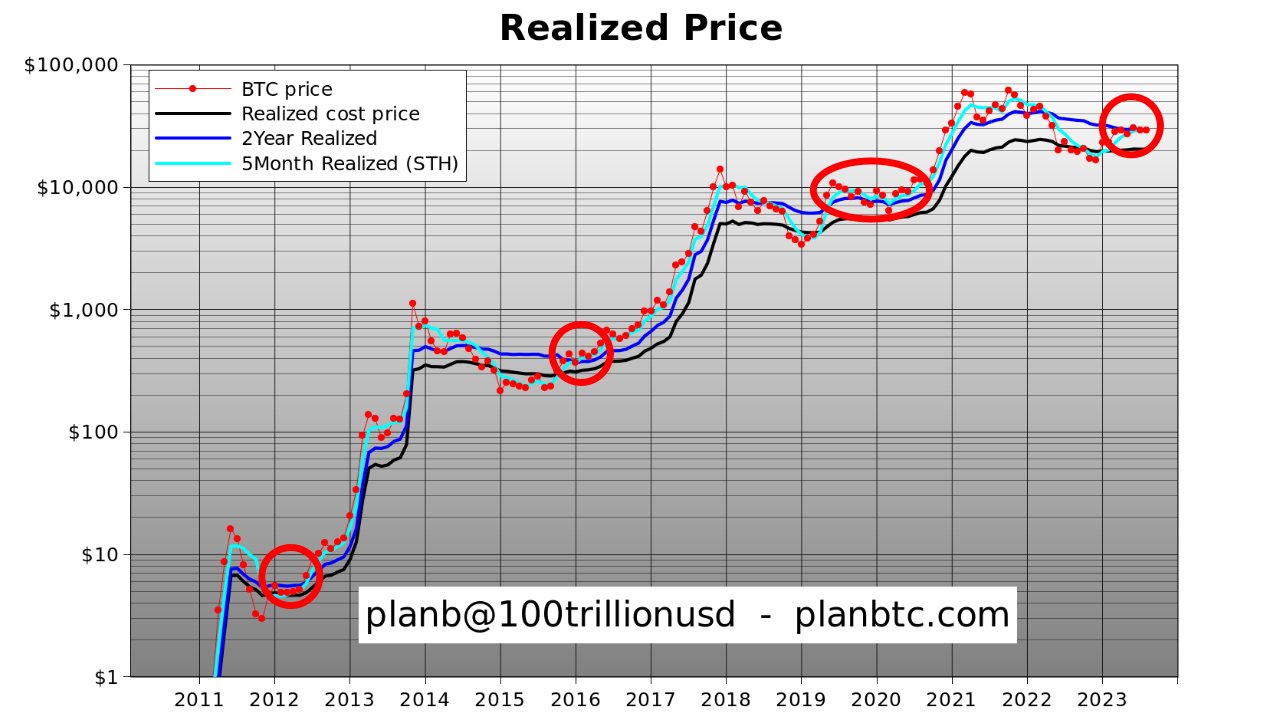

The pseudonymous analyst tells his 1.8 million X followers that BTC’s five-month realized price has crossed the two-year realized price, a pattern that has previously marked the start of a bull market three times in the past.

“Five-month realized price (aka. Short Term Holder price, light blue) is now above two-year realized price (dark blue). If history is any guide (red circles) it will stay above for the next 2+ years. Interesting times ahead.”

The realized price metric measures the value of all its tokens at the price they were bought divided by the number of tokens in circulation.

During bull markets, the crypto king’s price tends to remain above all of its realized prices, according to PlanB.

He predicts that Bitcoin will not revisit prices below the $30,000 level if the bull rally is underway.

“Not buying Bitcoin < $30,000 now is like:

Not buying Bitcoin < $10,000 in 2019/2020.

Not buying Bitcoin < $500 in 2015/2016.

Not buying Bitcoin < $10 in 2011/2012.

Life is all about choices.”

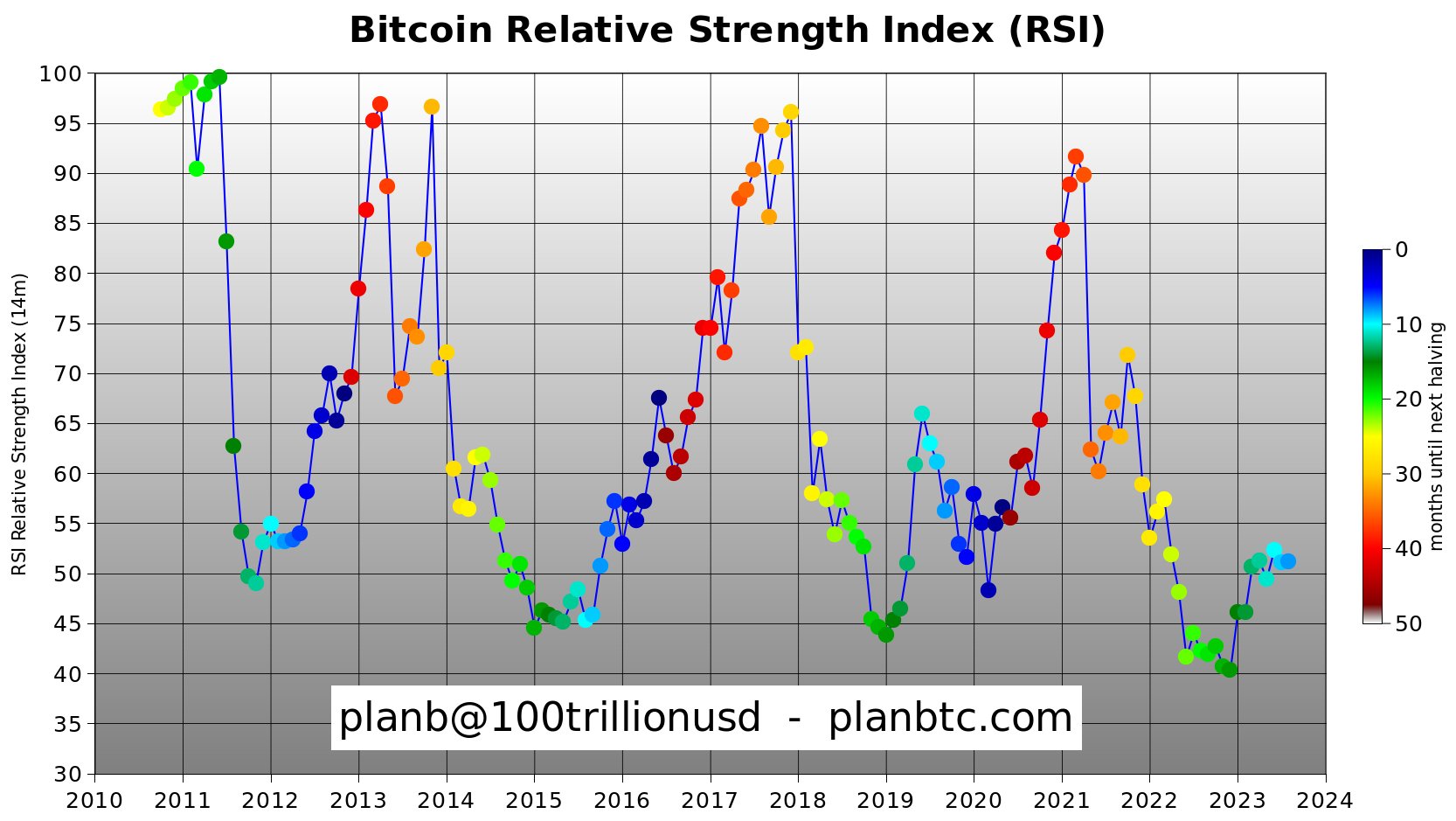

PlanB is also keeping a close eye on Bitcoin’s Relative Strength Index (RSI), a widely-used momentum indicator that aims to determine if an asset is overbought or oversold.

He says the indicator is setting the stage for a big rally similar to 2015.

“Like clockwork, exact same spot as October 2015.”

The analyst previously predicted that Bitcoin will hit $50,000 before the next halving event, which is expected in April 2024.

Bitcoin is trading for $29,620 at time of writing, up 2.6% in the last 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Featured Image: Shutterstock/Jorm S