Bitcoin options are a vital part of the broader cryptocurrency market, as the dynamics within these derivatives contracts can provide valuable insights into market trends and potential future movements.

Bitcoin options are financial contracts that give investors the right but not the obligation to buy or sell Bitcoin at a predetermined price within a specified time frame.

They serve as essential hedging and speculative tools, allowing market participants to manage risk and make informed investment decisions. Changes in the derivatives market can directly impact Bitcoin’s spot price, reflecting broader market sentiment and investor behavior.

Puts and calls are the two primary types of options contracts. A put option gives the holder the right to sell an asset at a specific price, while a call option grants the right to buy.

Monitoring the ratio of puts to calls is vital as it can signal market sentiment. A high put/call ratio may indicate bearish sentiment, while a low ratio may suggest bullish sentiment.

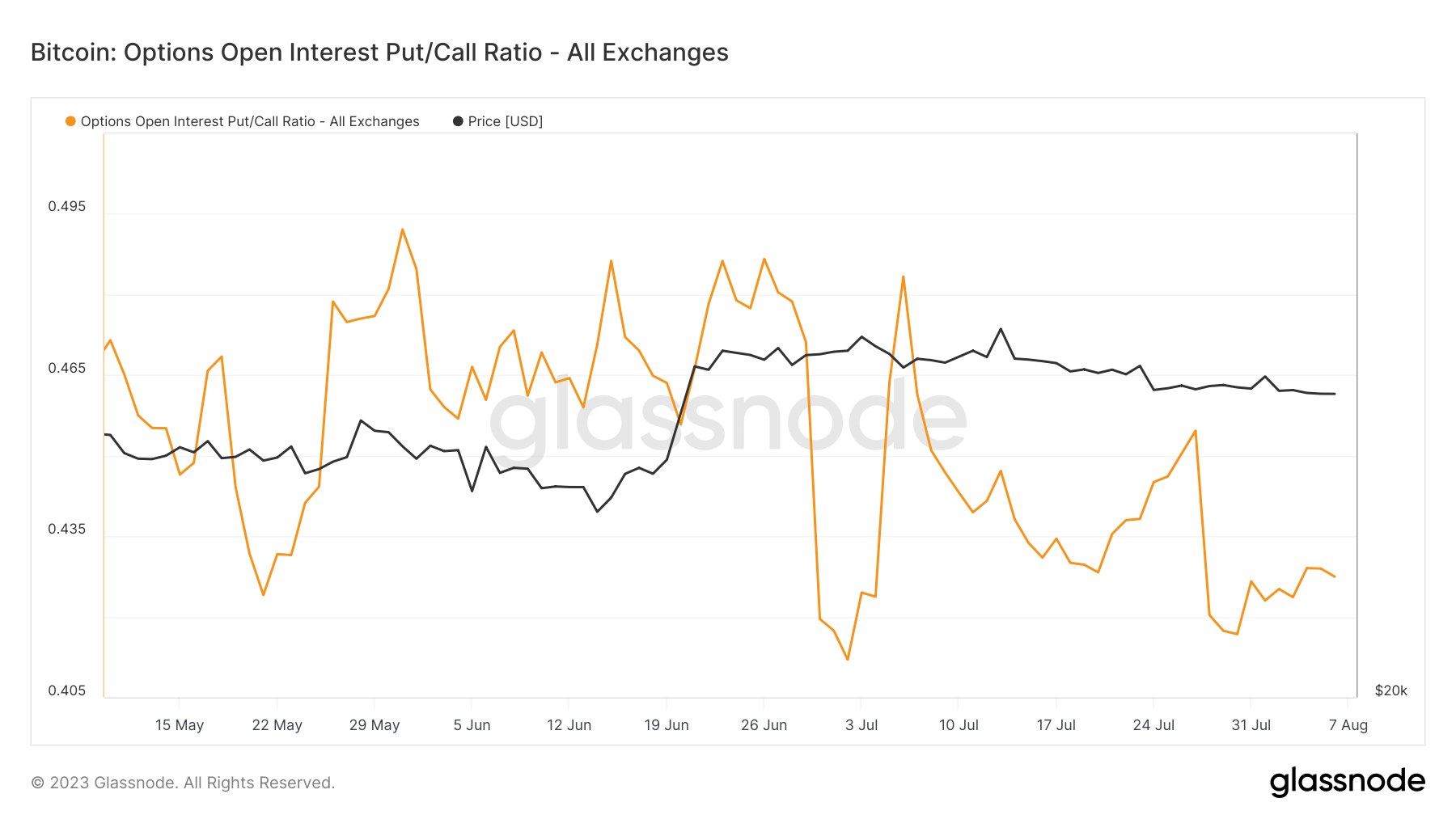

The Bitcoin Options Open Interest Put/Call Ratio is a metric that measures the total number of open put options to call options in the market. This ratio dropped sharply on July 27, reaching this year’s lows.

The decline in this ratio may signal a shift in market sentiment, possibly indicating increased confidence in Bitcoin’s price rise.

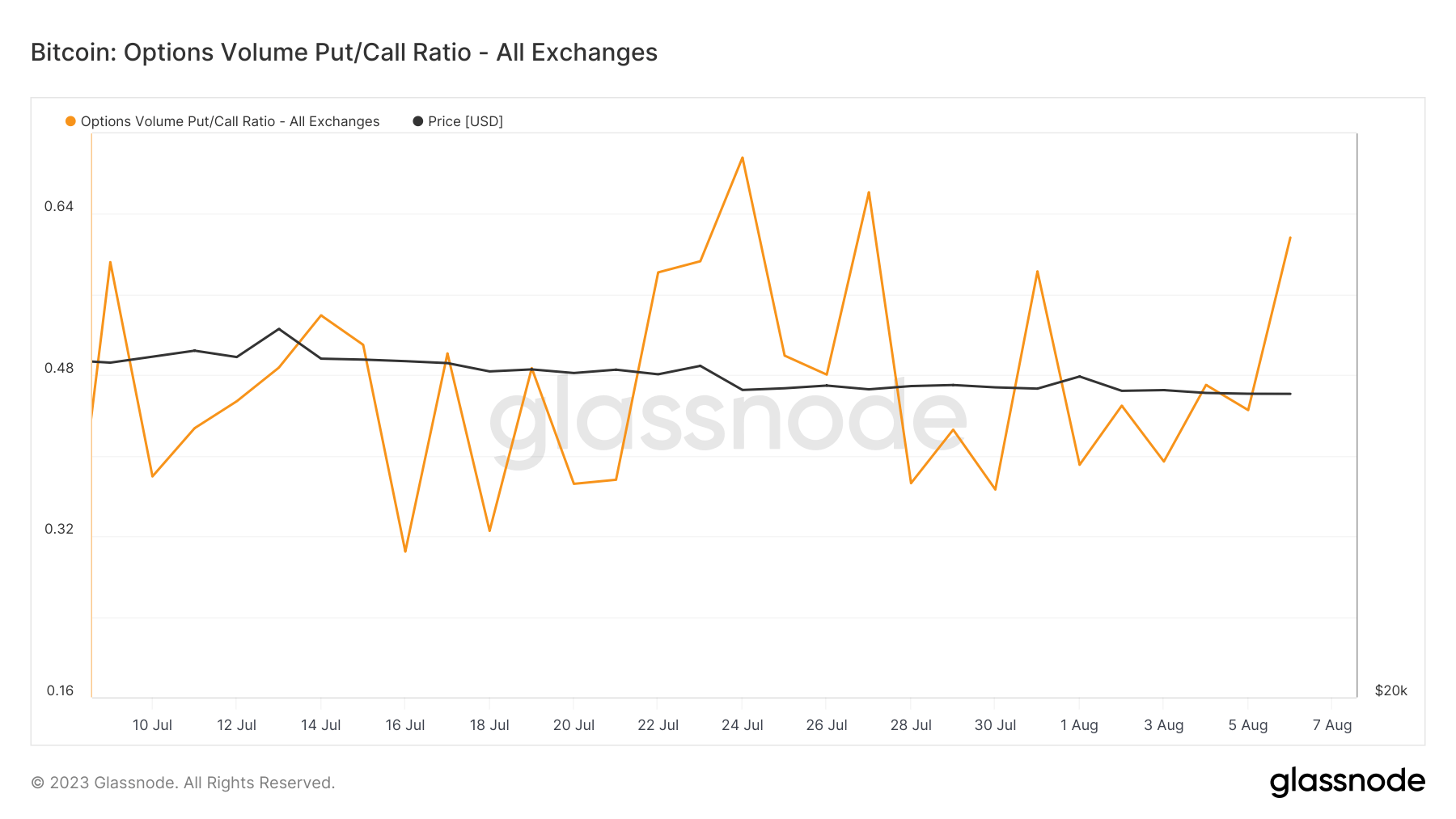

Another essential metric is the Bitcoin Options Volume Put/Call Ratio, which measures the trading volume of put options to call options. Unlike the open put/call ratio, the volume ratio experienced a similar drop on July 27 but has since recovered, experiencing a 64% increase.

This recovery might indicate a more balanced market sentiment, reflecting both optimism and caution among traders.

The steep decline in the open put/call ratio and the recovery in the volume ratio might indicate a complex market scenario.

While the drop in the open ratio may signal bullish sentiment, the subsequent recovery in the volume ratio suggests that traders are also hedging against potential downside risks.

When analyzed together, these two ratios provide a nuanced view of the market, reflecting optimism and caution.

The post Options Put/Call Ratio suggests cautious optimism among traders appeared first on CryptoSlate.