As we stroll past January 3rd, the day Bitcoin was effectively born, an old tradition in the Bitcoin industry passed us by, the “not your keys, not your coins” day, which was celebrated widely for a few years in a row back in 2014. While the news cycle this year was dominated by geopolitics and many Bitcoiners are entering the industry via ETFs, Bitcoin self-custody nevertheless remains a core value proposition of Bitcoin and one that merits a deep dive into the best options available to users to date.

To that end, here’s the top mobile, desktop, hardware, seed backup, and multi-signature wallets for Bitcoin-specific users in the market today, as far as I am concerned.

Opinions expressed in this article are entirely the author’s and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.

Mobile Bitcoin Wallet Apps

The first self-custody wallet everyone should try is probably on a mobile device. The comfort and speed of sending Bitcoin from your phone across the world, be it to a relative abroad or to donate to a special cause, is unparalleled with Bitcoin. The first way people are likely to use the digital currency is also through a mobile wallet. Not all mobile wallets are made equal; however, most software wallets are closed source and contain a bunch of crypto coins, which means they don’t specialize in any of them, often a sign of mediocre user experiences to come. Below is a list of the best Bitcoin-only or Bitcoin-savvy wallets that a discerning user should consider.

Phoenix Wallet

Leading the charge of the Bitcoin-only mobile world is arguably Phoenix Wallet. At the top of their game from a UI and back-end perspective, Acinq continues to deliver the best optimized experience for Bitcoiners concerned with self-custody. On the on-chain front, they support full self-custody, with on-chain payments at a decent fee rate, letting users make payments to all standard Bitcoin address types. Users can also fund the wallet to an on-chain address, which will automagically load up that balance into a lightning channel.

While Phoenix is not the best on-chain wallet by any means, it is, for most purposes, good enough. Where Phoenix shines, however, is on the lightning payments side. It supports a wide range of standards and has one of the best integrated and funded nodes on the network, giving users maximum reliability. The lightning arrangement with Phoenix is one of mixed self-custody, where the user has all the relevant key material, with some dependency on Phoenix and minimum trust.

The wallet can be side-loaded into Android via an APK, for those so inclined, and its back end can be run using phoenixd for app developers and node runners.

Phoenix requires a minimum of about 10,000 satoshis to be spent the first time the wallet is set up, to cover on-chain fees for Lightning channels and to buy capacity on the Lightning Network. This friction point can be awkward when setting up new users with Lightning. Making it an advanced yet powerful and easy-to-use Bitcoin wallet. Phoenix has a variety of open source tools and software available online.

Blockstream Wallet

Blockstream Wallet, brought to you by Blockstream Corporation of Adam Back fame, is a reliable Bitcoin wallet with well-rounded support for Bitcoin on-chain transactions, as well as native support for the Liquid Network. Liquid has gained popularity in recent years for supporting a similar user experience as on-chain Bitcoin with comparable speeds to the Lightning Network, and a security model that is probably good enough, leveraging a multinational federation.

Blockstream Wallet can hold USDT on top of Liquid, though it does not include a built-in swap interface, introducing significant frictions and exposing users to third-party fees for swapping in and out of the networks and into more popular USDT base chains. Nevertheless, liquid provides users remarkable privacy, as it encrypts amounts at the base layer similar to some of the most popular privacy coins, giving users some of the best privacy available in Bitcoin in exchange for some of the other UI pain points we just discussed.

Blockstream Wallet is open source and remains one of the top choices for Bitcoin self-custody today.

Bull Bitcoin Wallet

A new entrant into the wallet space, Francis Pouliot’s Bull Bitcoin Mobile wallet has left a strong impression among self-custody advocates, with its purist yet pragmatic design philosophy. The wallet is fully open source and on an MIT license. It includes the Bull Bitcoin exchange as an optional service, available in Canada, Europe, Mexico, Argentina, and Colombia, Puerto Rico (bitcoin jungle wallet), letting users buy bitcoin, automate purchases in dollar cost average format, sell bitcoin for local fiat, and even make payments to third parties. The user sends bitcoin, and the recipient gets the local fiat.

While the Bull Bitcoin Mobile wallet is designed for new users to have all the payment tools they need to use Bitcoin as money, the wallet also supports a variety of advanced features under the hood.

It’s one of the first to implement the async Payjoin protocol, which provides users with great privacy on-chain when using compatible wallets. This Payjoin feature is backwards compatible and invisible to the user, so it introduces no friction, just privacy benefits.

The wallet leverages the Liquid network to hold small amounts of bitcoin at rest, while natively supporting the Boltz protocol for swapping out into the Lightning Network, letting users make Lightning payments without issue, as well as receive Lightning payments with minimum trust, since Boltz uses non-custodial atomic swaps, delivering the value to users on a Liquid address.

The wallet also has full Bitcoin on-chain support, with NFC tap to pay for hardware wallets like the Coldcard Q, which are designed for deep self-custody, high-value transactions. All and all, Bull Bitcoin Mobile stands to be one of the most promising Bitcoin wallets for 2026, making design decisions that address the everyday needs of the active Bitcoin user.

Zeus Wallet

Zeus Wallet is a lightning payments app that has made incredible progress in taking Lightning Network self-custody to the limit. Bitcoin’s layer to payment network is very fast and has significant privacy benefits compared to the base on-chain payment rails of Bitcoin, but the downsides are seen when users attempt to take self-custody, as control over funds depends far more on running a lightning node. Zeus makes running a lightning node on a mobile phone easy and mostly automated.

Initially created as an interface for managing self-hosted home lightning nodes, it now supports a deep range of tools for advanced users alongside a full onboarding interface for new users, offering a superior onboarding experience to even Phoenix Wallet. The only downside is that it can be a bit slow to open and sync up, and eventually does start to demand users move up the learning curve, for the right person it might be a great choice. Zeus Wallet is also open source.

Cake Wallet

Cake Wallet has become an increasingly important player in the Bitcoin and crypto privacy space, as it has led the charge, bringing advanced privacy technologies to the mobile platform. They support a variety of privacy initiatives like the Payjoin foundation and were the first major wallet to integrate its protocol as well as the Silent Payments standard. Cake supports coins other than Bitcoin, such as Monero, Ethereum, and various other tokens, including stablecoins. Cake Wallet is also open source.

Desktop Wallets

Sparrow Wallet

On the Desktop front, Sparrow Wallet has emerged as the Swiss Army Knife of Bitcoin wallets. Easy to install, capable of connecting to local nodes as well as without them, with access to the full range of bitcoin address types, multisig, hardware wallet support, etc. Sparrow has, by most standards, reached the kind of “pro” level of feature richness and positive renown that the Electrum wallet has enjoyed for more than a decade. It is, of course, fully open source.

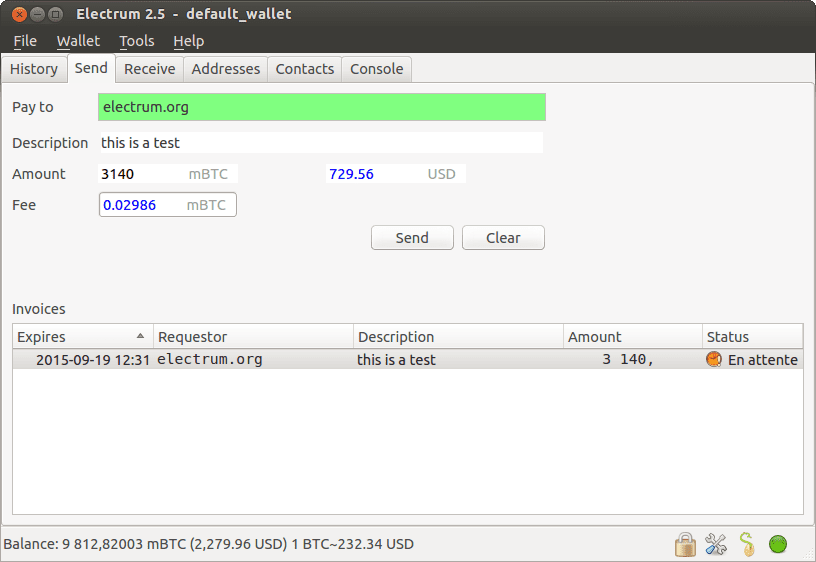

Electrum

Electrum wallet continues to be a staple of Bitcoin self-custody wallets, capable of connecting to most hardware wallets, with an interface so stable and straightforward that it very much defined user expectations of a desktop wallet, similar to the Bitcoin core QT, but much easier to run and use. Electrum even has a lightning wallet mode, which works surprisingly well, defying the idea that it is a feat for advanced users.

Electrum tries to default to its own 12-word standard, which is not compatible with most wallets, a technical decision that, in my opinion, has added unnecessary friction to the onboarding and recovery processes, but it is one that can be opted out of. It is also fully open source and can be run with its back-end companion, electrumX server, which indexes the full Bitcoin blockchain, making it easy to search for user balances, with very strong privacy.

Hardware Wallets

Coldcard Q

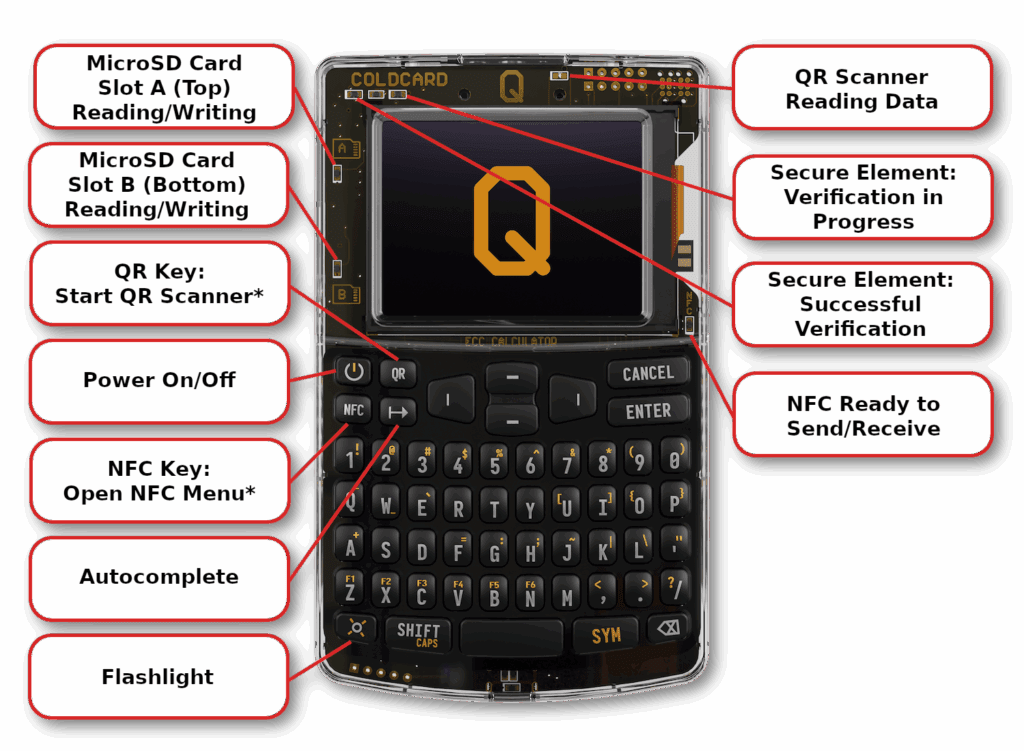

The Coldcard Q made a strong impact in the self-custody world in 2025 with its counter-tendency design decisions. Unlike many hardware wallets in the industry, it refuses to add Bluetooth support. NVK, the co-founder and CEO, considers it too risky, given the range and the black box code it depends on. Instead, to serve the rising user experience demands of the market, the Q comes with a high-quality laser scanner for QR codes and NFC antennas, covering both the input of bitcoin transaction data into the device and output, to send transactions onto the network. This flow is particularly useful when signing pre-signed transactions in the construction, for example, of a multisig, and should be easy to integrate with Payjoin privacy schemes LINK.

Opting for its hard cypherpunk aesthetic, the device has a transparent shell that lets the user verify the hardware inside, while bringing back the nostalgic Blackberry-style keyboard with comfortable buttons, leaving touch screens in the dust. The device screen rocks an orangy golden font over deep black, the Bitcoin version of the Matrix code color scheme. Finally, the device takes three AA batteries, letting it operate without power cables, entirely unplugged from any machines and de-risking it from battery malfunctions, bricking the devices as has been observed in some hardware wallets with integrated batteries.

All in all, the Coldcard Q is undoubtedly the gold standard of Bitcoin hardware wallet security, with all the downsides that its purity entails, such as Bitcoin only support, not even stablecoins are allowed in.

The firmware, hardware, and most, if not all, related software are source available under various licenses.

Trezor Safe 7

For those more crypto practical, Trezor continues to make excellent hardware wallet products, guided by its over 10 years of experience in the industry; they arguably created the industry, in fact, launching the first hardware wallet, the Trezor One, which still holds out well enough today. Nevertheless, they’ve recently launched a new version of their hardware, the Trezor Safe 7, with a wider screen and a variety of wireless-related user experience upgrades for the professional and active crypto user. Trezor firmware, hardware designs, and a variety of its software tools are open source under various licenses.

Multi-Signature Bitcoin Wallets

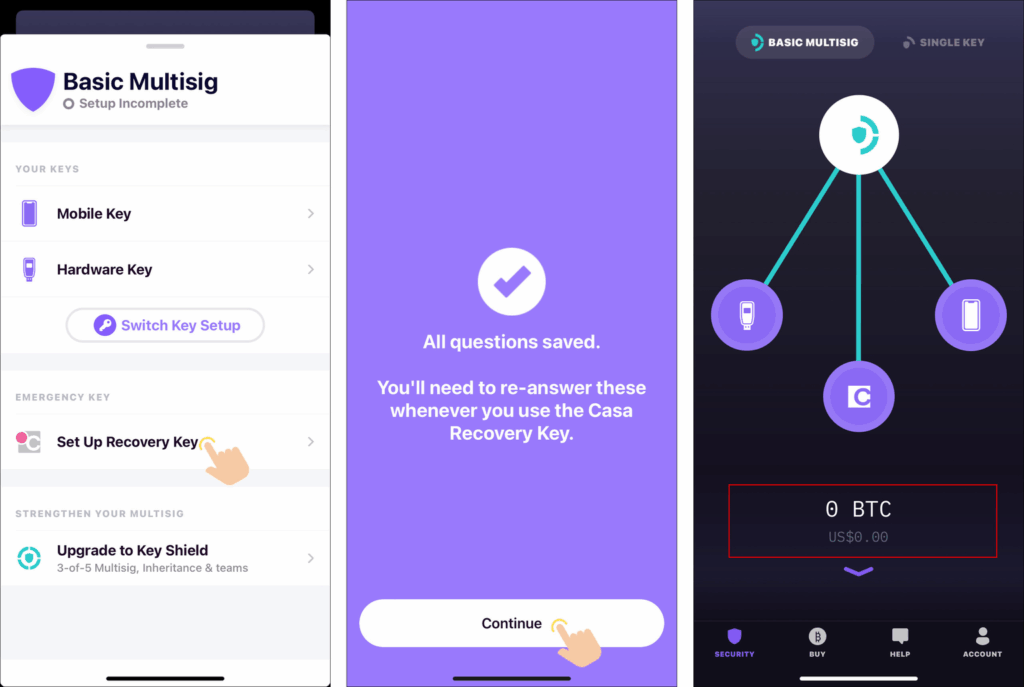

Casa Wallet

Casa Wallet, the multi-signature Bitcoin and Ethereum Wallet company led by Jameson Lopp, continues to be the spearhead of user experience and self-custody for those so inclined. The app enables users to leverage two general models of self-custody: 2 of 3 keys needed to sign and 3 of 5. With some variability and advanced settings that let users choose their own path. They support most hardware wallets for key management and offer their recovery key solution by default on both plans, a key pillar of their inheritance solution offering for advanced subscriptions.

In recent years, they added Ethereum support, a controversial but realist move which unlocked stablecoin storage in the multisig security model for crypto whales. The company remains defensive of its user data and collects the minimum amount required legally, letting users pay for their subscriptions with Bitcoin, which range from $250 a year up to $2100, depending on the model and services needed. They also offer custom support to individuals who have non-standard threat models, are famous, or are high-net-worth individuals with very specific demands.

Casa also offers support and technical guidance at various levels, depending on the user plan, and is known to respond quickly to support emails in general. Jameson Lopp has a deep range of articles covering Bitcoin and crypto security best practices, which can be found at Lopp.net.

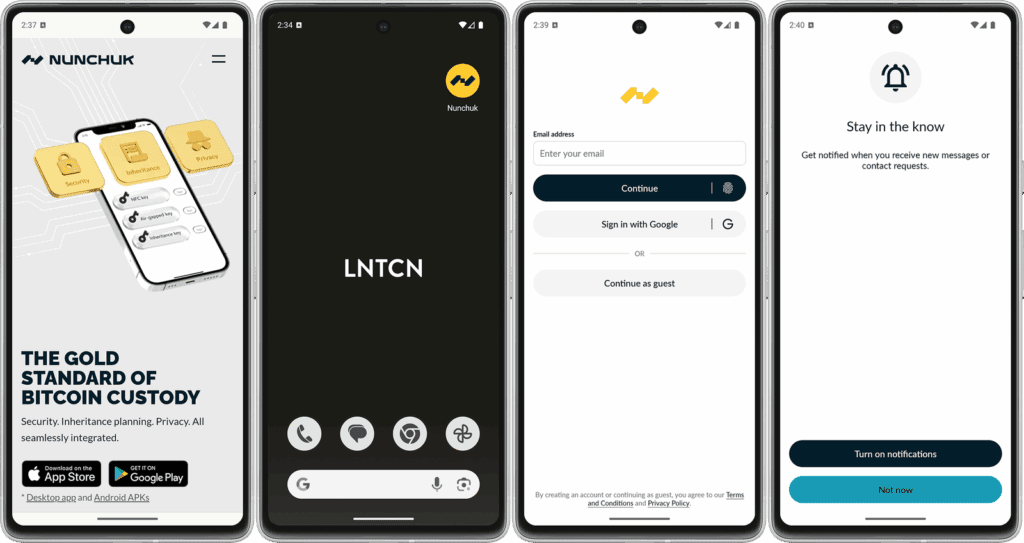

Nunchuck Wallet

Nunchuck Wallet is another multi-signature focused Bitcoin app that has gained significant renown in the industry in recent years. They were born and forged in the fires of COVID drama up in Canada, learning important lessons from the censorship that took place and getting a front seat to how Western governments can go rogue. The app lets users set up a wide range of different multi-signature accounts with a wide range of hardware wallet support, including some of the most advanced Bitcoin smart contracting tools available today, specifically in the form of miniscript support.

Nunchuck also offers an inheritance solution via a subscription service, holding a recovery key for emergencies and technical support. Their app is primarily a mobile wallet, considered by some “The Sparrow of Mobile”, given its deep advanced tooling, though the interface keeps things simple enough. Nunchuck Wallet is also open source.

Seed Backup

CryptoSteel

Last but not least, there’s a variety of 12-word backup companies that have emerged over the years to offer Bitcoin hodlers weather and tamper-proof storage solutions to those delicate magic words, which can give someone access to their holdings. Cryptosteel is one of the most renowned companies in this niche and offers a wide range of steel backup tools that let users protect their backup words from events like flooding or fires, and opens up new avenues for hiding and storing this essential recovery information.