A local media article alleges that Mauricio Novelli and Manuel Terrones Godoy, two crypto entrepreneurs, were present when Libra was launched, and that Milei was briefed on the launch’s status to prepare the post supporting it.

New Report Claims President Milei Had Direct Involvement in Libra’s Launch

The Facts

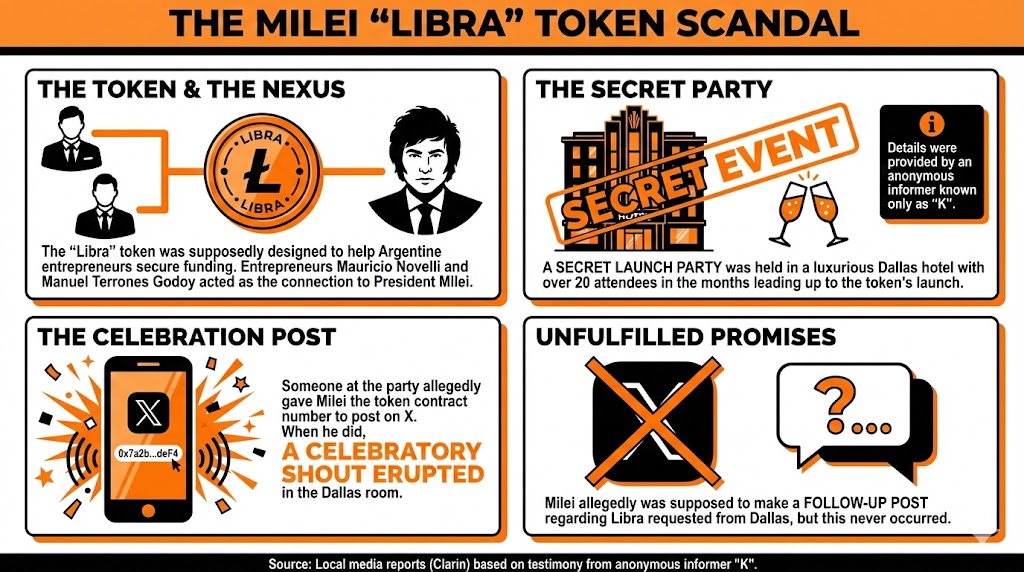

Local media published a damning article that chronicles the months leading up to, during, and after the launch of Libra, a token supposedly designed to help Argentine entrepreneurs secure funding.

According to Clarin, a secret launch party was held in a luxurious Dallas hotel, with over 20 people in attendance. The report states that Mauricio Novelli and Manuel Terrones Godoy, two entrepreneurs who had met with President Javier Milei before, acted as the nexus between the event organizers and him.

An anonymous informer, known as K, who participated in this launch, reported that someone in the room let Milei know about Libra in advance and gave him the contract number to be posted on X. When this finally happened, a celebration erupted.

“Milei posted the message, and the celebration was in full swing. A celebratory shout was heard in the room,” the informer declared. Also, Milei allegedly had to do a follow-up post regarding Libra, something that was being asked from Dallas, but this never happened.

Read more: Argentine Congress Publishes Report: Libra Scheme Not Isolated, Milei Should Be Probed For Misconduct

Why It Is Relevant

These revelations add to the evidence pointing to Milei’s involvement in the launch of Libra, which affected tens of thousands and is being subject to legal actions in the U.S. and Argentina.

Maximiliano Ferraro, who was the head of the congressional commission that investigated Libra, declared that he did not doubt that the over 16 meetings that Milei or his sister had with the involved “were part of a step-by-step process that led them to become directly involved as a central piece in Libra, a multi-million dollar business belonging to the organizers themselves and a few investors with inside information.”

This hints at a possible political trial against Milei for his involvement in this case, and at more legal actions down the line.

Looking Forward

The Libra probe continues to move forward in Argentina, even as the prosecutor in charge of the case, Eduardo Taiano, is being accused of protecting the government with his lack of action.

“It’s time for the justice system to stop looking the other way and investigate those in power while they are still in power,” Ferraro stressed.

FAQ

-

What details were revealed about the launch of Libra in Argentina?

A secret launch party held in Dallas involved key Argentine entrepreneurs and allegedly facilitated communication with President Javier Milei. -

Who were the main figures connecting the event to President Milei?

Entrepreneurs Mauricio Novelli and Manuel Terrones Godoy reportedly facilitated the connection between event organizers and Milei. -

What allegations surround Milei’s involvement with Libra?

Reports suggest Milei’s active involvement, including promoting Libra post-launch, potentially linking him to legal issues in both the U.S. and Argentina. -

What are the implications of this investigation for President Milei?

The ongoing investigation could lead to a political trial against Milei, with calls for greater scrutiny of his actions in relation to Libra.