Lido (LDO), a prominent player in decentralized finance (DeFi), has emerged as a leader in the fast-growing Liquidity Staking Derivatives (LSD) sector.

Amidst the turbulence caused by the highly controversial lawsuit filed in June by the US Securities and Exchange Commission (SEC), the decentralized finance sector (DeFi) is in a state of uncertainty and caution.

This legal battle has prompted many projects to reevaluate their strategies and made investors more cautious in their approach. But even in this challenging climate, the LSD space has managed to experience substantial growth and defy expectations.

The dominance of the LSD sector and the remarkable achievements of Lido

From data from Messari, the LSD sector has demonstrated significant dominance in the cryptocurrency markets. One of the main contributors to the sector’s expansion is Lido, which has shown impressive performance in recent months.

SEC lawsuits against @BinanceUS And @ Coinbase cause #DeFi TVL drops below $60 billion. But amid the chaos, liquid staking protocols thrive and become the dominant force of DeFi by TVL. pic.twitter.com/RL9Qy8cwLE

— Messari (@MessariCrypto) July 3, 2023

CoinGecko reports that the price of Lido’s native token, LDO, is currently at $2.16. While there has been a slight 1.7% drop in the last 24 hours, the token has experienced a solid 15.7% increase in value over the past seven days.

Source: Coingecko

The price increase of LDO has also resulted in a noticeable increase in the token’s MVRV ratio. This means that a significant number of LDO-enabled addresses have turned profitable in recent days, signaling positive investor sentiment and further fueling Lido’s success in the competitive DeFi landscape.

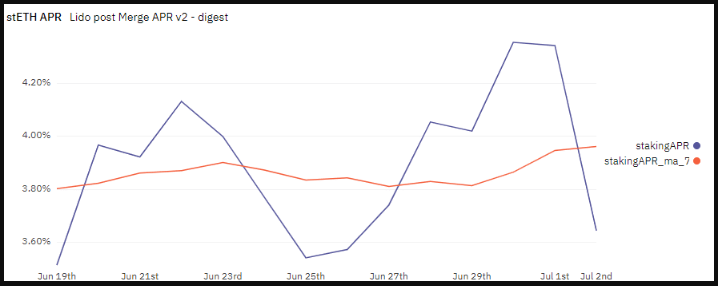

Growth amid concerns: Lido declining APR

Despite Lido’s remarkable growth and success, there has been a recent drop in the annual percentage rate of return (APR) offered by the platform. According to a recent LDO price reportits drop in APR in recent days raises concerns about the attractiveness of using Lido for staking, potentially leading users to look for alternative options.

Source: Dune Analytics

The falling APR indicates that the rewards and returns generated by staking LDO tokens on the Lido platform have decreased. This development could discourage some users who prioritize maximizing their restocking returns from continuing to use Lido.

LDO market cap currently at $1.9 billion. Chart: TradingView.com

Since staking rewards play a critical role in incentivizing users to join networks and secure their protocols, a continued decline in APR may prompt individuals to explore alternative platforms that offer more competitive and potentially higher returns.

To maintain its position as a leading player in the LSD industry, Lido should address the declining APR and explore ways to improve rewards for strikers so that they remain competitive and attractive to their users.

Featured image of The Market Magazine