The KAS price recorded an impressive 66% rise this week, moving from $0.037 to $0.061 as Bitcoin’s sharp rebound lifted market sentiment. With BTC climbing from its weekly low of $80,600 to $91,134 at the time of writing, since the major market is correlated with the king of cryptos, altcoins like Kaspa have benefited strongly. This recovery adds weight to the ongoing bullish shift ahead of December, and with KAS price today reflecting sustained strength, traders are looking closely at whether momentum can extend into the new month.

KAS Price Approaches EMA Barriers as Trend Turns Upward

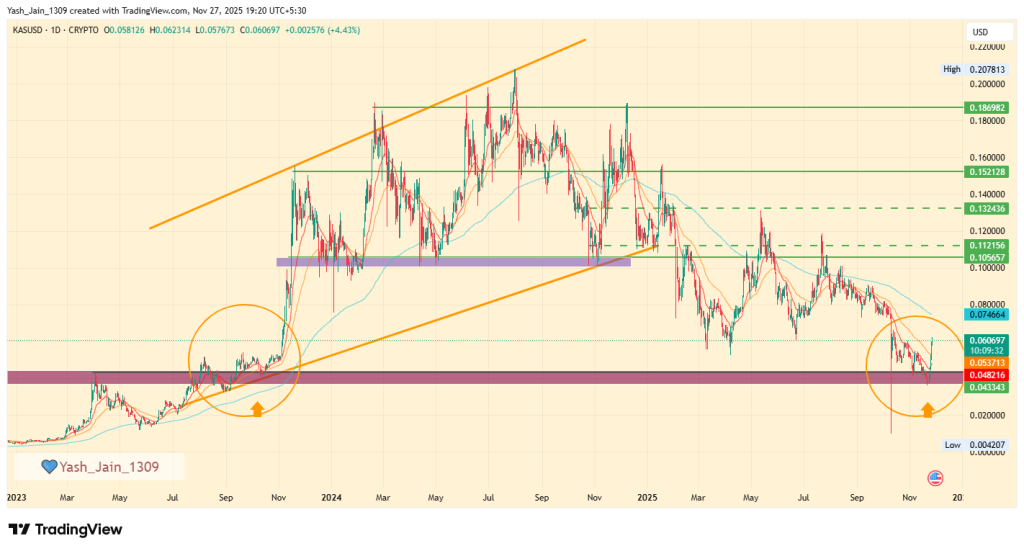

On the daily KAS price chart, this week’s momentum flipped the 20-day and 50-day EMA bands, signaling the early phase of a potential trend reversal. Kaspa now appears to be heading toward the next key hurdle at the 200-day EMA, currently positioned near $0.074.

Although November is nearing its close, the price structure suggests room for continued recovery, especially if Bitcoin maintains its upward trajectory.

Consequently, even under shortterm conservative assumptions, KAS price prediction 2025 scenarios indicate that Kaspa could retest $0.105 in December. This would mirror previous rebound structures observed in the asset’s historical cycles, particularly during periods of improving market sentiment.

KAS Price Forecast Supported by Historic Catapult Zone

What makes this rally attempt compelling is the origin of the bounce. The support zone that triggered this week’s bullish reaction is considered the most critical demand area on the higher timeframe chart.

This zone has acted as a launchpad before, most notably in Q4 2023, where a similar pattern resulted in a 400% rally to $0.20 by Q2 2024.

If such a performance repeats, the KAS price USD could again approach its historical peak near $0.20. Furthermore, if demand doubles compared to 2023 and Kaspa experiences an ambitious 800% expansion, upside targets could theoretically stretch toward $0.55-$0.60 from the current market price of $0.060.

With KAS crypto trading 4% higher intraday and holding a market cap of $1.63 billion, these levels become relevant in the context of continued buyer interest.

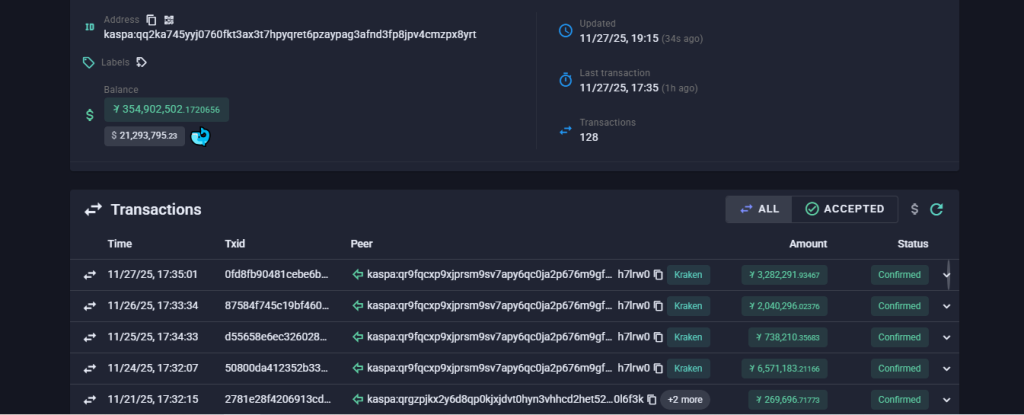

Whales Accumulate as Market Turns Favorable

A notable driver behind the renewed optimism is whale activity. From the top KAS addresses, the eighth-largest wallet, which is holding 1.316% of the supply, has been steadily accumulating throughout the month.

Most purchases appear to come from Kraken exchange, with buying accelerating after Bitcoin’s reversal from $80,600 on November 21. If the largest whale is positioning, the possibility of a broader bullish domino effect strengthens expectations for the coming month.

Additionally, it has a total of 94,618,583 addresses, while active addresses are approximately 1,046. The total transactions it has processed were 584.35 million transactions, and it maintains a TPS of 11 when writing.