The crypto markets rejuvenated a bit as significant liquidations pushed the Bitcoin price close to $92,000. As the token surged above the consolidated zone around $87,500, the altcoins like Solana gained strength. Solana is believed to follow the trend set by the star crypto, and hence, after rebounding from $127, a rise to $150 appeared to be on the horizon. Meanwhile, the latest hack on a popular exchange may serve as a catalyst, increasing the SOL price volatility in the short term. With the price trying hard to clear the $145 resistance, can Solana maintain its bullish structure and reach $150?

Upbit’s $36M Solana Exploit Sparks Caution

The confirmation of a $36 million Solana exploit on Upbit has injected fresh caution into the market, disrupting what had been a steadily recovering sentiment for SOL. According to early reports, the incident stemmed from unauthorized access to user accounts rather than a flaw in Solana’s core protocol, but the distinction has done little to calm traders.

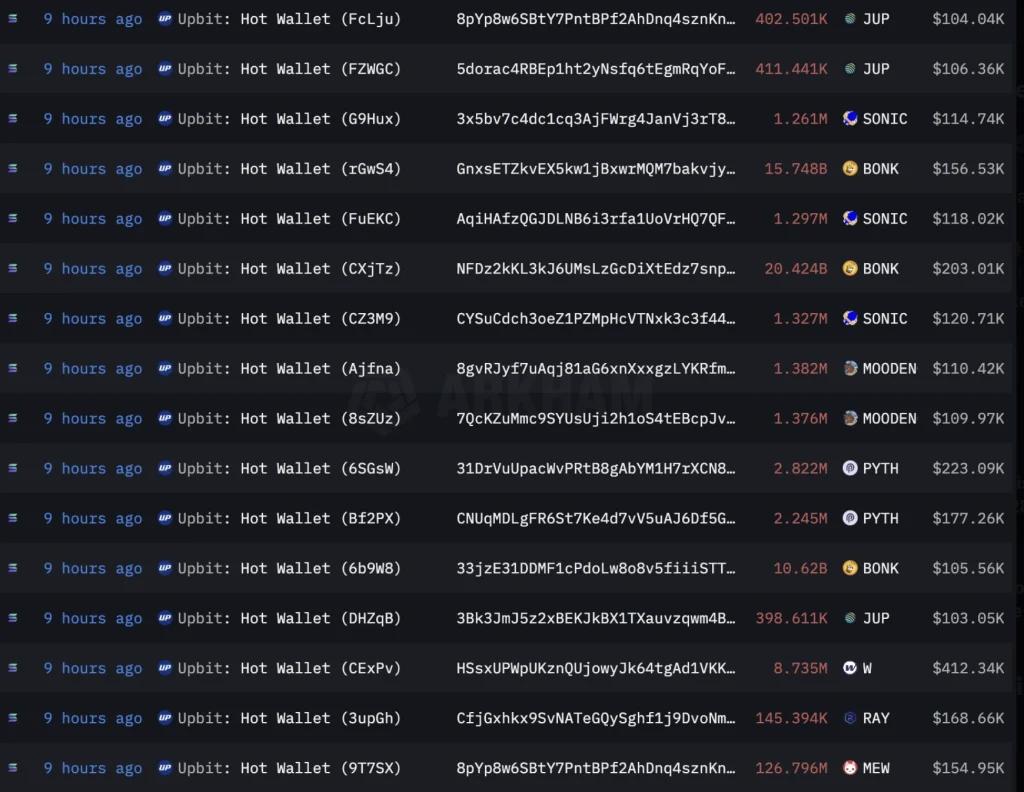

However, the exchange has suspended all deposits and withdrawals and issued a notice to conduct a comprehensive inspection. The exact nature of the breach is yet to be disclosed, which has drained 24 different cryptos, including SOL, USDC, BONK, LAYER, JUP, etc., and others.

Will This Impact the SOL Price Rally?

Similar to the Bitcoin price rally, the Solana price has also rebounded from the local lows below $130. However, the token appears to be struggling to break above the crucial resistance that has held for several days before the 15% pullback. Currently, the price has recovered almost all the losses incurred during the crash; however, in the broader context, the bearish influence persists.

As seen in the above chart, the SOL price rebounds from the interim support at around $127 but is unable to rise above the resistance zone between $142 and $144. The technicals have turned bearish, which raises concern over the next price action. The CMF and OBV have displayed a bearish divergence, suggesting outflow of liquidity, keeping the bearish influence over the token for a while. Hence, the price is still feared to drop back below $140 and consolidate around $138. However, a rise from $150 to $153 may invalidate the bearish trajectory for some time.

Can SOL Price Reach $150?

Technically, Solana’s pullback is still contained within a broader bullish structure, with the $180 zone acting as the immediate line of defense. On-chain metrics support this view—network activity, validator strength, and DEX volumes remain healthy, indicating no fundamental breakdown. Derivatives positioning also leans neutral rather than bearish: open interest has eased without collapsing, and funding rates remain balanced, showing traders are not aggressively shorting the move.

If buyers continue defending $180, SOL can stabilize and build the base needed for a push back toward $195–$205, where the next major resistance cluster sits. A decisive breakdown below $180, however, would flip momentum and open a pathway toward a deeper corrective leg before any recovery attempt.