The recent Bitcoin rally has led to speculation that the price could rise further with the introduction of spot ETFs. The arrival of ETFs, especially from reputable companies such as BlackRock and Fidelity, could boost institutional investor confidence and lead to an increase in Bitcoin price. However, the million dollar question is: how high? Clues to answering this question can come from a variety of statistics and data.

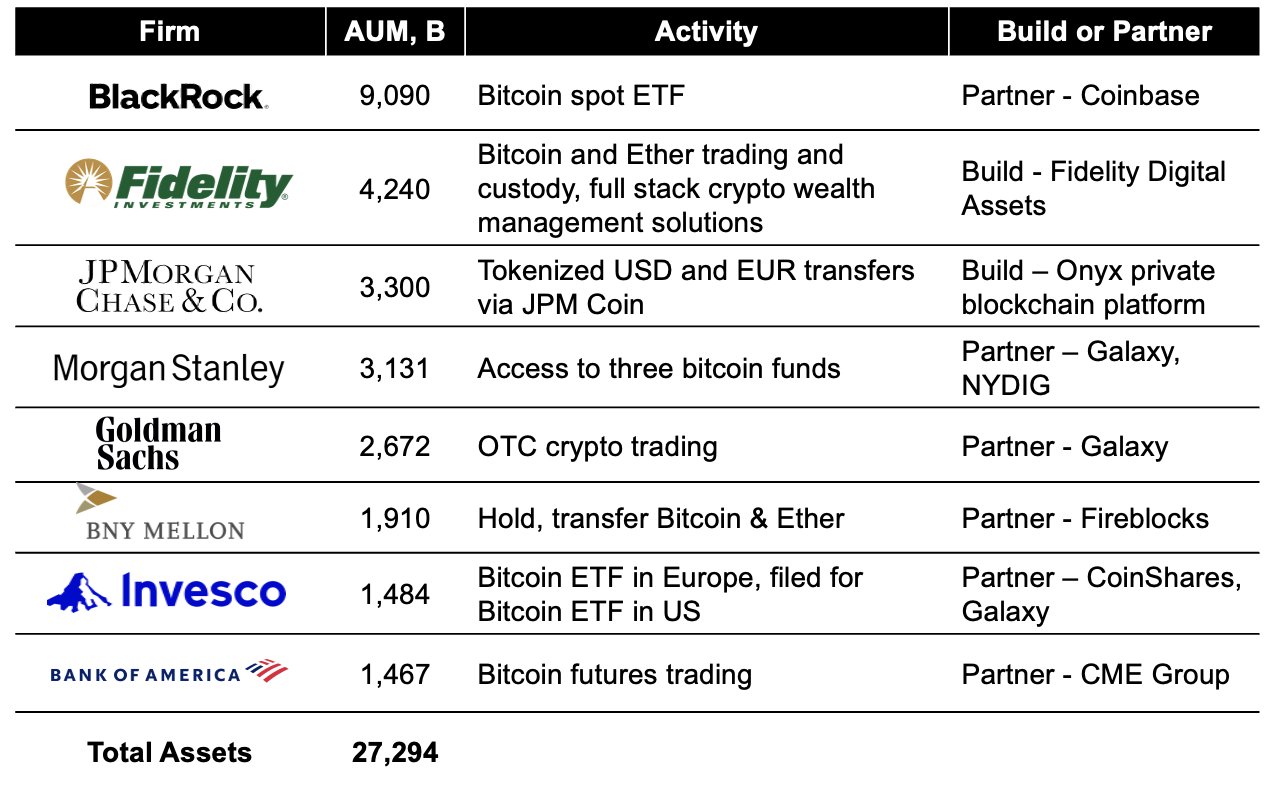

One of those data points was as long as yesterday by CoinShares’ Chief Strategy Officer Meltem Demirors via Twitter. As she writes, the Bitcoin mockery ETF news is not the only story. Many of the largest financial institutions in the US are currently actively working to provide access to BTC and more. In all, more than $27 trillion in client assets are waiting on the sidelines.

With BlackRock, the world’s largest asset manager has filed a Bitcoin ETF application. Rumor has it that the number three in the world, Fidelity Investments, is also flirting with a Bitcoin ETF. Bitcoin ETF applications from Invesco and WisdomTree (both top 10 ETFs) are a fact.

How High Can Bitcoin Rise? Highest ever? Quadruple?

If just a fraction of the $27 trillion in client money managed by the largest asset managers went into bitcoin spot ETFs, the impact on price would be gigantic. Just 1% would amount to more than $270 billion (rather more because not all Bitcoin ETF applicants are included in the chart). For comparison, Bitcoin’s market cap is currently $590 billion.

As NewsBTC reported two weeks ago, the performance of the gold price after the first gold ETF in November 2004 could also provide a benchmark for a glimpse into the future. The launch of the first gold ETFs led to a fantastic gold rally. While the price of gold was $400 at the time of approval, it reached $600 in 2006 and $800 in 2008. Seven years after approval, in 2011, gold reached its provisional high of nearly $2,000 (+359%).

Renowned expert Will Clemente noticed via Twitter:

Shown below is when GLD launched, giving investors easy access to gold exposure. If/when Blackrock’s (which has 99% ETF approval) launches Bitcoin ETF (very similar structure to GLD), expect similar price action as it unlocks access to Bitcoin exposure for the masses.

Since Bitcoin is the digital gold of the 21st century, it is also worth comparing the market caps of both assets. While BTC is at $590 billion, gold market capitalization is around $12 trillion.

If Bitcoin gained just 10% of gold’s market share (about $1.2 trillion), it would double BTC’s current market cap and, simply put, double Bitcoin’s current price. That this goal is by no means impossible is evidenced by BTC’s all-time high of around $67,000 at the end of 2021, when its market cap was already around $1.2 trillion.

Another measure is the total market capitalization of the global stock market of over $100 trillion. Apple accounts for about 3% of this. So the company is five times as capitalized as Bitcoin.

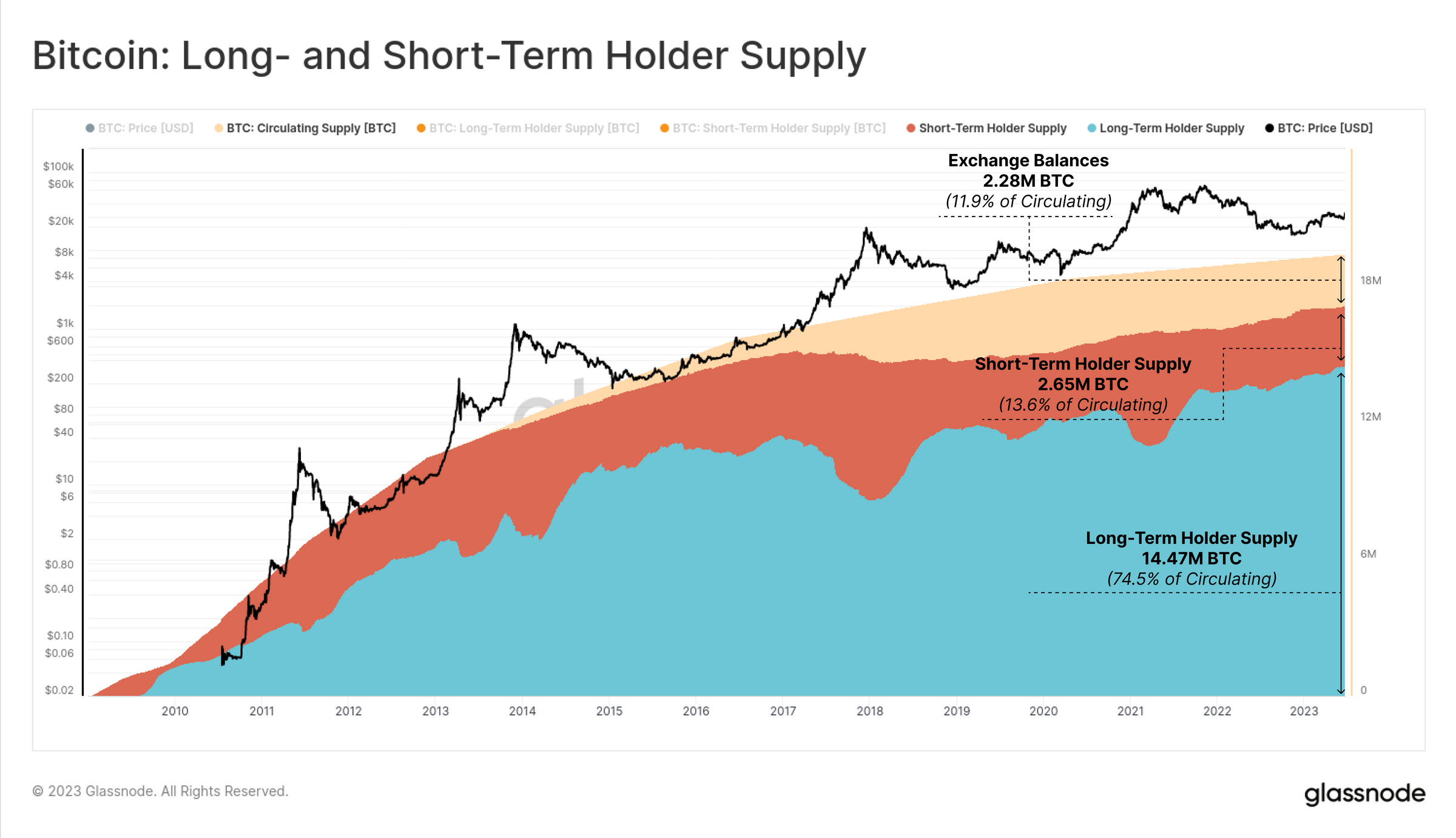

One factor that should also be considered when setting the price is the supply side. As expert Alessandro Ottaviani writes, BlackRock and Fidelity would only need to move 0.3% of their assets under management to Bitcoin to buy all existing BTC on the exchanges at the current price.

The on-chain analytics service Glassnode has published research on this. The analysts write that after a period of weaker relative US demand, there will be an upturn in 2023. This comes up against a very illiquid market.

Currently, there is an ongoing transfer of wealth to HODLers as more and more coins are withdrawn from exchanges. According to Glassnode, there are currently only 2.28 million BTC left on exchanges (11.9% of the circulating supply), a short-term supply of 2.65 BTC (13.6% of the circulating supply), while 14.47 BTC in the owned by long-term holders (74.5% of circulating supply).

All the above stats and data suggest that Bitcoin is facing a massive bull run led by institutions. However, there is no guarantee for this. One thing to consider is that the US Securities and Exchange Commission could reject Bitcoin spot ETFs despite BlackRock’s fantastic success rate.

On the other hand, BlackRock and others need to buy BTC on the spot market to have a direct impact on the price. But one possibility is that BlackRock could buy Bitcoin over-the-counter (OTC). For example, the asset manager can buy over-the-counter BTC seized by the US government (more than 200,000).

This can lead to a “buy the rumor, sell the news” event. But even if they bought over-the-counter from the US, it could be beneficial in the long run as it means the US government will no longer be selling its BTC on the open market as it has in the past.

At the time of writing, the BTC price was at $30,388.

Featured image from iStock, chart from TradingView.com