Cash App is making bitcoin more usable for everyday payments. Starting today, the app will let you pay with Bitcoin instantly — even if you don’t hold any — by automatically converting your USD balance on the app into bitcoin for the merchant.

In a series of app features announced today, the app will now spend bitcoin locally, pay in USD over the Lightning Network, and send or receive stablecoins. All these updates are part of Cash Releases, the platform’s first bundled launch of new features, the company shared with Bitcoin Magazine.

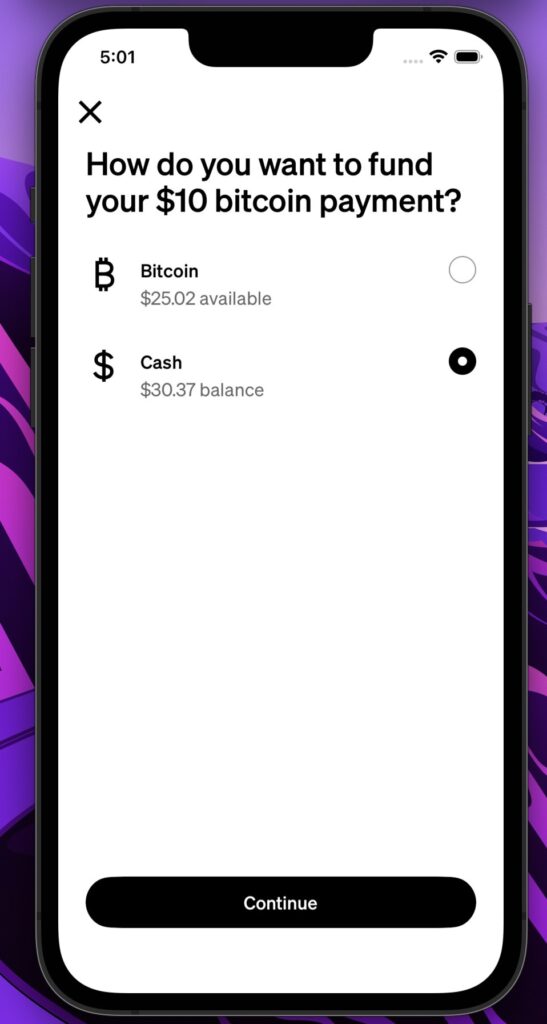

With the new ‘Bitcoin Payments with USD’ feature, users can make instant bitcoin payments even if they don’t hold BTC. Cash App will automatically convert USD from a user’s balance into bitcoin for the merchant.

In other words, this makes Bitcoin payments accessible to all 58 million monthly users of Cash App without taxable events or decreasing their Bitcoin holdings.

Square merchants benefit too, with no fees or chargebacks, and the network operates without middlemen. Users can choose any payment path — USD to USD, BTC to BTC, BTC to USD, or USD to BTC — all powered by the open Bitcoin network. It will encourage merchants to ask customers to pay in bitcoin to avoid card fees.

The system works wherever bitcoin is accepted, connecting millions more users to fast, low-cost, borderless payments.

Cash App’s bitcoin map

On top of this bitcoin payments feature, Cash App rolled out a Bitcoin Map. Following Square’s bitcoin payments launch, the map shows where local merchants accepting BTC are located, letting customers pay instantly via Lightning QR codes.

About 20% of Americans are open to using bitcoin for daily transactions, the company said, and Cash App wants to make that transition seamless for both consumers and businesses.

In addition to all this, Cash App is introducing stablecoin support. Customers can now send and receive digital dollars globally.

Stablecoins maintain a one-to-one value with the U.S. dollar while enabling near-instant transfers. Cash App will automatically convert received stablecoins into USD.

“Bitcoin was created to be peer-to-peer cash, and Cash App is building tools to make it work as intended — fast, open, and borderless,” said Miles Suter, Bitcoin Product Lead at Block.

When asked about stablecoins and whether they might compete with Bitcoin, Suter told Bitcoin Magazine that “legacy fiat systems are Money 1.0: slow, expensive, closed systems with banking hours and borders. Bitcoin is Money 2.0, the ultimate goal: truly decentralized, open, and permissionless. Stablecoins are Money 1.5, a pragmatic tool and a meaningful improvement from traditional financial rails, but we don’t see them as a competitor to bitcoin.”

He described stablecoins as a complementary tool for users, offering speed and stability while bitcoin remains the platform’s foundation.

Cash App will also enhance their Auto Invest feature, the company said. Scheduled bitcoin purchases now carry no fees or spreads, making it easier and more affordable for users to invest regularly.

“Standard one-time purchases have fees and spreads,” Suter said, “but we’ve built an entire ecosystem of ways to stack sats for free, like Auto Invest, Paid In Bitcoin, and Round Ups. The goal is giving customers multiple options to build their bitcoin position affordably.”

Since 2018, Cash App has helped over 24 million active users buy bitcoin, with features like Paid In Bitcoin enabling automated conversion of direct deposits into BTC.

Bitcoin payments via Square

Earlier this week, Square rolled out Bitcoin payments for U.S. sellers, allowing roughly 4 million merchants to accept BTC through their terminals with no processing fees until 2027.

The system enabled instant transactions via the Lightning Network, first piloted at Compass Coffee in Washington, D.C. Merchants could receive Bitcoin, convert it to USD, or automatically convert part of daily sales into BTC.

When asked about criticism that platforms like Square or Cash App might be centralizing Bitcoin, Suter said, “If you want access to the fiat banking system today, you need a centralized provider. The end goal is self-custody, which is why we built Bitkey. We’re building auto-sweeps to self-custody that will roll out later, and deep Bitkey integration with Square is coming in 2026 for self-custody of funds you receive as payments or convert from daily card sales.”

Jack Dorsey’s Block Inc., formerly known as Square, has evolved into a full-stack Bitcoin company spanning payments, mining, open-source software, and self-custody solutions.

Through subsidiaries like Cash App, Bitkey, Proto, Spiral, and Tidal, Block is driving Bitcoin adoption across both consumer and developer ecosystems.

The company holds over 8,780 BTC and continues to deepen its integration with Bitcoin, aligning its business strategy with the network’s long-term growth.

According to Suter, the company envisions Bitcoin becoming everyday money and a universal financial infrastructure enabling truly global commerce.