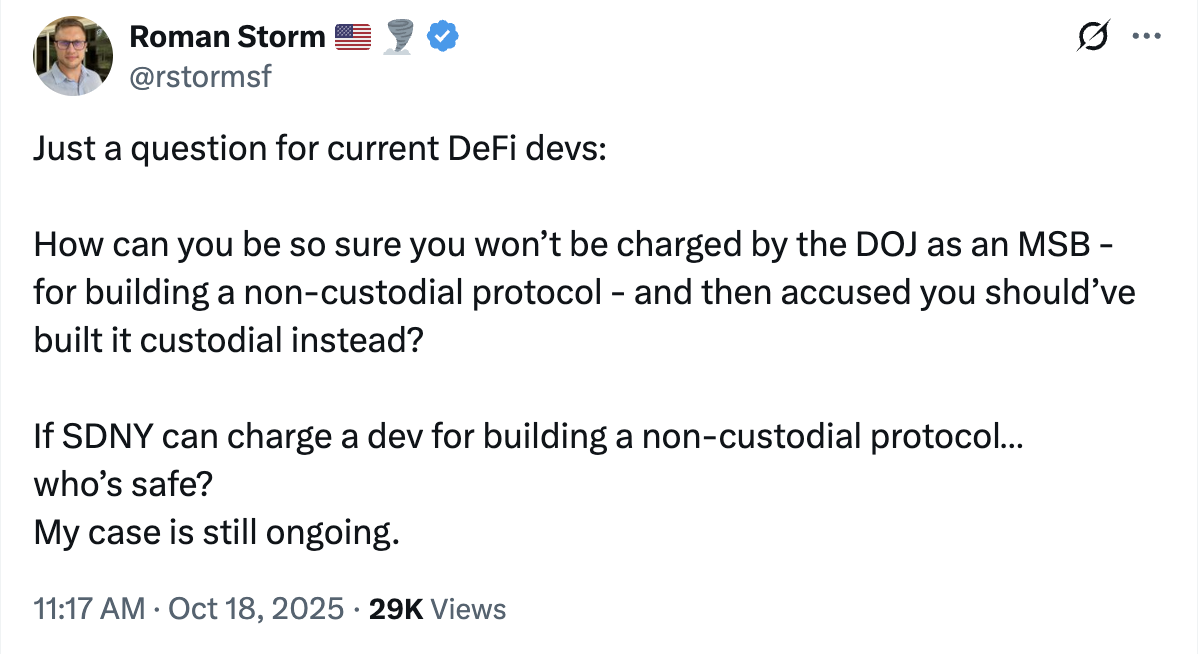

Roman Storm, a developer of the Tornado Cash privacy-preserving protocol, asked the open source software community whether they are concerned with being retroactively prosecuted by the US Department of Justice for developing decentralized finance (DeFi) platforms.

Storm asked DeFi developers: “How can you be so sure you won’t be charged by the DOJ as a money service business for building a non-custodial protocol?”

The DOJ could prosecute a case, arguing that any decentralized, non-custodial service should have been developed as a custodial service, as it did in the case against him, Storm added, citing his recent motion for acquittal, which was filed on September 30.

Source: Roman Storm

“Our company does not have any ability to affect any change, or take any action, with respect to the Tornado Cash protocol — it is a decentralized software protocol that no one entity or actor can control,” Storm is quoted as saying in the acquittal documents.

Storm was convicted in August on one of three counts; the jury found him guilty of conspiracy to operate an unlicensed money transmission business, setting a dangerous legal precedent for open source software developers and sending shockwaves through the crypto community.

The fight for privacy continues

Following the verdict, legal experts debated whether US prosecutors would pursue the money laundering and sanctions charges against Storm in another trial.

The Jury was gridlocked during deliberations and failed to come to a unanimous consensus on those counts, finding Storm guilty on just the unlicensed money transmitter charge.

“If the Trump administration wants the USA to be the crypto capital of the world, then the DOJ must not be allowed to retry the two deadlocked charges,” Jake Chervinsky, chief legal officer at venture capital firm Variant Fund, wrote on X at the time.

DOJ official Matthew Galeotti addresses the audience at the American Innovation Project summit. Source: American Innovation Project

Matthew Galeotti, the acting assistant attorney general for the DOJ’s criminal division, signaled in August that the DOJ would not initiate a retrial of Storm and would not prosecute similar cases.

“Our view is that merely writing code, without ill intent, is not a crime,” Galeotti told the audience at the American Innovation Project Summit, an event for regulatory advocacy and pro-crypto legislation in the US.

“The department will not use indictments as a law-making tool. The department should not leave innovators guessing as to what could lead to criminal prosecution,” he added.