Paul Atkins wants to cement his vision for the crypto markets before political tides shift again in Washington. As the new chair of the US Securities and Exchange Commission, he’s moving quickly to “future-proof” SEC policies, a push that could define how much freedom the crypto industry enjoys after President Donald Trump leaves office.

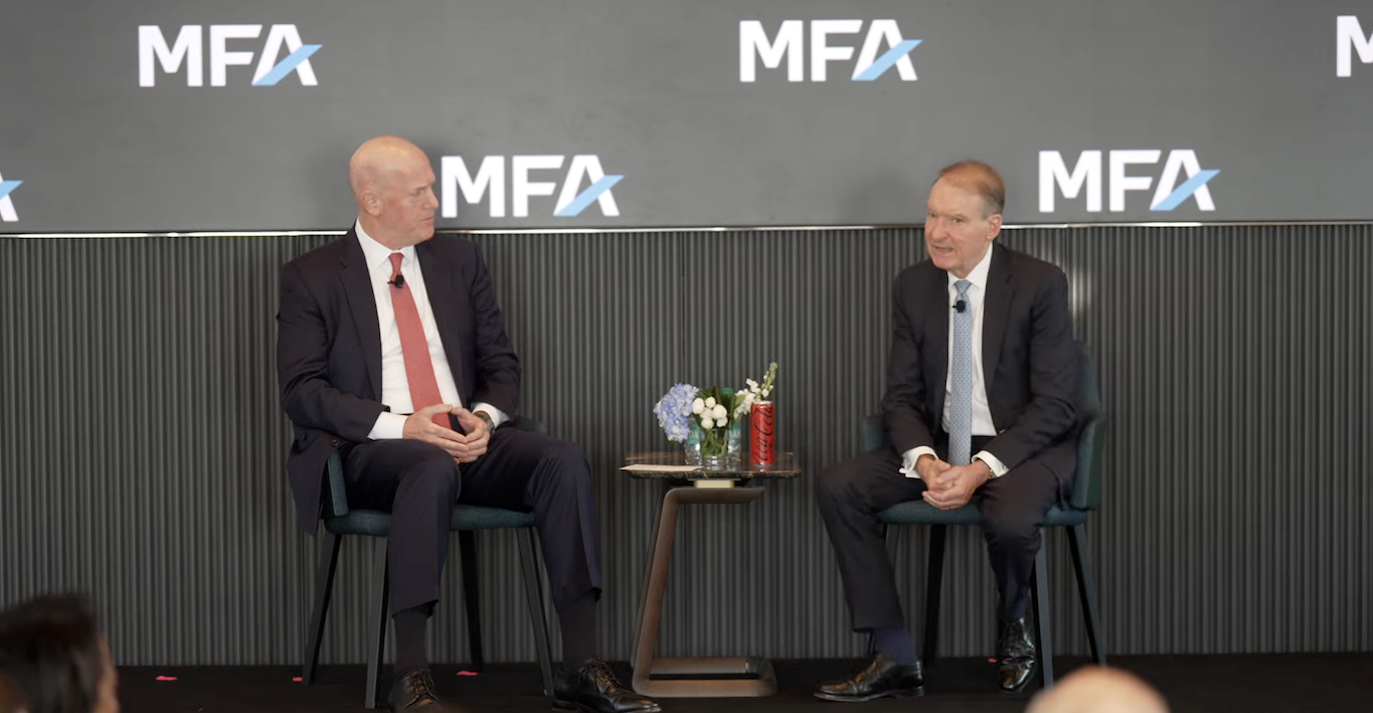

In a conference hosted by the Managed Funds Association in New York on Tuesday, Atkins said the SEC would work quickly to adopt rules that could “future-proof” his agenda. He specifically referred to removing or weakening regulations on public and private markets, both of which could impact the cryptocurrency industry after Trump or Atkins leaves.

“We have, I think, an amazing opportunity to get together and, in a can-do spirit, kind of create something that’s lasting,” said Atkins on US regulators collaborating. “My main concern is to future-proof this against future potential changes. What we have to do is to get things implemented, get things agreed, and then let the market work […]”

On collaboration with the Commodity Futures Trading Commission (CFTC), the SEC chair said:

“As we go forward, especially with digital assets, the one thing that I am trying to warn people about is we can’t have two fortresses on either side of a no man’s land strip, because that no man’s land strip right now is littered with the corpses of would-be products that have gotten killed in the crossfire of the two agencies over the years.”

Paul Atkins (right) speaking in New York on Tuesday. Source: Managed Funds Association

Even before the US Senate confirmed Atkins as SEC chair in April, then-acting Chair Mark Uyeda had significantly changed the agency’s approach to digital assets by closing several investigations and cases against crypto companies and establishing a crypto task force under Commissioner Hester Peirce.

Under Atkins, the commission changed listing standards for crypto exchange-traded funds (ETFs), reportedly weighed allowing stocks to trade on the blockchain, considered abandoning the agency’s quarterly reporting requirements, and held a roundtable with the CFTC to “harmonize” regulations.

“[T]he momentum behind digital assets is difficult to reverse,” Andrew Forson, president of Canada-based DeFi Technologies, said in response to an email from Cointelegraph. “US policy, even amid differing leadership philosophies, has increasingly aligned traditional capital markets with decentralized finance.”

Could a future US president undo all the SEC’s work with the stroke of a pen?

Though Atkins has broad authority to propose and support rules and policies favoring the crypto industry, he has been closely aligned with the current administration, based on public statements. As SEC chair, he can direct the agency to pursue enforcement actions and adopt policies.

Shortly after former SEC Chair Gary Gensler resigned in January, the agency softened its approach to crypto enforcement, dropping many years-long investigations and cases. Some might question whether a future US president who could be more anti-crypto or neutral on the technology would be able to quickly reverse Atkins’ agenda, as the SEC is doing for many of Gensler’s positions.

“It would be difficult for a new SEC chair to fully reverse Chair Atkins’ proposed policies,” Forson told Cointelegraph. “However, a future administration could layer on additional reporting requirements and compliance burdens—effectively slowing progress and innovation. This would echo the early days of ICOs, when overregulation stifled legitimate token offerings.”

Forson added:

“If a less crypto-friendly administration took over, existing instruments would likely be grandfathered in, but new entrants would face significant headwinds. Regulatory shifts might temper innovation, but they can’t dismantle the ecosystem that’s already firmly established.”

Related: US government shutdown enters day 1: How is the SEC still functioning?

David B. Hoppe, a technology and media attorney and the founder of Gamma Law, offered a slightly different perspective, saying that future SEC chairs couldn’t unilaterally roll back the agency’s rules and regulations. However, they could change the SEC’s “internal priorities” established by Atkins and shift resources back to pursuing enforcement cases and investigations against crypto companies.

“With a vote of the SEC commissioners, the future chairperson could also reverse official policies of the SEC announced under Mr. Atkins,” Hoppe told Cointelegraph. “This could mean a return to the SEC’s previous posture that crypto projects presumptively implicate securities laws. Although nonbinding, SEC policy statements communicate SEC rule interpretations and enforcement priorities and can significantly affect market participants.”

What about SEC regulations changed by Congress?

A market structure bill currently working its way through the US Senate could also significantly change SEC regulations and, should it pass and be signed into law, require another act of Congress to change or undo. However, according to Hoppe, some of the changes under the market structure law would likely face fewer challenges.

“[A]ny regulations adopted by the SEC and CFTC to implement the market structure law would be much easier to amend or withdraw, as they would need only go through the standard notice-and-comment process (or other applicable procedure),” Hoppe told Cointelegraph. “The SEC or CFTC could, in the future, decide to reinterpret the provisions of the market structure law and amend or withdraw regulations accordingly.”

Cointelegraph reached out to Atkins for comment but had not received a response at the time of publication.

As of Thursday, the US government had entered the ninth day of a shutdown caused by lawmakers’ inability to reach an agreement on a funding bill. The SEC continues to operate on reduced staff and operations, but Atkins said on Tuesday that the agency was “not slowing down” amid the shutdown.

Magazine: SEC’s U-turn on crypto leaves key questions unanswered